If you only look at the positives, it’s easy to think the market is set to explode to the upside. After all, the Treasury is pumping billions, while the Fed is printing trillions. Rates are at all-time lows and corporate balance sheets are in good shape.

However, the same cannot be said about the balance sheets of state and local governments, as well as the individual. See, during the last boom of 2003-2006, corporations were very stingy with their balance sheets, sans the stupid banks. For the most part, they were very conservative in controlling head count and building up inventories. As a result, a lot of companies have fortress balance sheets and will be able to endure the coming downturn.

The exact opposite occurred at the state a local government level. They went balls to the wall, hiring everyone in sight. They wasted money on a variety of pet projects and now find themselves in a very bad deficit situation.

As for the consumer: she’s been fucked for years, only worse now.

So, the whole notion that low rates and free money will make everything better is somewhat idiotic, considering no one will have a job in 6 months. As a point in fact, “Cally-forn-ia” is entirely fucked.

On a worldwide scale, things appear to be getting worse.

Japanese exports declined by 27% in November. TM, for the first time in company history, will begin to bleed capital, a la GM. Russian oligarchs are requesting a 78 billion dollar bailout from their government. And, to make matters worse, their ruble is about to get devalued.

The Chinese growth engine has all but stalled, yet here were are buying stocks.

For the love of gold chains and big rims, it’s Christmas. That’s what we do. For the most part, Americans are a bullish breed, always looking for the upside in things—even in death.

With my money, I’m afraid of getting lulled into some sort of drunken holiday stupor, only to be quickly woken up to the harsh realities of a world in economic decline—come 2009.

My advice is simple.

If I had 100k to invest right now, I’d keep a 30% cash position, 50% short and 20% long. With the 30%, I’d utilize it for intra-day or swing trades, in order to react to an upside tape, effectively stemming my losses. But, the main point is to keep the downside exposure in the majority, since it has proven to be a profitable bet for more than a year.

At the moment, I like short XOM, short KIM, short VNO, short CHL, long C, long UNH and long SMN.

