Any of you trading clowns catch one of these?

min cap: $5b

TCK +273%

ABX +202%

KGC +195%

AUY +194%

AU +168%

NEM +124%

AEM +112%

OKE +101%

CLR +97%

SBS +97%

Here is the median return breakdowns per sector.

Basic Resources: +13%

Consumer Goods +7%

Financials +1.55%

Healthcare -8%

Industrial Goods +10.5%

Services -0.35%

Technology +0.73%

Utilities +26%

TLT +19%

Bitcoin +86%

If you were in the reflation trade, long copper, oil and frac sand–you banked coin. Had you gandered at negative interest rates and said ‘fuck this’ and dropped money into dividend plays, like REITs, Utilities and Treasuries, you banked extreme coin. If you got pissed off at the New World Order, globalization, and the corruption of central banks and instead bought gold and bitcoin, you did the best.

Anyone delving into traditional bull market denizens, such as tech and biotech, did dreadfully.

The first half of 2016 was marked with cynicism and a lack of belief in the global growth story. Anyone who thinks the markets did great, sporting a 4% return on the SPY v a 26% return for electricity companies, are delusional.

Basic resources were helped by copper, oil and gold. Consumer goods were helped by the staples, basic necessities. Financials only posted a positive return because of the REITs and insurance. Industrial goods did well thanks to oil. Services, tech and healthcare did poorly, because we’re not really in a bull market.

For the second half of 2016, look for the narrative to change from “oh look at oil trade higher, gee that’s great” to “holy shit, how is XYZ going to refinance their debt in 2017?” There is a wall of debt coming due in 2017.

NOTEWORTHY: Coal was +51% for the first half, most likely due to Trump.

