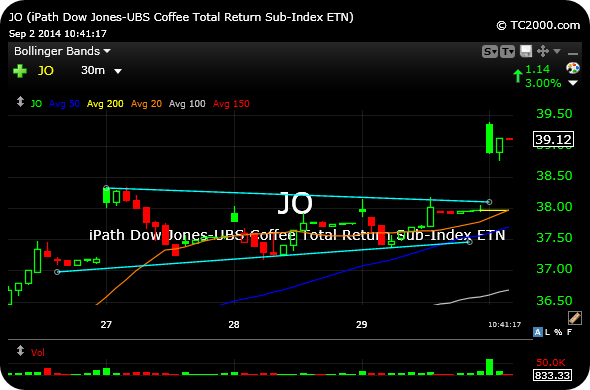

I added into strength just now, putting on more JO inside 12631 with several points of cushion on my original entry.

I am playing for a secondary rally in coffee after a riveting first quarter of 2014. Put another way, if coffee is in a new bull market then we should assuredly see another leg higher from here, lest the rally earlier this year be seen as an aberration.

On the 30-minute chart of the coffee ETN, below, note the base breakout higher this morning.

Indeed, coffee seems to be acting as well as any commodity this morning, with many of them soft.

________________________________________________________

Comments »