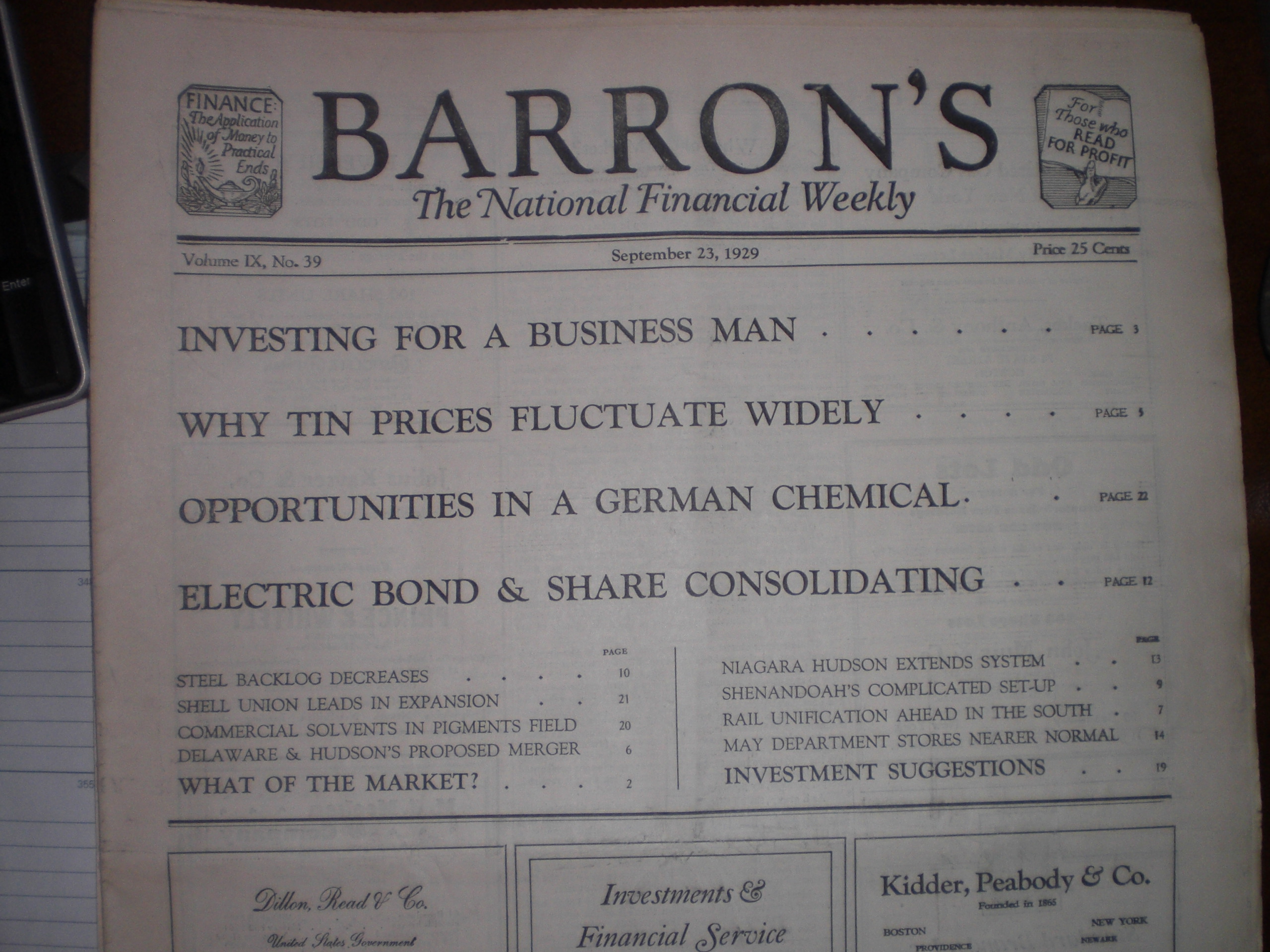

UPDATE: Barron’s, 9/23/1929— The commentary was very bullish, but at the same time cautious. In other words, they wanted the market to go up; but, you can tell they were somewhat apprehensive to go “all in.” Repeatedly, they discussed the peculiar nature of the markets and defaulted to weak arguments, such as “in the long run, stocks will do great.” One big laugher was a recommendation of German bonds.

If you enjoy the content at iBankCoin, please follow us on Twitter

first…

ps,

“The Fallacy of Mustard Seeds” … i agree…

What, no xmas rally on the thin volume?

I think any sort of equities are for those that wear their hind end as a sombrero.

Index plays seem the only safe way to deal with this lunatic market.

Personally, I’m thinking the Qsinator might be the only way to deal with the swings.

What happened to the long SRS?

Now that Detroit has gotten a taste of the TARP, commercial real estate developers are clamoring for some major bailout bucks too. If they get their way, U.S. taxpayers could be refinancing loans on suffering shopping malls and office parks.

Morning Call: December 22

With a record amount of commercial real-estate debt coming due, some of the country’s biggest property developers have become the latest to go hat-in-hand to the government for assistance.

They’re warning policymakers that thousands of office complexes, hotels, shopping centers and other commercial buildings are headed into defaults, foreclosures and bankruptcies. The reason: according to research firm Foresight Analytics LCC, $530 billion of commercial mortgages will be coming due for refinancing in the next three years — with about $160 billion maturing in the next year. Credit, meanwhile, is practically nonexistent and cash flows from commercial property are siphoning off.

Unlike home loans, which borrowers repay after a set period of time, commercial mortgages usually are underwritten for five, seven or 10 years with big payments due at the end. At that point, they typically need to be refinanced. A borrower’s inability to refinance could force it to give up the property to the lender.

A recent letter sent to Treasury Secretary Henry Paulson, and signed by a dozen real-estate trade groups, painted a bleak scenario: “Right now, we believe there is insufficient systemic capacity to refinance expiring, performing commercial real-estate loans,” said the letter. “For many borrowers, [credit] simply is not available,” the letter noted.

I guess Christmas is cancelled.

SMN… You trying to sneak in a 2 x inverse grenade on us?

Did you ever post a pic of that Barrons from ’29?

I’ll attach the Barron’s pic to this post. One sec.

NOTE: For the part, I will cease trading 2x,3x etf’s in 2009. SMN was just too tempting, considering the downgrades.

True you are holding tbt?

