Forget about the commodity sector and inane shopping mall plays; they’re red herrings. Your truest focus should lie on the banking sector, as they are the key to our survival.

Over the past week, foreign banks have been lit on fire and kicked into dumpsters.

DB -14%

BCS -13%

CS -12%

SAN -12%

LYG -11%

BBVA -12%

SBRCY -11%

IBN -10%

NMR -10%

RBS -8%

Over in the states, the carnage has been less pronounced, albeit concerning, nonetheless.

MS -7%

GS -5.5%

KEY -8%

C -8%

BAC -8%

WFC -6.5%

TREE -18%

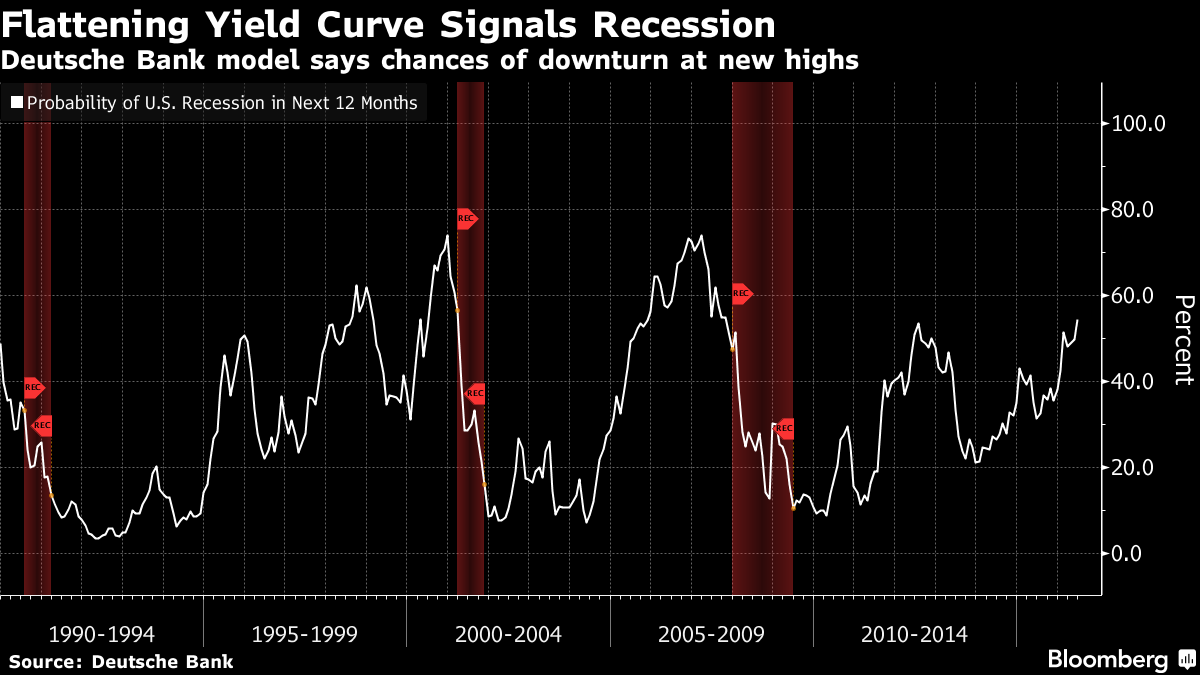

In addition to the above names, there are scores of regional banks with similar returns. Again, the crux of the issue is growth concerns, commingled with BREXIT fears, which is precipitating a monstrous rally in bonds, globally. The enemy is the ark.

The stated goal for the bull camp should be to focus their efforts on destroying the ark, forcing its inhabitants to flee from the purported safe haven of bonds, in exchange for shares of DB, BAC and GS.

Good luck with that!

Comments »