I think it’s fair to say many of us wonder or worry about the direction of the country, mostly for our children and grandchildren. We read about history and tend to compare the present to the past in an effort to draw similarities, mostly to feel like we’re living during important times. I think it’s also fair to say these times we’re enduring are different from previous eras, as a great demographic shift occurs behind the vanguard of marxist lunatics.

Some of you who haven’t achieved personal success and feel embittered by the way the cards were stacked for you and might lean towards socialism as a cudgel to punish the corrupt elite. But you’d only be punishing yourselves, by extension. There is no comparison to a free and capitalistic society vs a communist. We’ve achieved more than any nation in the world with this form of finance, which has been perverted in recent years to backstop and catch all of the falling knives to prevent losses at the top.

You can have capitalism and also price controls, especially on items needed for human survival — such as drugs, insurance, and education. How that manifests itself in an economy wholly reliant on keeping the Ponzi scheme going is impossible at once, but perhaps can be achieved slowly over time.

This website is chiefly meant to offer passive investment ideas and notions, also part diary for my missives — but I do not care to commingle my somewhat impassioned political ideas which I share on X here. Reason being: some people just don’t want to hear about it and only have an interest in controlling things within their grasp, which is understandable and also logical.

Many of the older people reading this will already know some of the things I am about to impart — but I’ll say it anyway because I am hoping it’ll hit across the bows of some younger punks who think they know it all.

Some investment maxims.

Position sizes should be thought of like driving a car. When you’re driving 35mph — you can easily control the vehicle and avoid errors or obstacles. However, when speeding 100mph, any small error can be fatal.

You should not have position sizes above 5% of your entire portfolio.

You should not be lured into wild eyed gambits in the hopes of using money to lavish yourselves with expensive items, which is really you trying to attract women. If you’re living your lives for material items, you’re living a vacuous life and will never be happy.

You should not hold stocks down more than 10%. You failed at buying at the right price and do not deserve to own it any longer.

You should not have more than 25% of your portfolio in one sector. There are 8 principle sectors: tech, services, consumer goods, industrials, basic materials, financials, healthcare, and utilities. Understand how you are structured you dumb son of a bitch.

You should not laden your portfolios with small capped stocks or companies that lose money. Think of your portfolios to function if you’re dead. If you cannot envision yourself long a stock 10 years from now — you should not own it now. This of course does not apply to day trading.

You should not have a portfolio with a beta greater than 1.5x. If you do not know what that means, find out. Once you find out, follow my advice.

What is the stated goal here? Financial security. How do we best ensure this? By making more than we spend and by investing our money with the goal of COMPOUNDING RETURNS. What does this mean? I will show you.

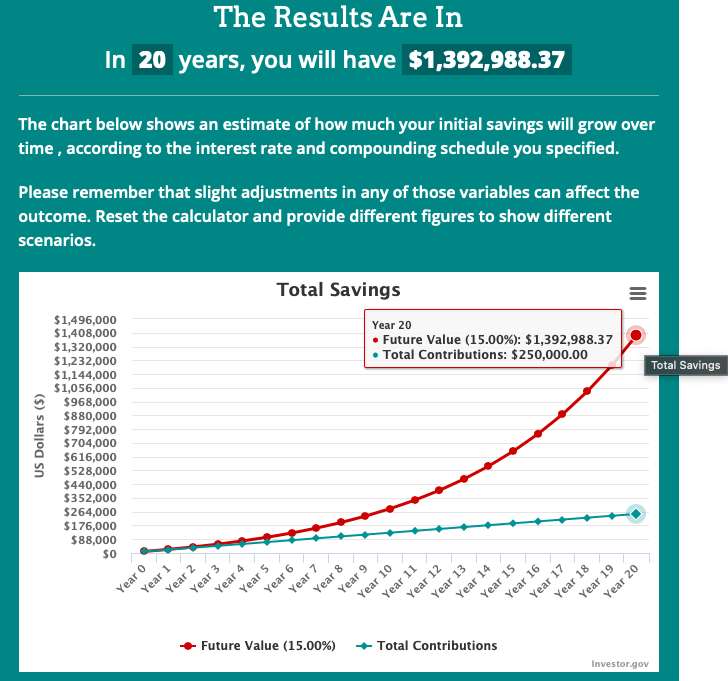

If you’re reading and are 27 years of age — let’s see how much you can save over the next 20 years, providing the world doesn’t blow up.

My assumption is you can start off at $10,000 and contribute $1,000 per mo, every month, for the next 20 years. Assuming you can do that and also return 15% per annum, which I feel is more than achievable, your $10,000 will be worth more than $1.3m when you’re my age — providing you with a cushion as you ebb into the retirement years.

I do not mean to dissuade you from making big dicked gains in other investments, getting rich young and enjoying your lives as kings. But I’ve seen way more young men blow the fuck up in a bad way than in a good way and they lose focus of what investing is all about: surviving the economic zone which is cold and dreary, where no one cares about you but your friends, family, and neighbors.

If you enjoy the content at iBankCoin, please follow us on Twitter

You say don’t hold more that 10% down. I guess you’ve forgotten Flotek (FTK). You took that to $1. Sure it ultimately worked out but that’s why people do that.