SIRS —

You have a choice before you. Are you a believe in corn cobs or not? Last week everyone thought living on a farm with corn was preferable to large cities with vast meaningless resources and crime. Today the opposite is true, thanks to a collapse in all commodities — largess drops in Aluminum, Copper, Coal, Steal etc have soured the once bright mood and cast high echelon stocks into the pits of hell.

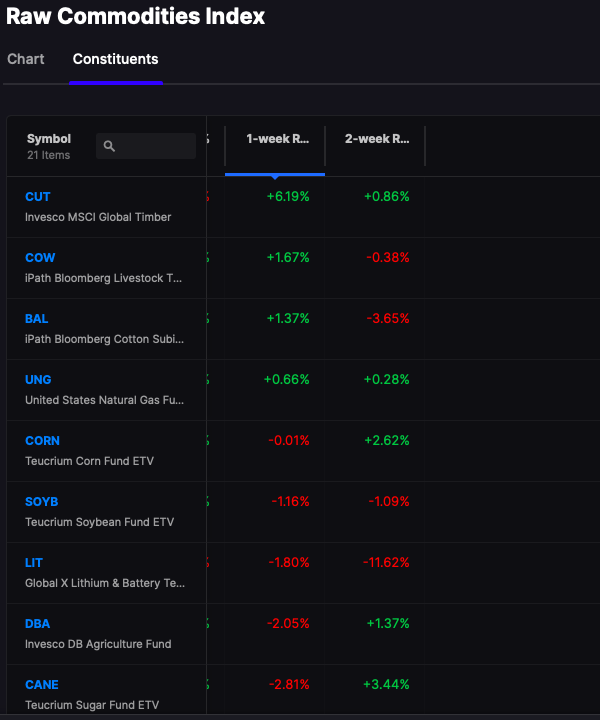

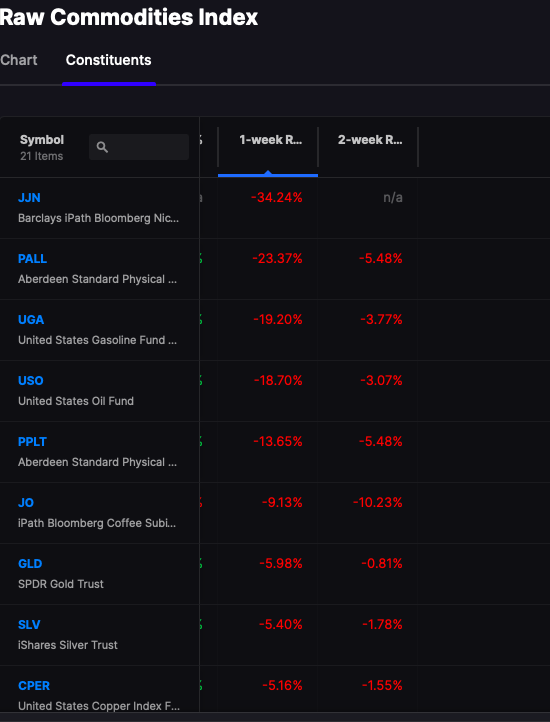

Above is the price performance of some raw material ETFs the past week.

Some stock ideas on this recent dip include, but not limited to, OXY, AA, MOS, IPI, FANG, APA, CENX, GFI, extending into the tankers and shippers too. But if you’re a believer that the war induced price spikes were one off events and what we’re seeing now is simply normalization of stock prices back to pre war levels, SIR — you are misguided.

- War is only getting started.

- Normalization of a stock like OXY places its shares into the $30s

My contention is simple: We are in the midst of a great commodity boom. This is merely a week in what might be a year + in higher prices, so don’t take it with much more than a grain of salt. I do think, however, prices could fall even further, so exposure should be limited. In one month from now, at least this is my guess, the share prices of the Commodity Super Cycle will be back to previous highs — predicated on supply shortages emanating from the war with Russia — which I believe will only get worse over time.

If you enjoy the content at iBankCoin, please follow us on Twitter

Indeed, agreed

Added to my positions, sold nothing

Energy is higher for longer

Demand cannot be realistically countered for quite some time, to many moving pieces on the chess board

It’s not a bad thing to have the commodities futures back down a bit. The companies are making money and best accomplished under the radar and off the headlines. The inevitable demand destruction (or over-production) mustn’t be a snuff-out this time.