I come to you, citizens of the internets, with more anecdotal evidence of a pending “correction” in the stock exchange.

Since I have started this portfolio at the dawn on 2013, I have only had one day with a better performance than yesterday. I feel as if my trading is cursed in this era of QE bull market runs…whereby every time I manage to string together some nice trades and am looking at generous paper profits, the market swoops in and snatches them from my grasp.

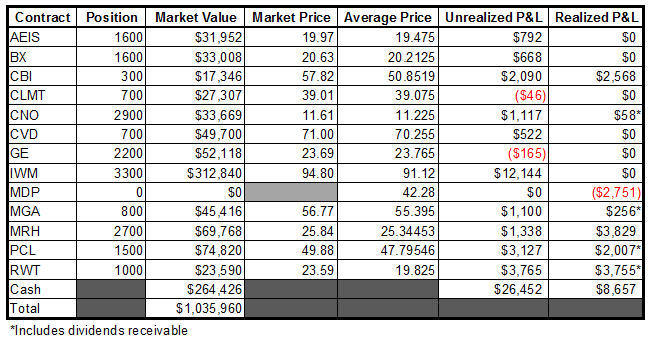

Thus you can understand my impending sense of doom as yesterday, essentially everything I own was green…and in most stocks, it was not just by a little.

For example, RWT has gone parabolic the past two weeks. I told you about this stock as it was “basing” in mid-late January stating: “If this stock can clear 19.5, what is to stop it from going to 30? Sure, one could say “common sense and logic”…and that would be a reasonable hypothesis. But we are also entering the “no logic” zone where demand far exceeds supply.”

We are currently sitting at 23.59.

I have sold half of my original position at two places in this rally (including once right before the close yesterday). Yes, I could have let it run, but I also expect some consolidation here soon…at which point I’ll reload with my sights set on my original target of 30 bucks/share.

Another of my olde (sic) time favorites was CBI. Now, I sold most of my position in this one prior to an earnings release and have not had a chance to reload.

Nevertheless, I was talking about this stock around the same time (mid January) with words such as: “Above 50, I foresee a push to all time highs in the low 60′s. While it is not likely to get there in a single swift move higher (i.e., stairs up, elevator down), there is little in the way of historical pricing equilibrium in this area to stop an advance.”

At that time it was trading at 48.15. Yesterday it closed at 57.82.

These are winners…and I served them up to you at a cost of nothing more than the time required to read my posts. Yes, my tales may lack the braggadocio that some of the other writers here are wont to employ…but I also know what the fuck I am doing…so do with that what you will.

Had you chosen to be more much aggressive with your asset allocation than I have, you, too, could be “crushing it”. As it stands, I’m chiseling away through new highs…slowly…quietly…but I’m there.

-EM

6 Responses to “Portfolio 03/14/13”

Vertigo

Thank you for spurning the braggadocio, unlike so many others that strut around like puffed up peacocks.

elizamae

It’s not in my nature.

I can talk shit with the best of them, but that serves little purpose unless I am unnecessarily provoked.

drummerboy

pcl,nice. one of my best since 08 🙂

elizamae

Yep, and the dividend is very solid. I think it is a great long-term addition to any portfolio

Sooz

now on to some snazzy jazz

Sooz

this would be true..

along with others, Z..