The main purpose of Stocklabs is to save time. We built the first iteration in 2008 when I managed money so that software could scan 10qs and 8ks for me, saving me the time to figure out the fundamentals of a company. We did the same for charting applying algorithms to each stock and ETF, grading them using various factors. I’ve always hated the monotony of having to sift through charts and viewed it as an antiquated practice.

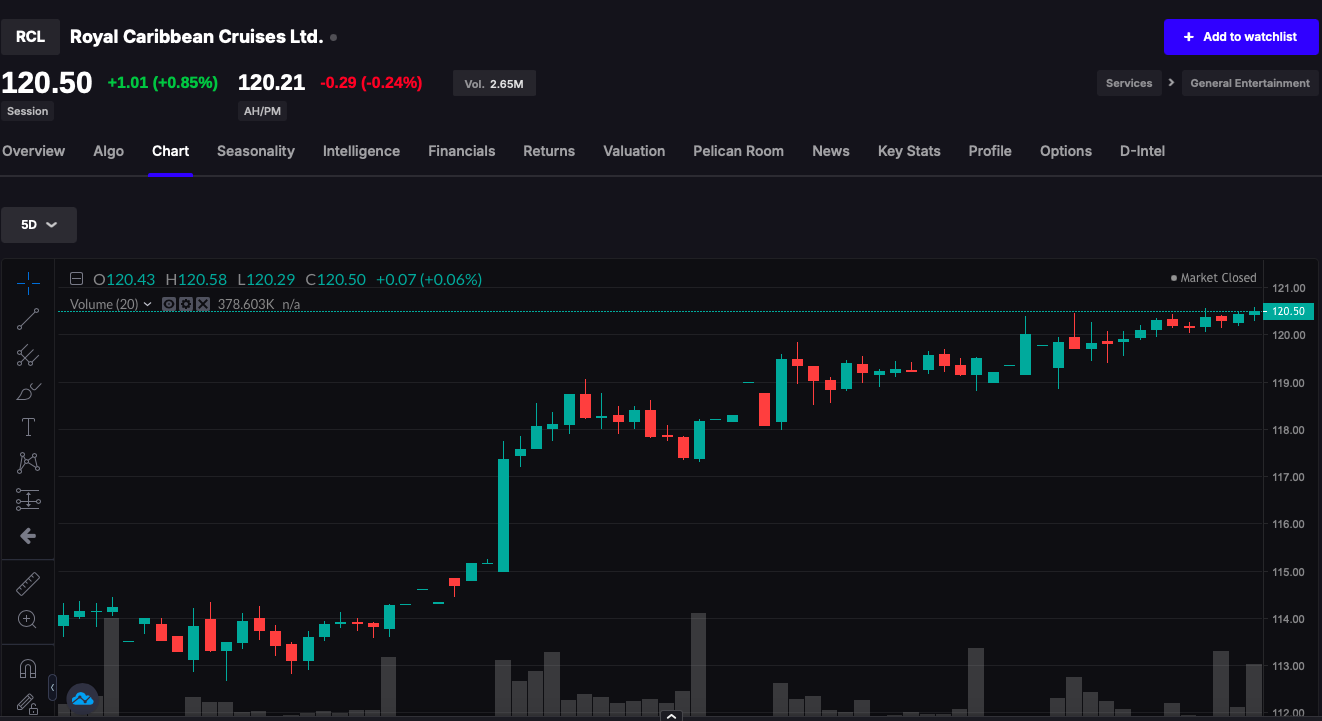

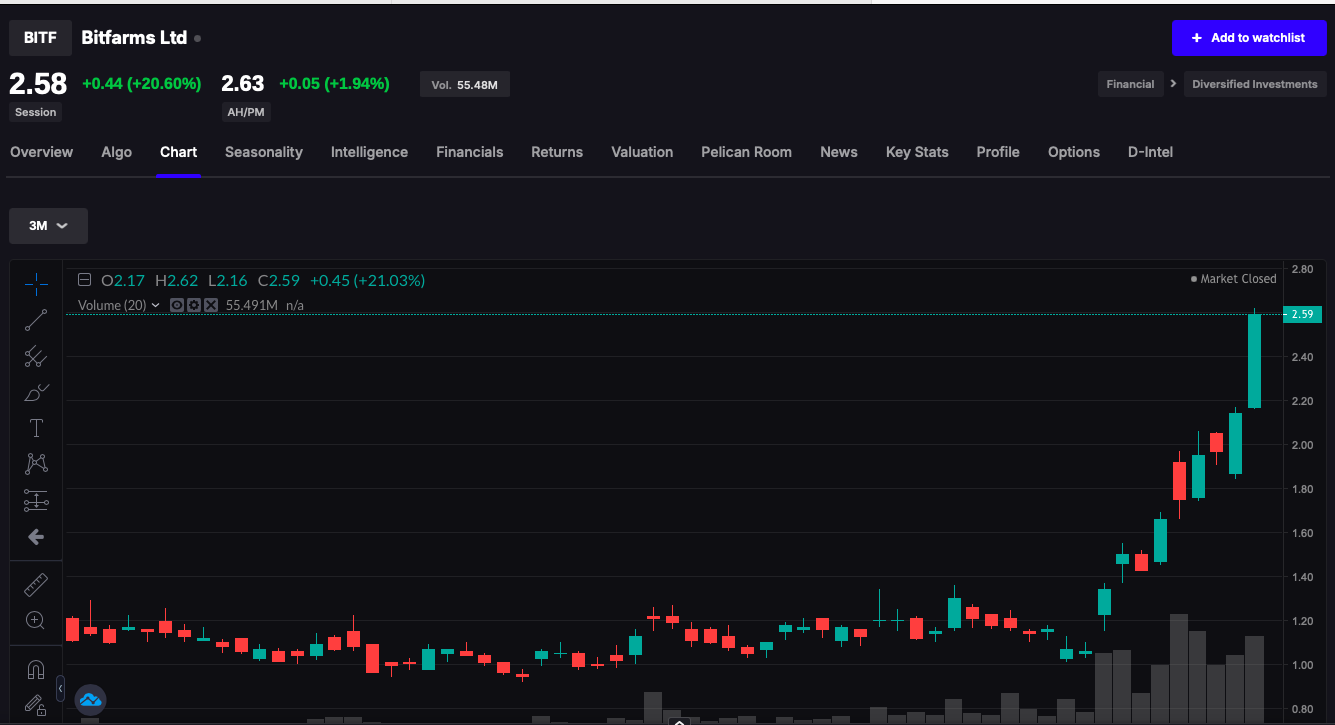

Inside Stocklabs we have a tech score that finds the best rated stocks intraday. I use this score every single day to help identify breakouts. Here was the top rated stock at the close Friday.

Top rated tech score (intra-day)

