Friday’s jobs report is most likely the last big market moving event of the year. With Yellen’s recent comments, and that fuckhead Dudley talking greasy daily, odds of a December rate hike are now upwards of 50%. Should the jobs numbers come in better than the expected 180k, things should get dicey, as in your portfolios will be shredded to pieces…maybe.

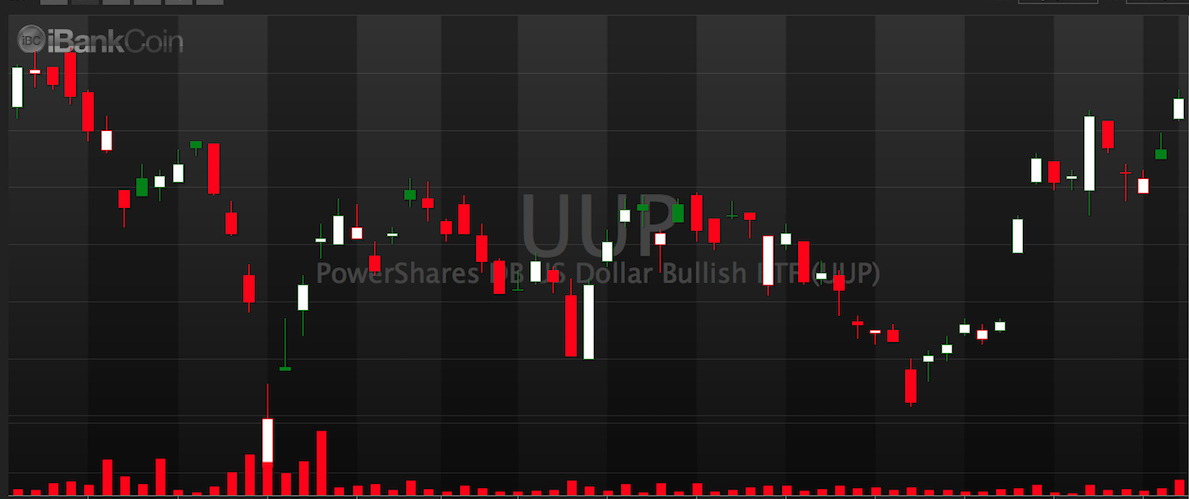

Expect the market to mark time over the next few days, entering into a state of malaise, as traders position in ahead of the number. If the Fed is really going to hike, dollars go up and oil and gas stocks get hammered. Oil stocks get hammered, not just because UUP is rallying; but because credit, inexorably, will get tighter. The Fed might actually be trying to induce bankruptcies amidst a number of injured sectors, in order to “clear the market.” I know that sounds fucking nuts; but the normal business cycle has been fucked for over 5 years now and maybe Yellen is old and crazy enough to do something bold.

Yields up; bonds down. Regional banks are winners, as well as money center banks. In short, I read that banks stand to make over $7 billion in additional profits, should the yield curve widen, thanks to Fed tightening.

The other headwind is King Dollar.

It’s up almost 20% over the past two years and it’s killing our exporters, making them less competitive and hurting earnings. This, of course, is not a zero sum game and perhaps orchestrated by the Fed and ECB, to help Europe, who was on the verge of dissolving like wet toilet paper in a bowl a few years ago. Since they started QE, everything has improved, including Italian, Spanish GDP, even Greek bonds have risen– in true opera-esque dramatic fashion.

Everything is done with purpose, by our benevolent central’d bankers. Try to read the tea leaves and be careful with your positions heading into Friday.

If you enjoy the content at iBankCoin, please follow us on Twitter

FIG

For Oil, we are at 80 year high levels per EIA weekly reports, it belongs so much lower. One Biggie thing that nobody cares about is that Bank of Japan did NOTHING last Friday. The global markets should be slipping this week, but we have been on this Bull Party which I don’t understand at all. Of course NFP will be revisit Septembers Numbers on Friday in an UP amount, NFP always screws up numbers and fixes them the following month. Way too many Help Wanted Signs at Cheap Job Sites to have a September miss like it did. Oct should be good too. BTW, have you looked at the Dry Shipping Rates these Days, it is so low and ugly, I really expect a lot more carnage in that field if anything sinks super hard. That really hurts Greece cuz that is their Biggie Biz, fwiw.

Dollar broke out of its wedge. Oil should break down from here.

If USD breaks out of this weekly bull flag we see some countries burn to the ground due to high USD debt load…..Turkey, Ukraine to name a few……..got war?

My hope is that The Fed is targeting China. they have popped their bubble and forced state intervention. China is down and a Dec hike would put a boot firmly on their face.

nice ink over at MW..kudos

bot moar FEYE. haha it’s going to zero

BLUE and VRX are looking nice haha