Look at how stupid all of you bears are now, stuck like fools with heads jammed into honey jars. You never had an idea what to do with your money in the first place, let alone now.

Update on my sloppily drawn channel. We’re going to 6,650 on the NDX. You’d be wise to sell short at that level, not now.

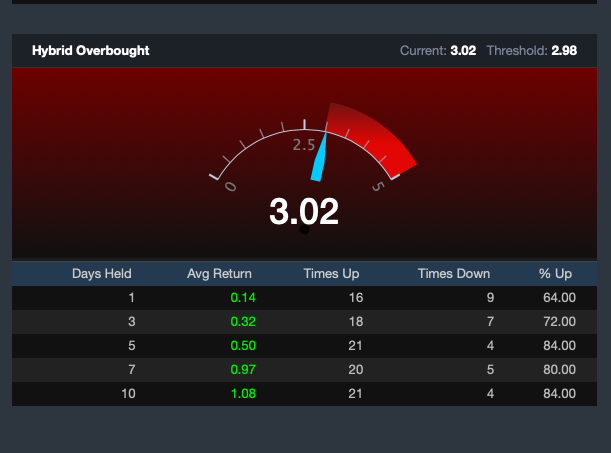

Over in Exodus — stocks are OVERBOUGHT. But do not panic just yet, fucked face. Here is the data over the past 36mo when the system was overbought. HIGHER PRICES 84% of the time.

What are you gamblers and bozos doing for the weekend? Perhaps a 10 hour spate of panhandling or perhaps shoplifting at the local grocery? I’ve noticed an appreciable degradation in the quality of the people on the free site — probably because it’s free and attracts the very worst people in the world. Just know, I am watching you and making sure you don’t get out of hand. Say whatever you want about me, even feel free to make fun of each other. But don’t you dare make fun of Dr. Benjamin Bernanke. That will get you a lifetime ban and your mustache punched clean off your face.

Off for another fun filled day with the nuclear family, perhaps a visit to the shopping mall, the infamous food court, and a nightcap of sober television viewing.

If you enjoy the content at iBankCoin, please follow us on Twitter

I will not insult you, my Good Dr. Fly. Not many have the fortitude to tolerate my vileness, and I appreciate that you allow me to display it.

It is a warm a day, and wealthy folk like yourself are enjoying a drive with windows down. So much better for the begging! I have collected enough for a good meal at Taco Bell and have enough left over for a put option on Amazon. Wish me well.

I hope you can afford a side order of cheese fries.

I would never make fun of Bernanke. But is it OK to make fun of anyone who thinks well of this guy who’s negligence helped break our economy in 2008 and who then doubled-down and transferred of additional $trillions from our children’s future to the already asset-rich; who facilitated our many wars by funding them with future inflation; who then had the audacity to write a self-congratulatory book about his own “courage”?

>guy who’s negligence helped break our economy in 2008

Some truth there, Greenspan is the Fed anti-Christ…who took rates from 1 to 4.5 in 2.5 years

Bernanke then put his foot on the throat in 2006 going to 5.25.

Powell is the new Fed God as he is wise enough to take a slower pace

With “negligence”, I was referring to the supervision and regulatory roll of the Fed.

e

easy for you to talk 10 years after the fact that we thought the whole economic world has going to hell in a basket and he was instrumental in saving it. Hard times called for hard choices. In the end, we lived and prospered and now slowly slowly the Fed will undo some of the excesses.

AND WHAT EXACTLY WAS YOUR CONTRIBUTION TO THE SOLUTION???

My contribution, modest though it is, is simply to verbally object whenever some programmed idiot like yourself repeats the nonsense that they’ve been fed. A partial solution is for you to go fight in the mid-east on your own dime and for you to give up all your assets in order to help pay down the debt.

Lol is it that simple, really? “Unwind” the excesses? Our economy cant even bare 3% rates now when 5, 6 and 7% rates used to be the norm. And when the next crisis hits and policy makers have no room to maneuver? Its not over by a longshot.

And why did our economy go barrel towards hell in a handbasket in the first place? Because of prior Fed-induced interventions which caused a massive credit bubble, then collapsed it, then “saved the day” with more interventions like QE. You see the problem? Its the Fed itself!

He was the Depression expert/scholar and in in his small mind that’s all he cared about.

He was the Depression expert/scholar and in in his small mind that’s all he cared about.

