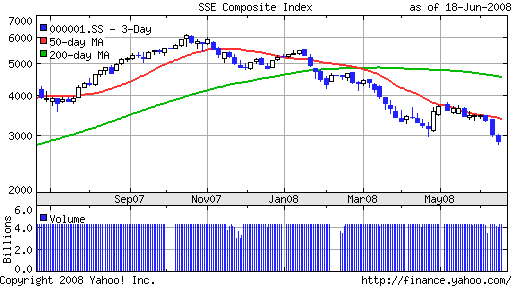

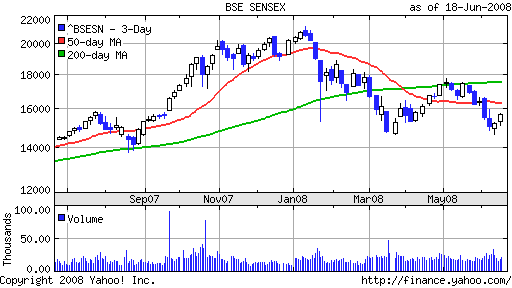

As we are told everyday, China and India are on fire, man. They’re just buying everything in sight. They cannot be stopped by price, supply or inflation. As we are told, ‘they are the future.’

China

India

If this is what runaway expansion does for their markets, I’d hate to see what contraction will do. I’ll stick with good ol’ boring US of A and its stupid fucking consumer driven playground of the nescient.

If you enjoy the content at iBankCoin, please follow us on Twitter

By Jim Cramer

RealMoney.com Columnist

6/20/2008 6:39 AM EDT

URL: http://www.thestreet.com/p/rmoney/jimcramerblog/10422235.html

How bad was that Bear Stearns portfolio? I am beginning to believe that JP Morgan’s (JPM) buy of Bear is looking like a big mistake. It can only be justified by what might have been an even bigger problem for JPM — the collapse of the trades that Bear made, which were being processed by JPM’s clearing.

We are now beginning to get a real sense of the worthlessness of the mortgage portfolios. Not that we got any help from the SEC, which has taken a “we don’t care what’s in the mortgages as long as you tell us you have mortgages” attitude. That’s been worthless for investors, and maybe even for JP Morgan.

The losses now exceed $400 billion, according to my modeling (if you simply assumed that 50% of the exotic mortgages that were issued from 2005 to 2007 eventually went into default). That’s amazing, but it looks like I dramatically underestimated the losses. UNDERESTIMATED!!

The most egregious issuers of these exotic mortgages were Bear, Merrill Lynch (MER) and Lehman Brothers (LEH) . I believe that JPM has taken in a huge number of uninsurable, non-hedgeable mortgage instruments that are a pure write-off. And that means they are probably underwater on everything they took in.

Worse still, judging by the Goldman Sachs call (GS) , JP Morgan didn’t pick up much from the point of view of clearing and prime brokerage. I am really worried JPM got nothing from this deal.

JPM is adamant that it got a lot out of the deal, which would infer that I am totally wrong. I can’t buy that. Sorry. Not after what we have seen from the other companies that have similar vintages.

Second, it’s a really bad sign for the next shot-gun acquirers. Without insurance from the government for all of these bad portfolios, it simply isn’t worth it to call the government and say “I want Nat City,” (NCC) or “I want Washington Mutual (WM) .”

It also makes me think that Countrywide Financial’s (CFC) balance sheet will really impair Bank of America (BAC) . And I simply don’t have any idea how Wachovia (WB) can make it in its current form.

Everyone is way too bullish on these companies. They should all be sold. Period

Random musings: it is time to reassess the negative view of gold. The Fed isn’t tightening, which is what caused gold to go down. That was a canard. The reversal in these banks is no doubt freaking the Fed out. The idea of raising rates takes away the one reason why you would want to invest in banks: the yield curve allowing the banks to refinance. That logic is sheer lunacy.

Avoid Bank Stocks

In the “Sell Block” segment, Cramer referred to what he called Goldman Sachs’ “hit list” of troubled banks, as well as several others, and told investors they simply cannot own them.

He said the arguments made by Goldman offered persuasive reasons not to own these bank stocks.

According to the Goldman report, banks needing additional capital will soon be forced to destroy their stock values in order to stay afloat. The report cited four reasons for this situation, all of which Cramer agreed with.

First, credit losses won’t peak until 2009. Second, it’s getting harder and harder for banks to raise additional funds. Third, the consensus earnings estimates for many banks are still too high. And finally, the yield curve may be in jeopardy as the Federal Reserve hints at possible interest rate hikes.

