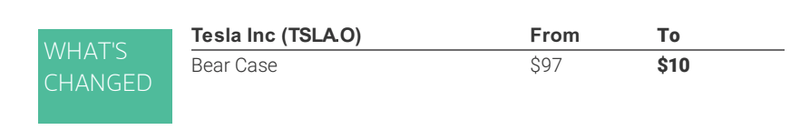

This is like predicting Amazon will land a man on the moon by 2024. Adam Jonas, who probably left the Jonas brothers to become an analyst at Morgan Stanley, is out making a dramatic splash today — thanks to his research note that says TSLA can go to $10, if a sundry of things coordinate and all work towards the stated goal of destroying the company.

Needless to say, the TSLAQ crowd on Twitter are besides themselves with joy this morning — retweeting one Tesla car crash after the next — warning people of the dangers of auto fires, and simply stating to others that there aren’t any Tesla auto-mechanics to fix or service the Tesla fleet — alongside this Morgan Stanley note.

We have long held that Tesla’s share price performance is driven by: demand for its products, ability to generate cash flow, and access to capital markets. This year’s sharp deceleration in demand has led to a substantial curtailment of the company’s ability to self-fund through free cash flow generation, at the margin potentially impacting the firm’s access to capital. Tesla’s recent $2.7bn equity and convertible debt raise may provide an extra year of liquidity to run a business of this size and cash consumption. However, Tesla may now find itself in a cycle where a lower share price may itself contribute to a potential deterioration of employee morale as well as potentially increased counterparty risk with both customers and business partners (suppliers,governments)… potentially further impacting fundamentals.

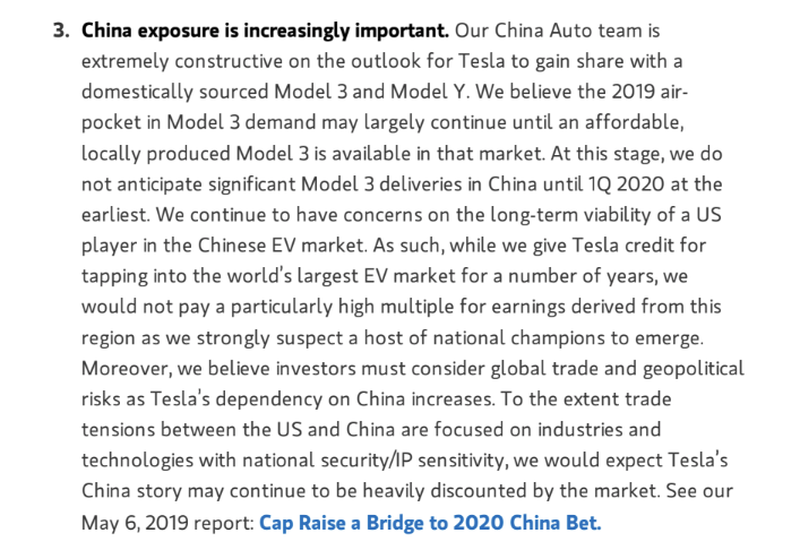

We believe Tesla may have over-saturated the retail market for BEV sedans outside of China. Tapping into new demand could require aggressively expanding into: 1) the Chinese domestic market, 2) lower-priced SUVs, 3) and logistics/mobility fleets. Tesla is a large and highly vertically integrated company, capacitized to build between 500k and 1 million units annually. In our opinion, Tesla has grown too big relative to near-term demand, putting great strain on the fundamentals.

Shares of TSLA are -3.1% in pre-market trading.

Full research note.

If you enjoy the content at iBankCoin, please follow us on Twitter

Ten bucks? Outrageous. Twenty five …. maybe.

It’ll go to zero if it goes to $10

If sentiment matters at all, the bottom must be near.

Adam Jonas doing one hell of a Skip Bayless impression. Bold. Outlandish. Wrong. Being wrong isn’t the point, it’s the gained publicity that’s the goal!

Its an overvalued POS but throw some darts and you’ll nail other high flyers that have defied gravity causing shorts to lose their minds. Fundies don’t mean shit in this market. I think this will need to get under a hundo for the cult to start puking.

GOOGL or AAPL would buy them way before $10

Yup, $10 is about $2B market cap. I’ve said before that TSLA ia among the most overpriced companieos, but I haven’t been shorting it becuase their IP is valuable and they may get smart and get out of the car manufacturing business and just license their patents.