“For the most part, Americans are a bullish breed, always looking for the upside in things—even in death.”

Very clever.

I am long TBT, again. What a loser.

Japan’s exports to the U.S. declined a staggering 34%. The most ever since they started tracking the data in 1980. The ’80-’82 recessions were mutherfuckers, and U.S. trade with Japan is even worse now than it was then.

China had to lower interest rates again. The fifth time in 3 months. Panic mode.

CAT is lowering white collar workers pay by up to 50%. I told you fuckers months ago that people lucky enough to keep their jobs during this depression will face massive pay cuts. And now you are seeing it.

This “bottoming process” all the wingnuts keep talking about isn’t going to take weeks or months, but years. This bear is only a year old. The average bear is about 22 months. So we have the biggest credit bubble in history pop, effectivley wiping out many or our largest financial institutions, automakers, and homebuilders, with commercial property developers and retailers on deck for 2009, and people want to believe this will be a shorter than average bear just because the decline has been so steep? Good luck with that.

BTW: Coach had bags discounted 30% yesterday by me. I have never seen that before.

And, Macy’s is still slashing prices 70%, across the board. It’s ridiculous.

Good to see the fly communicates via the iPhone. Even space alien magicians know AAPL’s technology is light years ahead of the pack.

thanks for the barron’s pic. that’s some cool shit right there.

I DO NOT own an iphone.

That shit is for pussies.

My RIG short working as planned.

practically giving shit away.

Very cool!

I collect old newspapers. It’s actually a pretty cool hobby.

What are you doing hanging around the Macy’s….

Are you working them for FREE fragrance samples?

I have many gifts to buy.

As a matter of fact, I will be heading out shortly.

Mr. Fly

Are you a brokerage company- is this why you occasionally get audited?

Saks has some great sales…however I recently ‘went wild’ at the River Oaks Shopping Mall (high-end district of Houston, I live a few blocks from here). All of the high-end boutiques have things 50-70% off, the greatest thing was a very exclusive shop…is going out of business and have slashed everything. I bought up tons of cashmere sweaters for everyone, great skirts, jackets, coats, shoes, men’s blazers…etc

I think we wont see stuff this good next Christmas because all of us will really be cash strapped.

Fly, awesome gift you received, that Barron’s paper.

Prestigious white shoe firms like Dillon Reed and Kidder are on the cover. After a couple of intermediate deals, both ultimately ended up as assets of UBS. First Boston and DLJ went to Credit Suisse. LEH is part of Barclays.

R.I.P. American investment banking.

“As a matter of fact, I will be heading out shortly.”

———————————

Fly…go getcha self a 3G iPhone !

Be a MAN !

.

The storm’s interface tops the phone imo.

The Sprint Instinct is just as good as the IPhone and is cheaper with better coverage and faster download speeds. It has a built in REAL LIVE navigator GPS. IT also has live ” locate any person or business’ they pinpoint your GPS and you say who or what you want and they find it. IT also has live TV, radio, music ‘standard in the package’. REAL Television programs.

Its an all in one package for 99.00 first phone (unlimited everything) and 80.00 second phones I bought several for the men who work for me. They are on the road a lot and can use it like a computer. You can sinc up your emails as well. It has a camera and video too.

I got killed holding the Apple stock when it first crashed…not buying that stock again.

I own a rotary Ma’ Bell wireless shoe phone.

I thought you only collected spoons…according to D.T. anyway.

Somewhere I have some papers from the day after the 1987 crash.

Unfortunately, without a disastrous follow-through, the potential coolness is much reduced.

They’ve probably been consumed by silverfish by now anyway.

Fly, wasn’t that Barron’s originally published out of Boston?

I have 36 consecutive hours of video tape of the 1987 crash starting at 9AM (CNBC and CNN)

and going into Tuesday evening.

I turned a $63,000 account into minus $250,000

by short the Nov 300 OEX puts the previous Fri.

at 3/8, twenty of them bringing me in $750.

They went to 150 Tuesday morning.

I replayed the videos about 5 years ago and remembered every fuckin’ minute of them.

The good news is the margin clerks missed me, I shorted 15 more Tues AM, and a week later I was almost back to even.

I plan to have those tapes buried with me.