Cramer said with all of these pressures weighing on the bank stocks, now is the time to sell.

In particular, Cramer is worried about Bank of America (BAC) , Citigroup (C) , EastWest Bancorp (EWBC) , First Horizon (FHN) , Huntington Banshares (HBAN) , KeyCorp (KEY) , Marshal & Iisley (MI) , National City (NCC) , Popular (BPOP) , Wachovia (WB) and Washington Mutual (WM) .

I have meetings to attend.

I placed sell stops for WB, limiting my loss to 40 cents. And, I have buy orders for FXP and REW.

Also, I will look to sell short EWBC and PACW into this disaster.

And, as always, buy some FTK.

See you all around 12ish, et.

“Playground of the nescient”–I love it. I’m stealing it. Pure poetry. You’re wasting your talent banking all this coin. Write the next great American (sic) novel.

I’m an idiot who couldn’t guess the future direction of an elevator at the top floor. Fade my calls with all your available margin.

Agree with your Joys of Global comments –

My international investments now in Brazil – ILF RIO PBR. The rest..in USA oil biz. RIG/APA/ECA. I don’t work for ECA but God – they have 25000 new well locations to drill in current land portfolio. And they don’t pump their stock ??

Let’s see, when was ‘The Fly’ right? Reference: Fly buy WB

BKX is near 2002 support levels. Cutting down on financial short positions and going short SKF. High probability this support will hold or we’ll get a very strong bounce.

BBT is off to the races chopping balls.

$KACHING!!!!

More Louise Yamada coming up on Bloomberg.

Grabbed some Sept XLF calls, Q’s looked fucked if they drop from here.

Oh shit here we go again, I am getting fucking errors with this website again. Fly what the fuck kind of operation do you have going over there. Fucking database connection errors now.

sell ftk yesterday, i did

and buying now

banks are going to ride this circus elephant into the ground.

Fly Dick Bove called you out this morning on BBT. He wants to kick your ass.

“This company is not the same as numbers of banks that are dealing with bad management due to excessive risk taking yet its stock is being treated as if it was,” Bove wrote in a note to clients.

Fly is right, it used to BRIC this, BRIC that in the financial media. Now India’s stock market is way down and no one seems to notice in the media. Check out Tata Motors TTM, trading around it’s 52 week lows, and doesn’t look like it’s going to bounce any time soon.

BRIC is actually a metaphor for how those markets can drop.

I have to go make some money now. G’bye.

Long BBT, breaking out!

Long Financials short Tech. A good trade here IMO.

Long UYG short SKF Long QID Long REW.

I think going long bank stocks here is a very low risk trade. Sell if BKX breaks 60. A good chance BKX rallies to 70-75. 10 points of upside less than 2 points downside. Best probability I have seen in ages. Also check July XLF call activity. Big bets that financials recover.

QID is forming an inverse head and shoulders. Might sell from 42 to 43. Then wait to see if it breaks out to buy back in. Charts for ETF’s and small caps work sometimes.

Math question for anyone who knows options:

If you take a guy with a 100MM commercial RE portfolio, and this guy wants to put some kind of a safety net or counterbalance underneath his most risky assets, say 10MM worth, and he cannot get out of his investments – how would you do it? The guy is convinced the market is going to soften and he is panicked, and is willing to throw money at a solution.

I was thinking SRS Jan’09 calls (when they were a lot fuckin’ cheaper though) to mitigate say a 20% decline in value over 6 mos.

Would any of you genius number crunching options experts do some quick math and determine which calls would be the best in this situation, and how much $ would be needed?

My calculation on the Jan 90 calls was roughly 330K when the calls were going for $15.13 each, to offset 2MM of unrealized loss on the 10MM.

Thoughts?

Looks like short covering on BBT and some banks – it brings on mo buyers and up she goes …..until it fizzles out. Mr. Mortgage did not mention that mortgage rates have edged a little higher – no exotic or low interest mortgage available and the resets continue …. ARMs are being reset every month …….we have been told several times that it is the seventh inning …..NO! wait until the lights have been turned off. WB will likely cut the divvy and it will whack the stock when it happens.

WTF, Cramer used the word egregious! haha, that fucker does read IBC

The most egregious issuers of these exotic mortgages were Bear, Merrill Lynch (MER) and Lehman Brothers (LEH) . I believe that JPM has taken in a huge number of uninsurable, non-hedgeable mortgage instruments that are a pure write-off. And that means they are probably underwater on everything they took in.

Banking crisis = 3rd or 4th inning. Bears hurling a no-no so far.

Somebody stop ESI. It’s not supposed to do that.