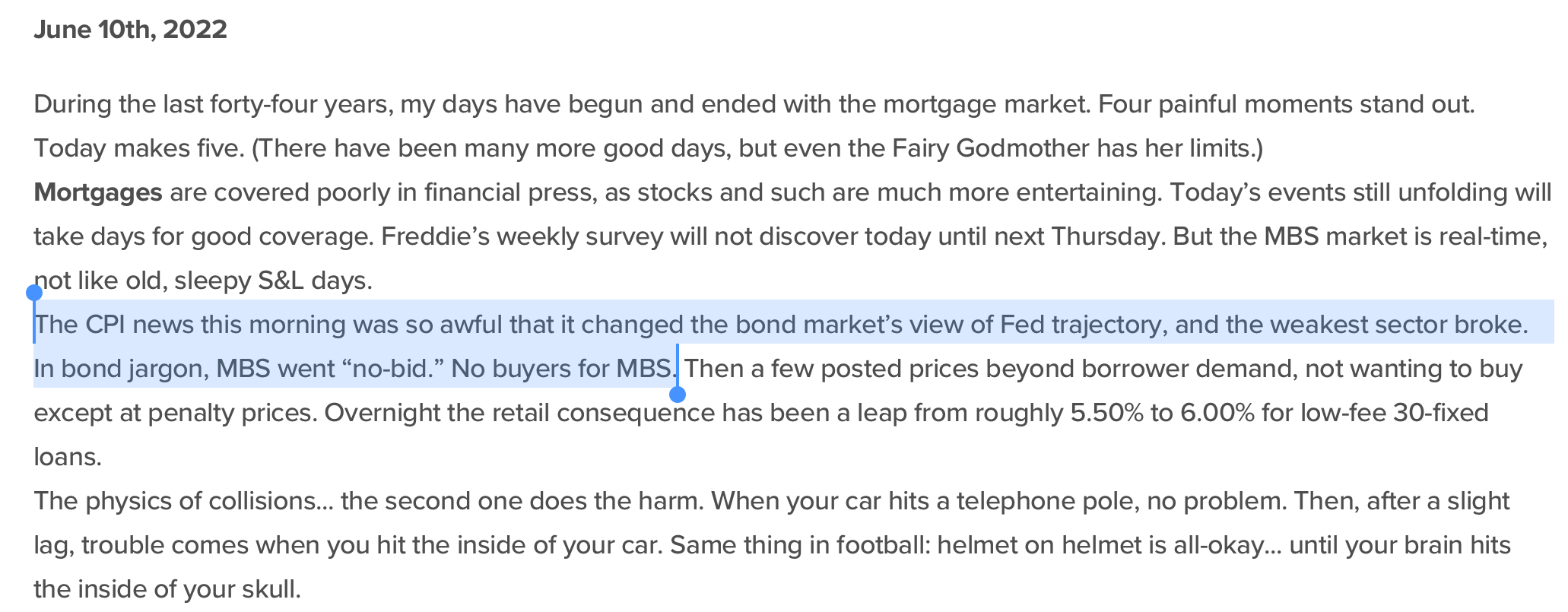

Mortgage broker Lou Barnes had an interesting blog last week, as he witnessed MBS go “no bid” following the worse than expected CPI print.

