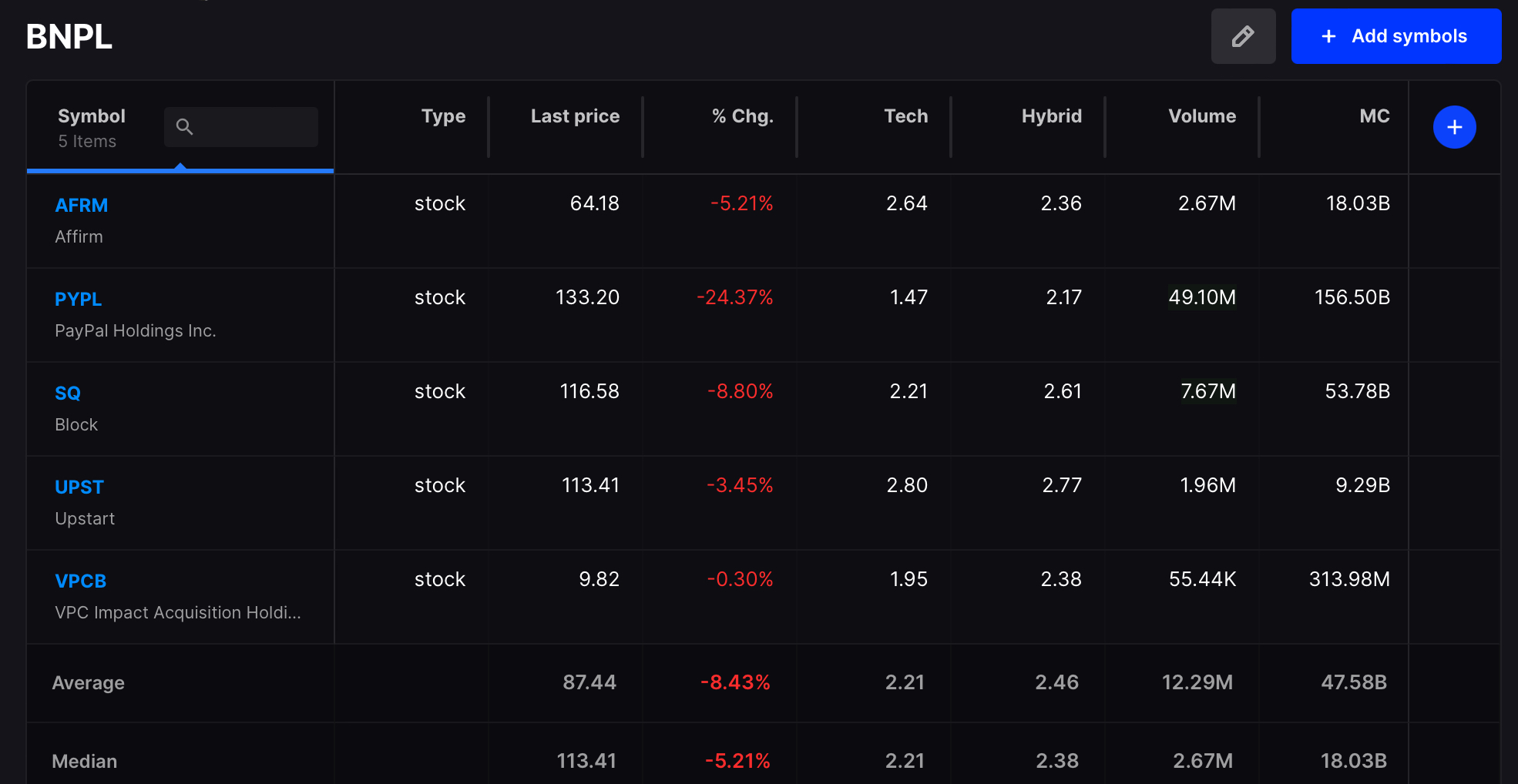

This era will be known for easy access to capital and how companies like SQ, AFRM and PYPL took advantage of good economic times in order to boost profits. The only problem with the buy now and pay later schemes is eventually people will never pay. You’re extending credit to those least likely to pay you back. This is sub par of the sub par and now we see shares of PYPK careening lower in a manner unbecoming not such a once great stock.

Let’s not forget about SQ and how they extend lines of credit to just about any business who uses them, at a time when, thanks to COVID policies, sales at restaurants are down 50% in major cities across the country.

I sold some stocks at the open, but not all. I hedged a little via TZA and feel ok with most of my stocks. I’m no longer chasing high beta and view the recent rally as the easy money made. It’s possible we can still rally, which is why I’m still long. However and nevertheless, I remain pessimistic about the prospects for too great a rally amidst the backdrop of higher yields, higher commodities, and Russian military wares on the move.

It’s worth noting, shares of SHOP and other online retailers dropping like a stone on this PYPL move. How much of the post COVID online retailer boom was predicated and reliant upon credit schemes?

If you enjoy the content at iBankCoin, please follow us on Twitter

Hah Yellen is trying to minimize the yield damage by reducing treasury auction sizes.

Good luck. Her funding requirements aren’t changing on the budget side.

Euro Area inflation numbers out. Increased to 5.1% from 5.0% last month. Was forecasted to fall to 4.4%.

USA on deck. Anyone want to bet on inflation topping after oil went from sub $70 to almost $90 in one month?

Central Bankers have screwed up royally.

I surmise their balance sheets are huge. Especially, the Fed.

Anyone care to speculate?