The stock is rising like a bat out from hell after the co smashed estimates by .17 cents and outlined free cash flow for 2016 would be upwards of $3 billion–balancing out expenditures–accounting for these low copper and oil prices.

Reports Q4 (Dec) loss of $0.02 per share, $0.17 better than the Capital IQ Consensus of ($0.19); revenues fell 27.5% year/year to $3.8 bln vs the $3.82 bln Capital IQ Consensus.

Consolidated sales totaled 1.15 billion pounds of copper, 338 thousand ounces of gold, 20 million pounds of molybdenum and 13.2 million barrels of oil equivalents (MMBOE) for fourth-quarter 2015.

Consolidated sales for the year 2016 are expected to approximate 5.1 billion pounds of copper, 1.8 million ounces of gold, 73 million pounds of molybdenum and 57.6 MMBOE, including 1.1 billion pounds of copper, 200 thousand ounces of gold, 19 million pounds of molybdenum and 12.4 MMBOE for first-quarter 2016.

Consolidated unit net cash costs averaged $1.45 per pound of copper for mining operations and $16.17 per barrel of oil equivalents (BOE) for oil and gas operations for fourth-quarter 2015.

Consolidated unit net cash costs are expected to average $1.10 per pound of copper for mining operations and $15 per BOE for oil and gas operations for the year 2016.

Operating cash flows totaled $612 million for fourth-quarter 2015 and $3.2 billion for the year 2015. Operating cash flows for the year 2016 are expected to approximate $3.4 billion (Prior guidance $6.8 bln)

Capital expenditures for the year 2016 are expected to approximate $3.4 billion (Prior guidance $4.0 bln), including $1.4 billion for major projects at mining operations and $1.5 billion for oil and gas operations, and excluding $0.6 billion in idle rig costs.

Revised Operating Plans

FCX today announced additional initiatives to accelerate its debt reduction plans and is actively engaged in discussions with third parties regarding potential transactions.

Several initiatives are currently being advanced, including an evaluation of alternatives for the oil and gas business (FM O&G) as well as several transactions involving certain of its mining assets. FCX expects to achieve progress on these initiatives during the first half of 2016.

Cash Flow Guidance

Based on copper prices of $2.00 per pound and Brent crude oil prices of $34 per barrel, FCX estimates consolidated operating cash flows of $3.4 billion (net of approximately $0.6 billion in idle rig costs) and capital expenditures of $3.4 billion for the year 2016.

The impact of price changes on 2016 operating cash flows would approximate

$440 million for each $0.10 per pound change in the average price of copper,

$55 million for each $50 per ounce change in the average price of gold,

$60 million for each $2 per pound change in the average price of molybdenum and$135 million for each $5 per barrel change in the average Brent crude oil price.

Using similar price assumptions and the recent 2017 future price of $40 per barrel for Brent crude oil, FCX estimates consolidated operating cash flows of $3.5 billion (net of approximately $0.4 billion in idle rig costs) and capital expenditures of $2.3 billion for the year 2017.

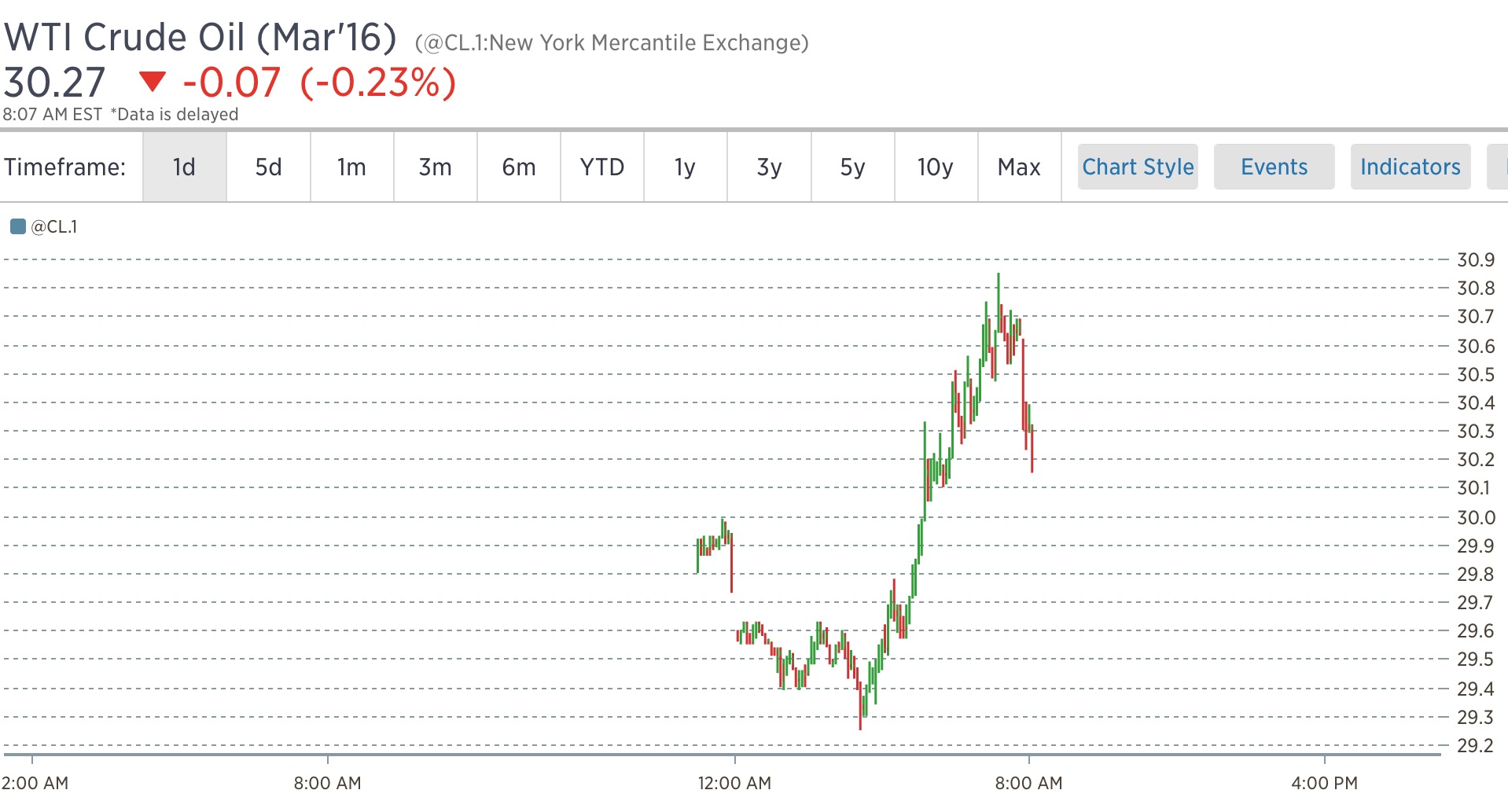

Related: NASDAQ futs are positive, reversing a deep deficit. And oil prices have recovered and are now moving about the $30 handle.

If you enjoy the content at iBankCoin, please follow us on Twitter

Shorts beware, they are coming for you. All of you are scared shitless, lacking of bull balls and semen. You are quick to join the catamite ranks as the teevee has convinced you everything is going to zero. Bollocks, your untimely deaths are awaiting you.

So once again analysts are revealed as frauds and those who rely on their opinions suckers. Nothing new here.

I think iran in Italy is the biggest news. Positive reaction to iran playing nice?

Where have all the bearshitters from Yesterday gone?

Another pop and fade.