The luster of Icahn’s NFLX trade has worn off. By the way, it’s worth mentioning that it was Carl’s son who insisted he buy NFLX. Carl wanted to sell it and his son had to threaten to quit the firm, in order to get him to hold it a while longer.

“Permanent capital” Carl doesn’t really give a shit what I think, definitely not what you think either. He’s a thousand years old, worth $20 billion, and buys whatever the fuck he feels like, on any given hour in any given day.

God bless.

The billionaire revealed a 7.13 percent stake in Xerox in a securities filing on Monday, making him the second-largest shareholder of the 109-year-old company.

Icahn, who recently took stakes in American International Group (AIG.N) and Freeport-McMoran Inc (FCX.N), said he would look at getting representation on Xerox’s board, as well as pursuing strategic alternatives.

“We are aware that Carl Icahn has made an investment in the company,” Sean Collins, a Xerox spokesman said. “Xerox welcomes open communications with shareholders and values constructive dialogue.”

Ivan Feinseth, a Tigress Financial Partners LLC analyst, offered a cautious view. “I like Icahn. He has done well but I just don’t know what he can do here,” Feinseth said.

On the other hand, Susquehanna Financial Group LLLP analyst James Friedman said there are multiple things that Icahn can push for in the company, including selling the equity stake in its joint venture Fuji Xerox and separating the Documents business and the IT services business.

Xerox’s IT services business offers business process outsourcing while the document outsourcing business primarily includes sales of printers and copiers.

Friedman thinks Icahn can position himself for a board seat in the upcoming May elections.

“Getting on the board is the easy part, actually fixing the business is harder,” Friedman said.

The last reported position by Uncle Carl was FCX, whose shares have been fucking poleaxed in recent weeks– off 33% over 1 month’s time.

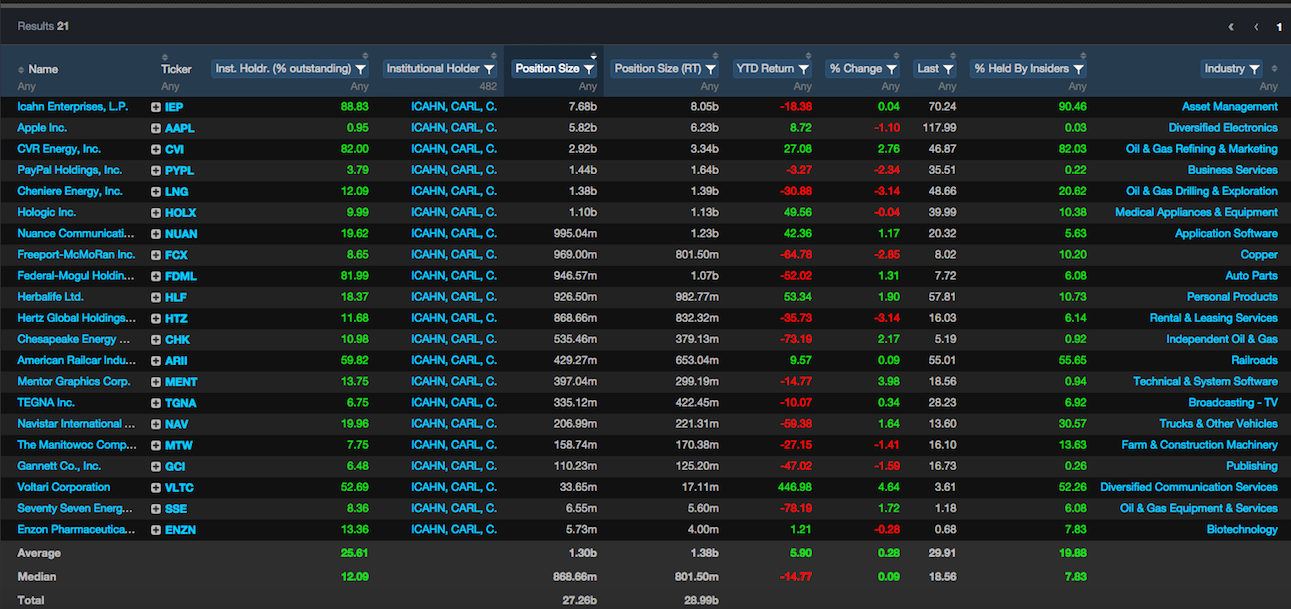

Here is a list of Carl’s holdings, with their YTD returns.

Data provided by Exodus

It’s also worth mentioning the market has gone straight the fuck higher, since Icahn threw shade on the entire market with his absurd “DANGER AHEAD” short film.

If you enjoy the content at iBankCoin, please follow us on Twitter

Major companies in the commodity space like FCX are priced as if 2008-2009 is here again and in some cases, worse.

U.S. Steel is priced at a low in price to book. Valuation not seen ever in data going back to 1991.

XOM,PBR, CVX, you name it. If it’s attached to commodities, it’s screwed.

What is going on?

All Carl wants for Christmas is a board seat. 3 of them to be exact.