It is time to fight back against the slow, snooty service at your local Starbucks.

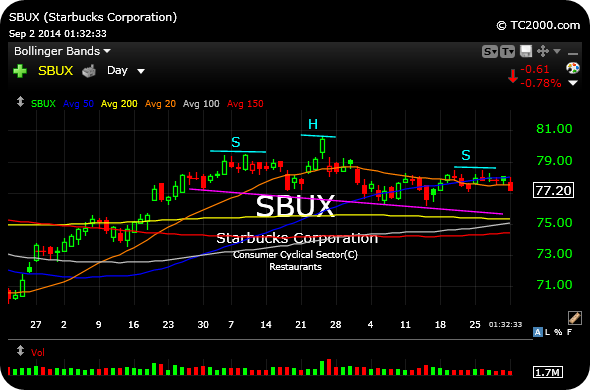

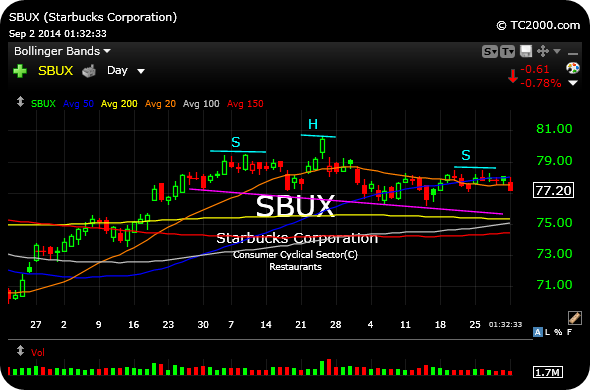

In all seriousness, though, I went short the name earlier today in part based on the daily chart technical setup, below.

Note the potential head and shoulders top targeting ht $72/$73 area.

In addition, the name could get hit on the same consumer issues the major casinos are getting hit on (I know they have Macau issues, but still some Vegas concerns).

Finally, if the rally in the coffee commodity has legs Starbucks could easily see sympathy selling, even if they have coffee prices already locked in at a low rate.

My cover-stop is a close over $79.

_____________________________________________________

Comments »