Is there any doubt?

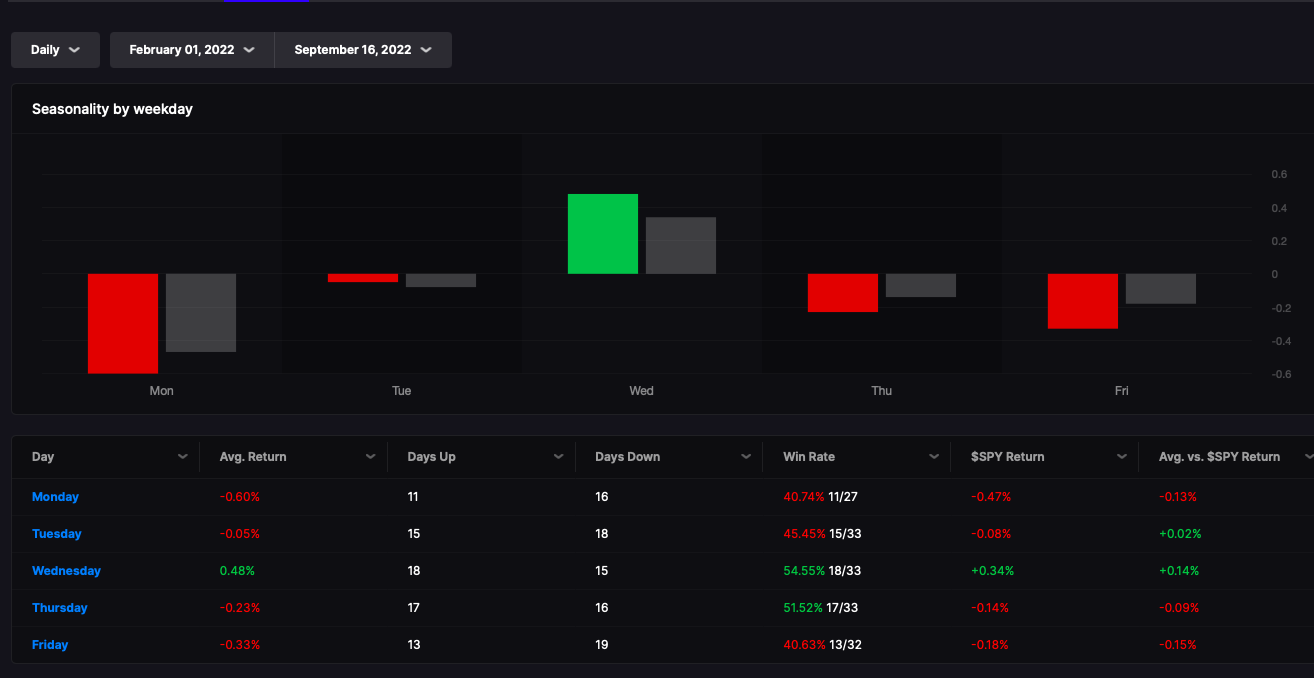

All Mondays YTD, Stocklabs

I stand before you a vanquished man, both of the physical and mental. Not only has my body succumbed to the pangs of COVID, but it scrambled my brains that caused me to shed 5% for the week. I see only darkness now and cannot think of a scenario where I might find a salient to surge upwards again. Because of this, I am 95% cash.

It would BEHOOVE me to not warn you of the hard times to come. Now with FDX firmly in the bear’d camp, there is little hope for humanity save a Federal Reserve spazzing out — halting of Fed hikes. That will never happen — because Powell is Volker now — and he is destined to be a cult hero.

Would it surprise me to see markets jimmy higher into the close and again on Monday in a “fuck you pattern” for the ages? No. We have seen this back and forth all year and I’d venture to argue traders have made more on the upside buying oversold dips than shorting into the hole. For the most part, traders have been immune to this bear market, since the oversold dips have provided bounces with very good consistency. All one has to do is wait for a bad two or three days, get long, and wait. Stocks like SHOP, RBLX and ROKU will provide quick 10% gains and then all you need to do is sell and wait for another dip.

This has been a very FORGIVING bear market and it has been quite mild in comparison to say 2002 and 2008. I barely know anyone who has blown up this year, just complainers bitching about 10-30% losses. If you’ve been long only and find yourselves down between 10-30% — that’s fairly benign is it not? All you have to do is keep adding to your accounts into the dips and wait for the turn — which I am told will eventually come.

But then you have the PERMANENT BEARS who say this bear market is going to be worse than 2008 — because the leverage is so much greater. It’s hard to reconcile it all and it’s especially hard to believe in the most grim forecasts — mainly because the worst case scenario rarely plays out.

If you enjoy the content at iBankCoin, please follow us on Twitter

Not oversold yet?

“We have seen this back and forth all year”

I’d venture to argue (in the vernacular) We have seen this back and fucking forth our entire lives and are likely to see it continue.

The worst case scenario rarely plays out – when the goal posts are moved continuously.

A few years ago, economic shutdown, massive job losses, rolling blackouts, 20% pump in all cause mortality, changing the sex of a 2nd grader w/o telling the parents… was the worst case scenario