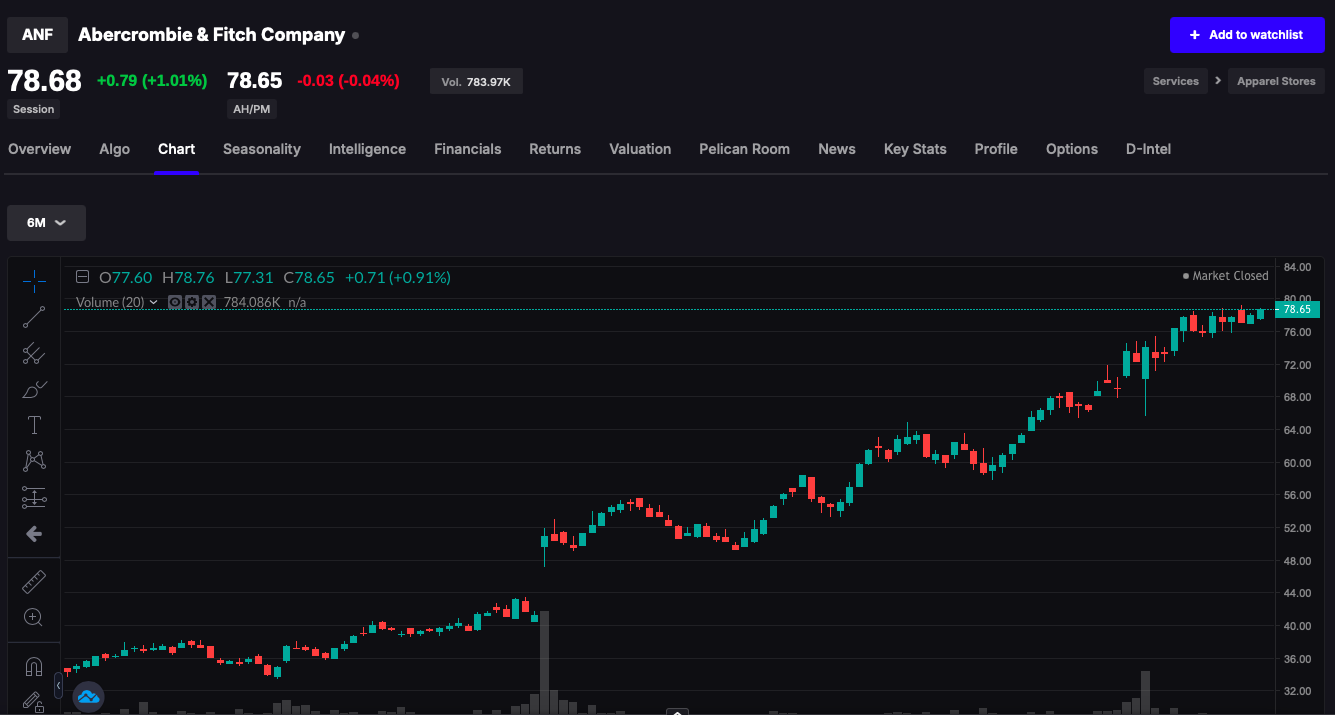

We then took that tech score and build aggregate datasets over various time frames — going out 1 year. By using these tools, any user can isolate the best traded stocks over these time frames. I use this to view pattern changes and money flow in and out of sectors.

Here are the top rated stocks over the past week and 6 months.

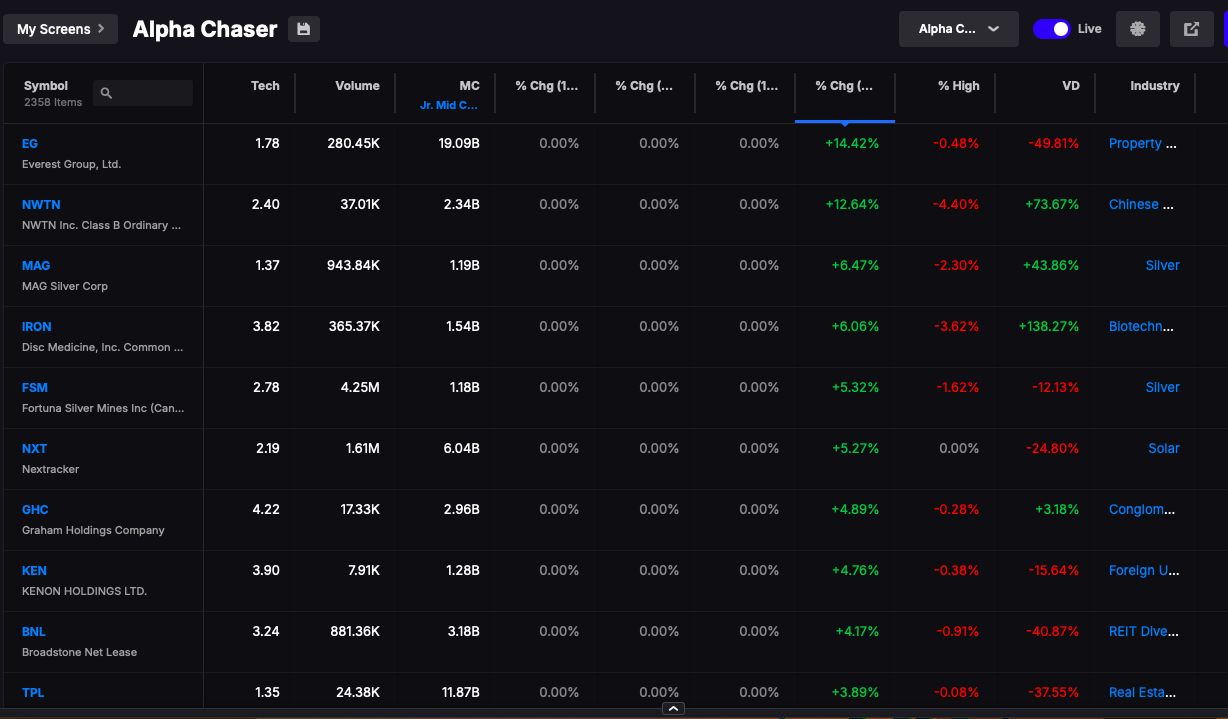

Here is the last thing I’ll show you, knowing most of you have ADHD. The way I find stocks every single day for the past 3 years is using the volume tools inside the platform. The graphic below is a still shot of the “Alpha” screener, which I keep set on 5 min change of +0.3%.

