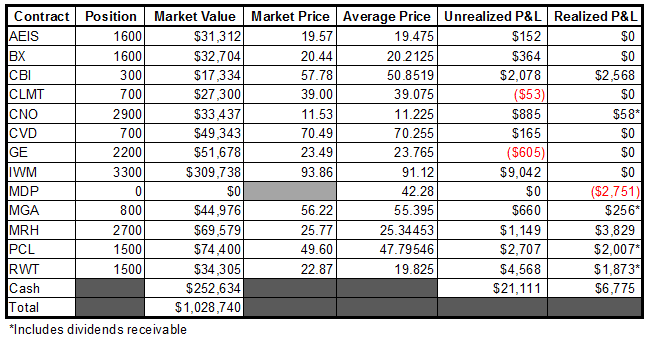

Yesterday brought about several transactions in the portfolio.

I had been watching CLMT for quite some time waiting to pounce. I almost bought on the break higher at the end of February, but held off and waited for a pullback. I didn’t want to get caught flat-footed, so I decided to pull the trigger on a starter late in the day yesterday at 39.07.

I should mention that this stock sports a volume void from current prices all the way up to all-time highs around 55. Translation: this one has a lot of room to run. Of course, you can ignore this information and keep trying to buy AAPL in search of a bottom…if that’s your thing, that’s cool, I’m just providing this information for your entertainment.

I also reloaded my MRH position on the break higher (at 25.75) out of the range the stock has been stuck in since early February. This was one of my first volume void finds, and also has a lot of room to run. So far this has been a low-beta, slowly developing experience…nevertheless, there is very limited historical volume to speak of from current prices all the way to all-time highs…around 43.

Again, this is another boring-ass stock that is not going to be “trending” on your favorite social media outlet…but could (and I emphasize COULD) appreciate significantly in the coming months. Yes, months…be patient. Or you could go and try to catch the bottom in EXK…I really don’t give a damn.

Lastly, I sold out of a little more than 25% of my PCL position at 49.67 (from 47.79) to raise some cash and lock in some gains.

The portfolio rolls on to a new highwater mark. Yes, the gains are somewhat muted YTD, but this is a marathon, not a sprint. There are plenty of people out there that can offer up trades that will return 200%…then conveniently forget to update others (trades) that go horribly wrong.

That’s fine.

Everything is here for you to see…this exercise is about managing money not recklessly throwing it around like a baboon flinging feces at the wall.

-EM

2 Responses to “Portfolio 03/13/13”

raul3

We’re mighty close to a tradable bottom in AAPL

elizamae

I do tend to agree with that; however my point was that there are many many other opportunities out there that aren’t as slippery or uncertain. Basically, I dislike stocks that trade against an upward market.