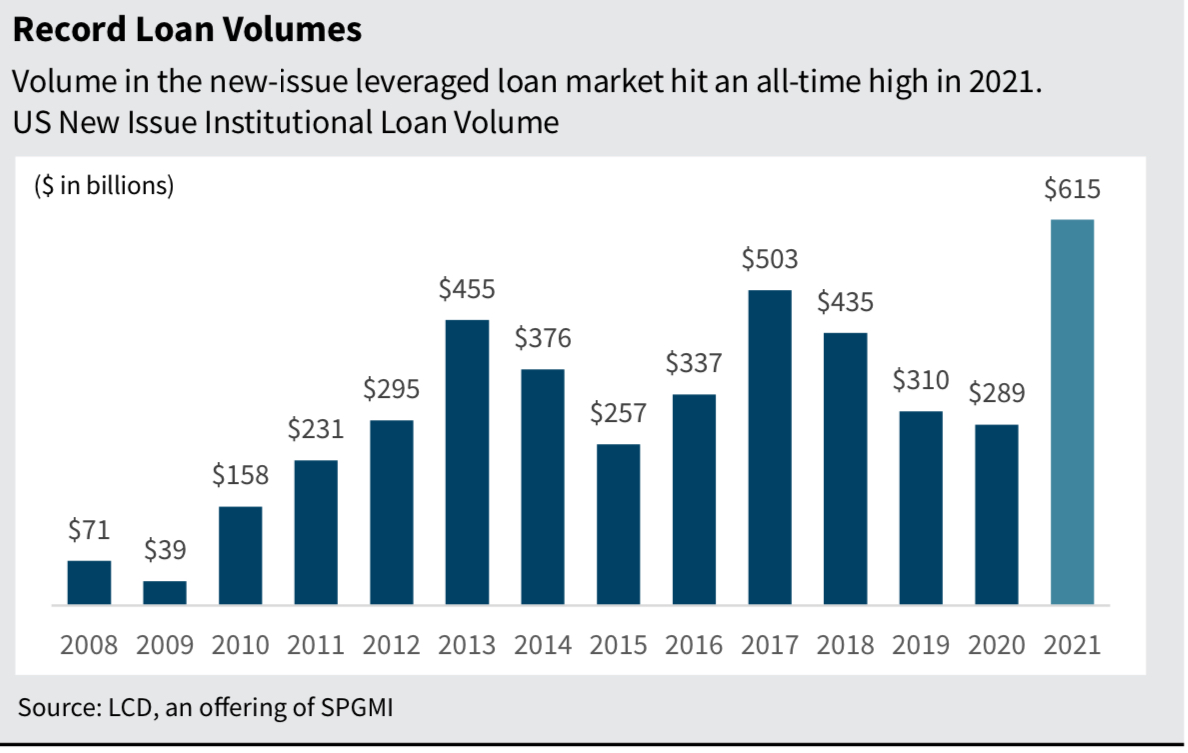

We’re already seeing the technicals of the banks get truly horrendous and worst of all the junk bond markets are completely upended. Even high grade credit is getting hit. It’s worth noting the leveraged loan market is at a record $3t + now.

Much of the low grade credit is in consumer oriented areas of the economy, which is directly under siege from high inflation. Bear in mind, these companies were finally starting to come around post COVID lockdowns, a spiteful assault by government on business. Now with gas in excess of $5 and natural gas approaching double digits, it goes without saying this winter is going to test the consumers mettle. It might possibly be the worst Christmas season in several generations.

Then we have the de-globalization effect happening, again all purposeful and pre-mediated items popping up here.

CHINA'S WEI SAY WE WILL FIGHT TO THE END IF ANYONE TRIES TO SECEDE TAIWAN FROM CHINA

CHINA'S WEI SAYS RELATIONSHIP WITH UNITED STATES IS AT A CRITICAL JUNCTURE

CHINA'S WEI SAYS U.S. INDO-PACIFIC STRATEGY WILL CREATE CONFRONTATION

— The_Real_Fly (@The_Real_Fly) June 12, 2022

Back in 2008 the housing market collapsed due to rates increasing at record housing price levels which led to ARM resets and massive delinquencies that ended up on the balance sheets of banks who rigged their numbers to issue so many of those bad loans.

Two things we’re not seeing yet.

High unemployment

High delinquencies

Those two items above are key to everything. Providing people have money to pay their loans, they should be fine. The main question is, can employers maintain overhead in this environment?

During the 1973-74 recession, unemployment crested to 9% from pre recession levels of 4.6%. Similarly, the unemployment rate during the housing crisis of 2008 saw unemployment top at 10%. It would seem reasonable to assume our 3.6% unemployment rate is at a bottom and might soon start racing higher.

If you enjoy the content at iBankCoin, please follow us on Twitter

If MBS goes no-bid a few times what are the leveraged, small mortgage shops gonna do?

If people want food on the table, truckers must be paid more. It’s that simple.

Inflation goin UP!

@WallStreetSilv

A grocery store is only 3 days away from having nothing on the shelves. Remember this.

Thousands of truckers are sidelined now because routes don’t pay enough to be profitable at current diesel prices.

As long as we have 40% who think Jim is doing a good job; we’re F’d.

And another bad cpi print is a near certainty.

A stock up now hoarding mentality seems to be taking hold, thanks to shortages of baby formula, paper products, etc. Prices will be higher next time you buy, if items are even available. – 3rd world stuff

Retail inventories are like 17% above trend which is much larger than the 5% reached in 2008. Overstaffed retailer liquidating inventory to an uninterested consumer is yet another leg to the crisis developing. (US Real Inventories, Retail Trade excl. automotive).

imho crypto cannot bottom until the stock market bleeds out.

seems we still have a ways to go for that

I was looking at what to expect in future annual CPI based on the monthly inflation that will roll off. June’s annual inflation rate shouldn’t be too bad because June 2021 was 0,9%. So I don’t see monthly inflation moving annual inflation rate up much.

But July, August, and September are another story. 2021’s monthly numbers for inflation were 0.5, 0.3, and 0.4%. https://www.bls.gov/news.release/pdf/cpi.pdf

So when the BLS’s early October release for September CPI is released, annual inflation should be above 9% fairly easily and possibly pushing toward 10% annual inflation rate.

Gold. Look at the price of Gold. Tells me the fed will blink

Let’s go Brandon! : )