Admittedly, I’m too bearish. My contempt is keeping me in a constant state of hatred. Good thing my rules are such that I blow out of my positions regularly, otherwise I’d be liable to short this market and never cover. Long term shorts, hoping for the worst.

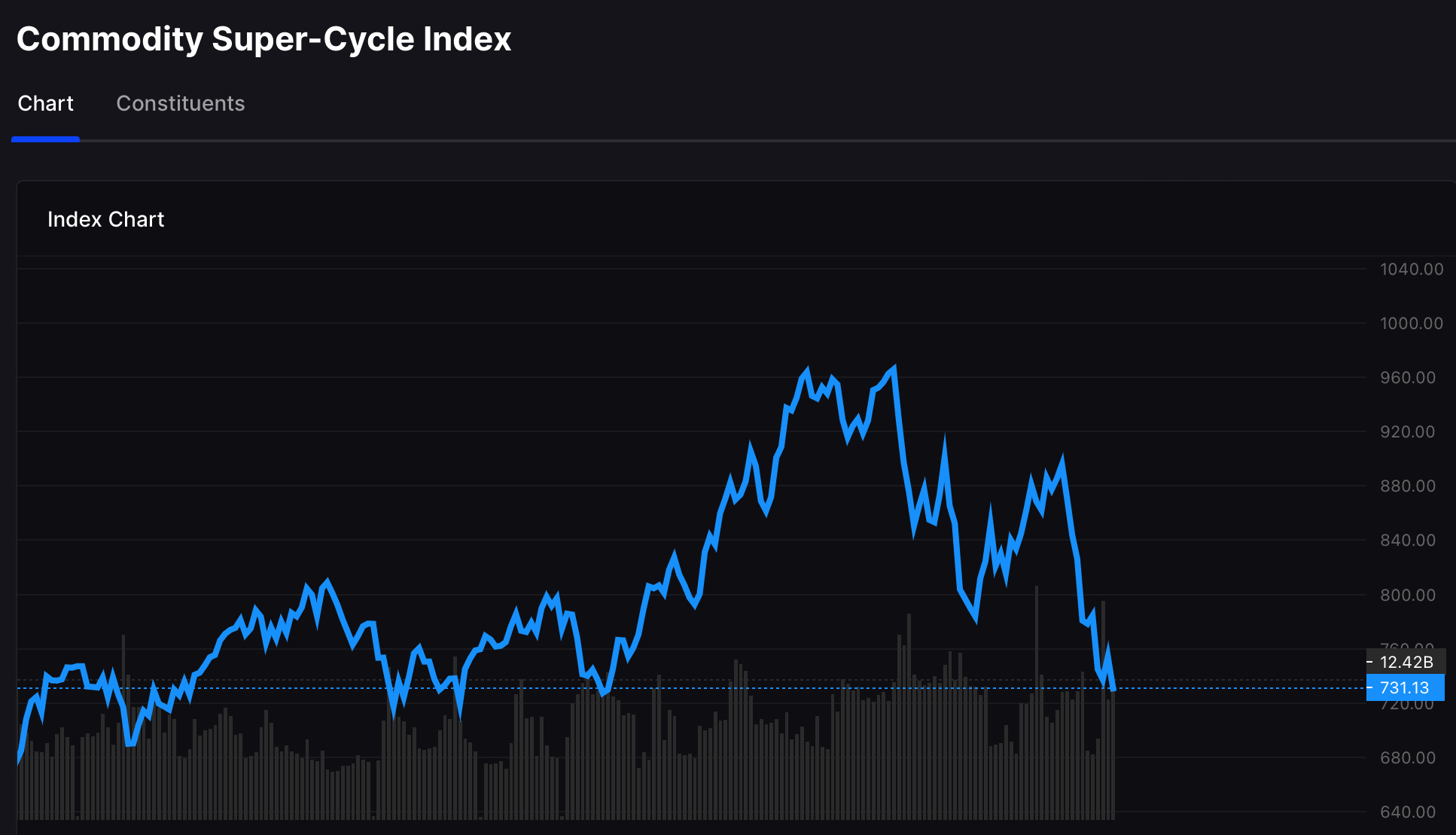

Futures are higher this morning, but commodities are once again getting drilled. You can view this two ways.

1. The Fed is successfully bringing down inflation and we are first seeing it in commodities.

2. The economic backdrop is such that supply shortages are negated by a fucking clown car collapse in demand.

The CRB index is only part of the story here.

The more significant story is the price action in the underlying stocks for commodities, ravaged in recent weeks and now FLAT to down for 2022. There are gains in the energy complex, but just about every other facet of Putin’s price hike has been neutralized.

So which is it — full economic collapse or successful victory over inflation by the Fed?

If you enjoy the content at iBankCoin, please follow us on Twitter

The Fed won’t be able to tackle the inflation issue without collapsing the economy. What they are attempting to do is thread the needle between the two which they’ve done successfully in the past but the needle was much larger then.

Too many other factors driving inflation now, and much of it is man made and done on purpose, so we’re going to get massive shortages and massive price inflation and they’re going to be powerless to do anything about it, assuming that they really want to.

It’s complicated PMI is being heralded as some huge disinflationary thing but it still grew. And pricing remains elevated its the orders that are getting hit.

In general the state of things were so constrained it’s possible lower commodity prices don’t even get passed along since manufacturing margins collapsed. The output will stay priced high to accomodate margins and the looming possibility of future inflation coming back (these things historically came in waves).

The last week has seen massive retracement of commodity prices. But that happened in 2021 as well. It was just a counter cycle that ended then gave way to more inflation.