What the fuck does this mean? It means that is ANY stock moves more than 0.3% over a 5 min time frame it will show up in this scan. If you’re like me, you can see how valuable this tool could be when day trading. A typical setting for me is tech score above 3 (scale is 1-5, 5 being best), minimum volume of 500k shares trades, and within 2 or 3% of session highs.

The percent near session highs is a very important distinction for me. I do not want to catch falling knives. I am a momentum trader and want stocks busting loose at intraday highs. Many times the Alpha screener will produce stocks in a similar sector, which I clarify using more than 100 custom watchlists to help me isolate trends.

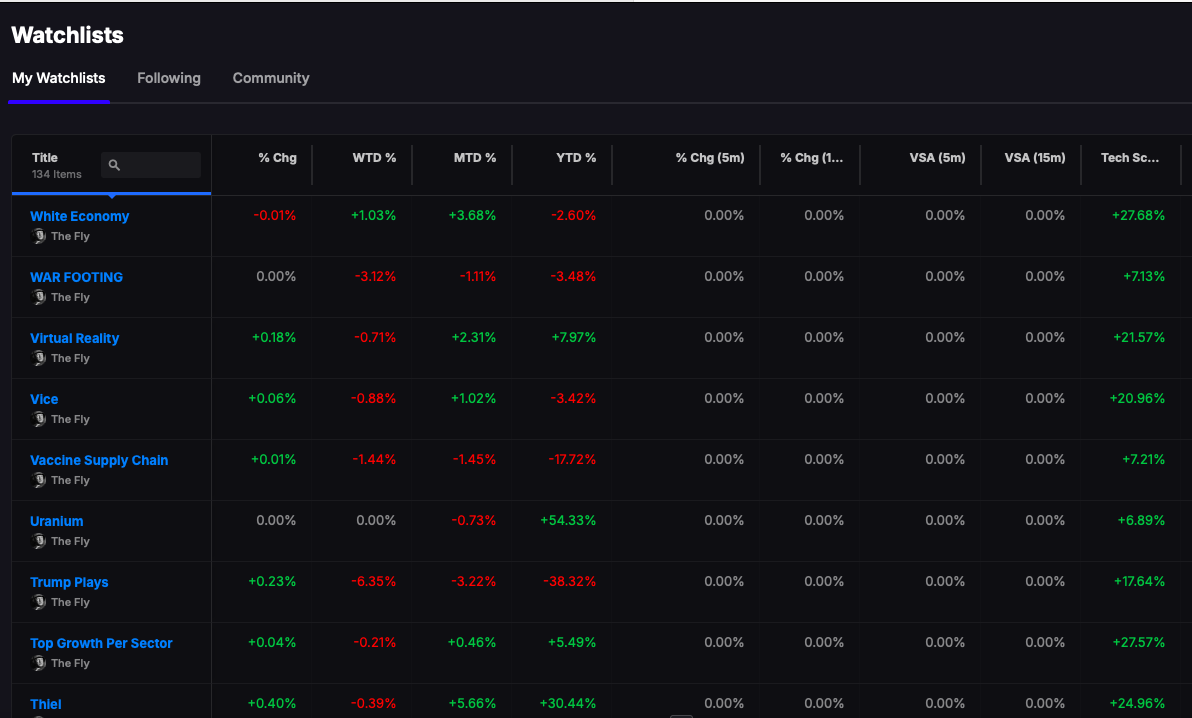

Here’s a look at some of my lists — which I use daily to monitor breakouts.

I’d be lying to you if I said Stocklabs is the only reason why I’m a good trader. I’ve always been good, even before SL. HOWEVER, my annual returns used to be in the ballpark of 30% and since I’ve started day trading and using these tools, my gains have exploded to +112% annualized.

GOOD DAY.

If you enjoy the content at iBankCoin, please follow us on Twitter