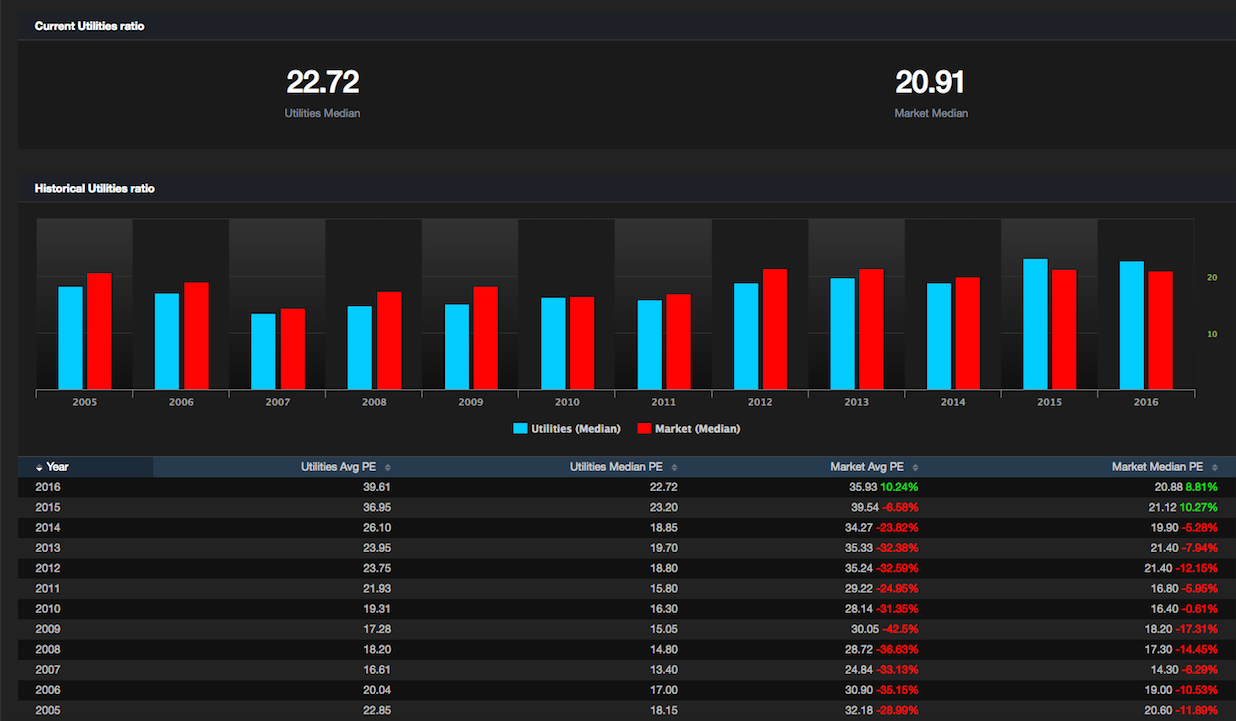

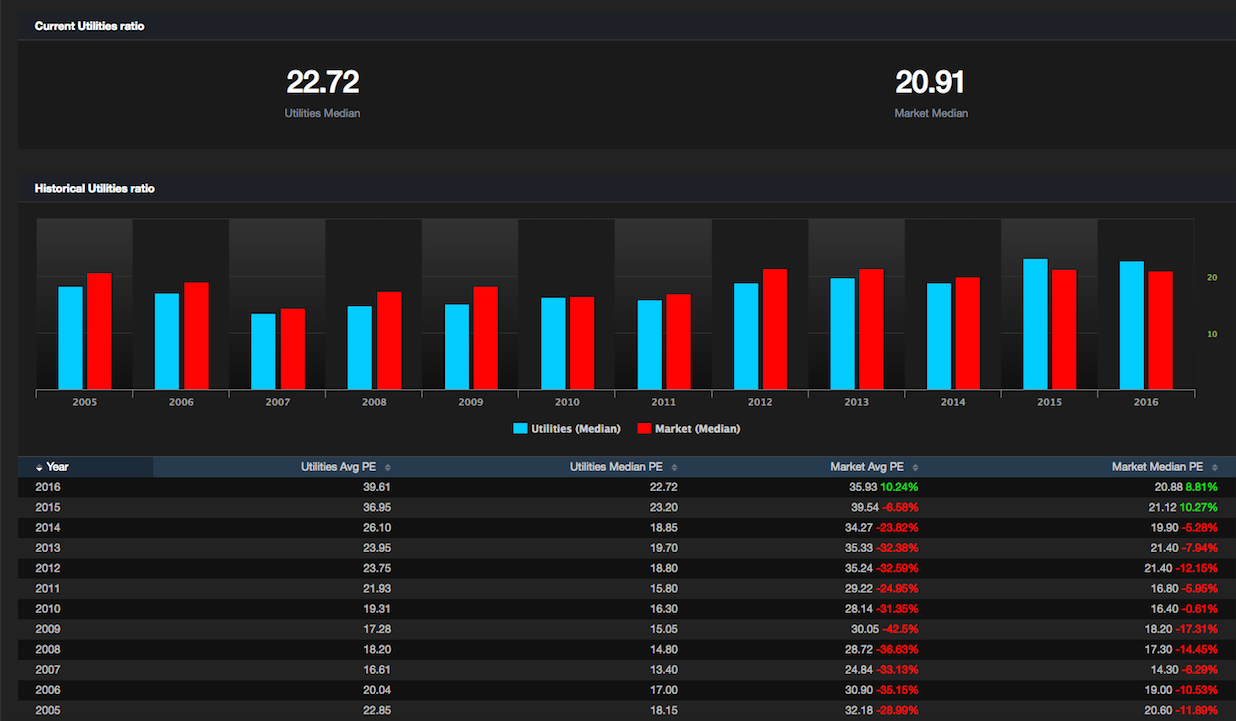

Regarding the utes, for the first time over the past decade, the average ute PE is trading at a premium to the market. The median PE is now at an absurd 23x. For a sector bereft of growth, this is patently absurd.

Data Provided by the Indefatigable Exodus.

Comments »