What are we talking about, normal garden variety GDP recession or a crisis of the banks and general economy that causes a spiraling lower in all economic statistics? Perhaps a hot war with Russia might lend to some risk aversion when tankers are being torpedoed in the pacific.

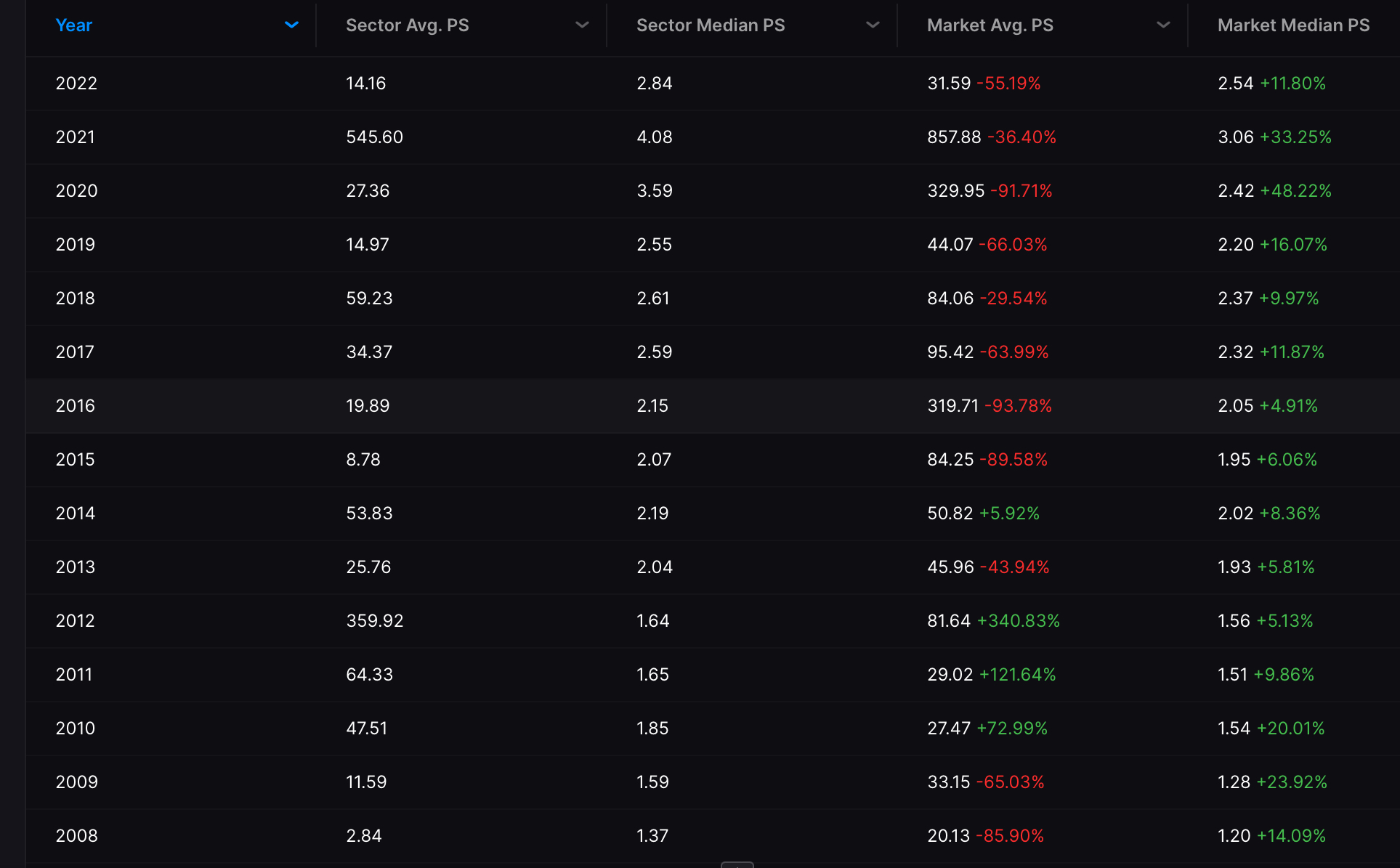

If we are to compare current PE or more importantly PS metrics vs 2008, the last real financial crisis, we have at least 50% more downside to go from here. I know that sounds unusually cruel, but the numbers do not lie.

Price to sales metrics for tech sector, via Stocklabs

Fun fact about the Moscow exchange, the last time it closed for this long was 1917, at which point it remained closed for another 75 years. Russia will just nationalize everything and remove the idea of a stock exchange.

As for America, we need our financial assets. It’s the best thing we have going for us. Let’s hope the worst case doesn’t play out. But if we do head into real crisis, know the lines in the sand from historical precedence.

If you enjoy the content at iBankCoin, please follow us on Twitter

I don’t know the result but Russia could possibly back the domestic on ruble with gold.

Not an option or even a consideration here.

domestic only

Gold at $30,000/oz might do it

The S&P 500 hit a CAPE ratio of almost 40x last year. It is presently at 35x.

In the 1970s, during the last stagflation period, the CAPE ratio dropped below 8x.

If we are being honest, the preponderance of all stock market gains over the last 20 years have been a product of multiples expansion and people generally paying more for the same dollar of earnings, not from growth and economic development. The justification was that growth was high and inflation was low so it made sense.

Inflation is the enemy of earnings multiples. And our inflation is set to be substantially worse than the 1970s. In the 70’s America was a relatively isolated industrial powerhouse with strong labor unions that kept foreign competition at bay. Today, America’s supply chains stretch far beyond our borders. A good begins its life in a Russian mine, then makes its way through a Chinese factory before getting stuck in the port of San Francisco.

That entire process is either jammed up still reeling from the pandemic or else just full of people who hate us. In the 1970s, it was really just oil causing us grief. Now it will be just about everything.

Run a trading platform, blog, and provide better WWIII coverage than all of MSM collectively. Respect. And thanks for the stuff you share on Twitter.

World Bank will try to get money to Ukraine next week.

Send crypto. It will be there before you finish your interview.

With all the levers they are pulling and buttons they are pressing, think of all the unintended consequences they will cause without knowing it. They certainly will not take any blame if it is traced back to them.

All of it – massively inflationary & no one knows other ramifications.