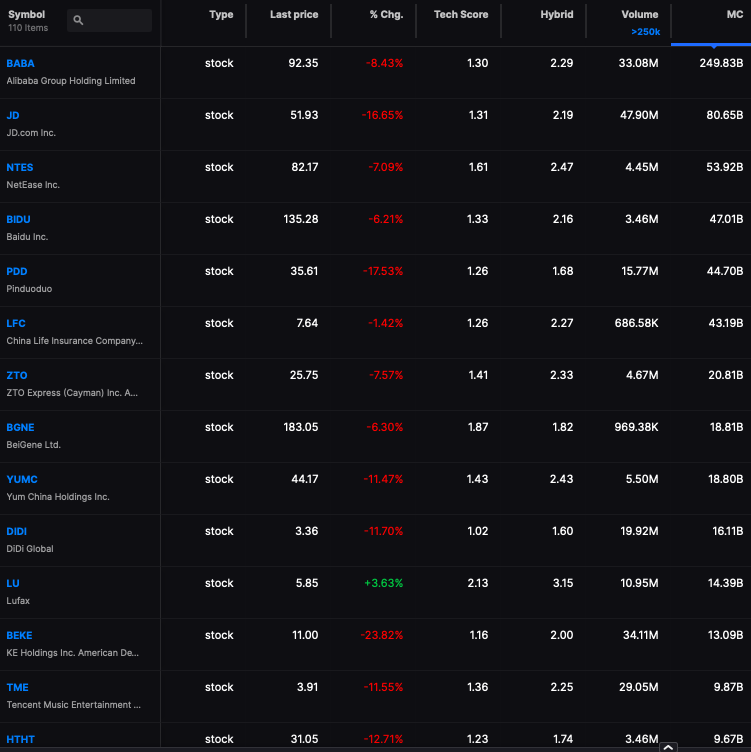

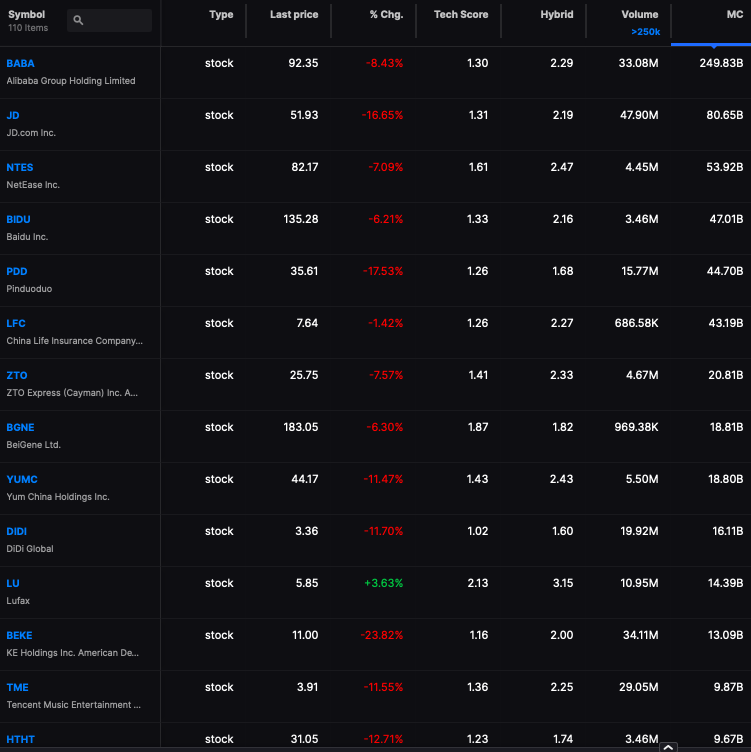

When I started the business in the late 90s, one thing was clear back then: ALL ISRAELI STOCKS WERE SCAMS. Over the years, Israeli companies become more mature and less scammy. Then entered China in the early 2000s and everyone jumped on the bandwagon — but I was not fooled. Inside my data platforms, now Stocklabs, I quarantine all Chinese stocks in a group called “Chinese Burritos.” It doesn’t matter what the fucking company does because I assume it’s all bullshit and their shares more or less trade as one.

Today Chinese stocks are down more than 6% in on top of losses of 50%+ the past 12 months. If you’re a China bull: you’ve been completely dispatched and much much more.

I almost wasn’t gonna look up the news, since it’s always the same story. Lo and behold, accounting issues. For those who’ve been around awhile will remember I once sold short all Chinese stocks that used this one accounting firm — since they were running a scam. I forget the name and this doesn’t help from a journalistic point of view — but if you’re really curious fuck off and search my archives.

Today’s bad news.

China watchers believe this is likely because the Securities and Exchange Commission has identified five U.S.-listed American depositary receipts of Chinese companies (Yum China, BeiGene, Zai Lab, ACM Research and HUTCHMED) for failing to adhere to the Holding Foreign Companies Accountable Act (HFCAA).

ADRs are securities that represent shares of non-U.S. companies, and they are traded on U.S. exchanges.

The act, which was passed in 2020, permits the SEC to ban companies from trading and be delisted from U.S. exchanges if American regulators are not able to review company audits for three consecutive years.

These are the first China ADRs to be identified as failing to adhere to the HFCAA. These five companies are on the list because they recently filed their annual reports with the SEC.

“All the Chinese listed ADRs will likely end up on the list, because none of them will be able to comply with requests to have their audits reviewed,” said Brendan Ahern, chief investment officer at KraneShares, told me. This is “because Chinese law prohibits the auditor to provide their review to U.S. regulatory authorities,” he added.

Needless to say, I won’t be buying this dip.

UPDATE: Deloitte was rigging books in 2011 in China. I had some ideas.

Comments »