Here are some actionable short ideas on this list, especially if the market sees another day of weakness.

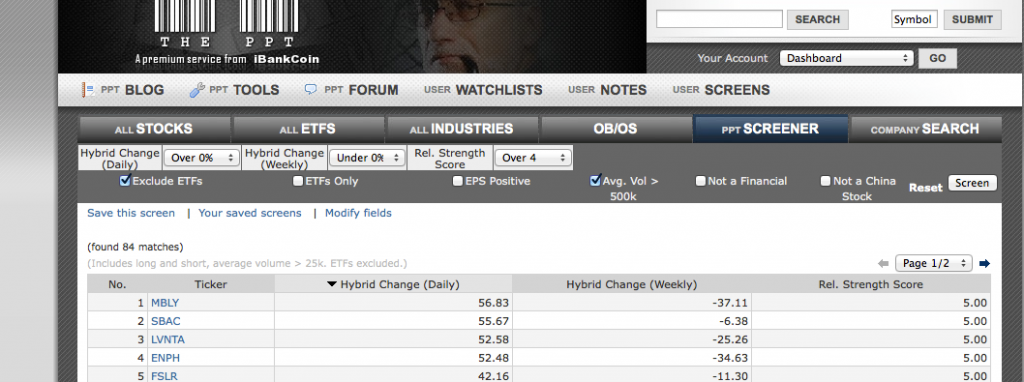

Courtesy of The PPT algorithm, here are some very aggressive ideas for short trades headed into Friday If you are not comfortable shorting (especially in a bull market), there is nothing wrong with taking a pass. Keep those cover-stops in place.

Nonetheless, a good chunk of readers are always looking for short ideas.

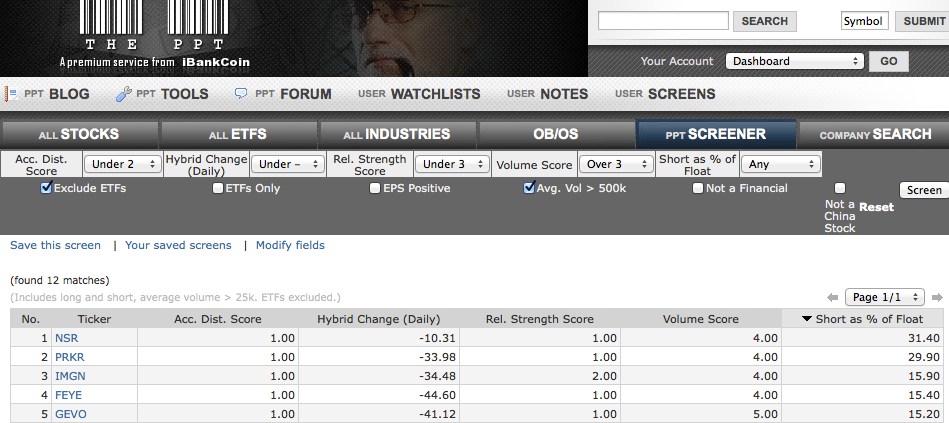

Members of The PPT can click here to view and save this “Titanic” Screen, as I named it when I created it a few years back. The screen isolates stocks vulnerable to further weakness.

Please click on image to enlarge

________________________________________________________

Comments »