PREPARE FOR ANOTHER LEG LOWER – BET AGAINST THE SEMIS … remember way back one day ago when you had these gems !!!

Watch your mouth, shoplifter. He told you to bet against the semis (until his next blog post after your money is gone). He didn’t tell you to call him out.

Also, this is the free site where you degenerates deserve the shit stock tips. Only the real suckers who use the paid site make money with FIG. Ha Hah!

I hope you were able to panhandle enough for a hammed burger this weekend, maybe even one with some cheese on it.

here’s the code for the delta hedging bot with the data to backtest it on canadian stocks for 2015-2016. the features with the hidden markov model are patchy right now and should be implemented on a bigger time sample to better capture the regime on a weekly, daily and 4h basis i believe and then be traded on a 15 minute interval but i dont have the right data yet.

community on the here taught me a lot of stuff, so i’m happy to share this back to anyone that can use it. it would have to be edited slightly to be turned into a live trader

https://github.com/Dop4m1n3/gamma-scalper

Python is for children and the invalid

get ready to die old man.

Shhh. He must be one of them punch card Fortran old guys that used an IBM 360 terminal. LOL!

I come out of hiding just for you, my dear, and hope that you as smart as you seem to understand.

I sincerely suggest that you rethink your entire investment philosophy and techniques before you lose a ton of money and (more importantly) YEARS of your life.

The problem of your approach is in fat tails- things that are hard to model, impossible to forecast and conflicting to code. In other words: shit that always happened before never happen again, and shit that could never-ever happen atall happens with surpising regularity. The guys like you (and former me) always happen to get caught in a middle, bleed to death (financially), swear of this trading thingie forever and walk away bitter and disillusioned.

Try this instead:

1. Quit with prop desks, options, futures, leverage and especially fast trading systems.

2. Step out to longer time frames.

3. Look for a method that can survive volatility, not gain from it – so you still have money to trade when the going gets good.

4. You have good logic and skills, but your algo is to complex already. Try to go for a system with minimal inputs and conditions: your rule set has to fit on a 3×5 index card and be explanable in 10 words.

5. Save money. Save more. ALWAYS trade your own money. No investors. No partners.

I hope you can hear me right.

Good luck

One more thing: same system will not work on weekly and hourly time frames. Markets are NOT fractal like thar anymore because these participants are not the same, have totally different abilities and objectives.

Basically Mandelbrot was wrong about fractal nature of markets, but right in a sense that everything that we think is true (in finance) will eventually be proven to be an illusion.

thanks a lot. i appreciate it but im dumb and in it for the stories.

Bergamot speaks truth.

Backtesting makes several assumptions. Key among them:

1) all possible market-effecting events will affect the market in the future the exact way they did in the past

2) all possible market events have already occured in the past, and no new types of events will occur in the future.

Also, don’t forget GIGO. The quality of any algorithm/model pales in relationship to the quality of the training data. It looks like most of your data is only fro 2014 onward. If that is waht you used for SPY (I couldn’t find the SPY.csv file), that is a piss-poor training set. I’m not saying it that way to be rude. I am trying to grab you by the shoulders and shake you.

Even if you used a longer training period, that shoudl offer you little consolation: the Yahoo data for SPY only goes back to 1993, which still seem insufficient. Look at a 25-year interest rate chart if you want to know why.

I would like to weigh in on the Fed debate. We could go cause-and-effect all the way back to the stone age but I will start with the 90s.

First a little background. ALL economies are credit based. It’s just the way it works, our wealth is built upon an ever-growing mountain of debt, both public and private. Decreases in debt levels have a name- DEPRESSION. A fact that eluded our well-meaning President Clinton and his cabinet. They simply did not understand, or underestimated, the toxicity of budget surpluses.

Attempts to deal with the apparant unraveling were inadequate due to other economic misunderstandings, mainly by Greenspan. The Bush administration and Bernanke inherited the mess. W did the the right thing with budget deficits but Darth Vader’s contention that deficits could always be grown out of created an inflationary fire that Bernanke was a little slow in fighting in hindsight. The extent of the danger was not completely knowable at the time.

After the scope of the crisis began to reveal itself in late 2007 we had one of two choices: permit the world economy to collapse or take extraordinary measures to save it. Overall, performance here was good, and if anything, was handled a little too conservatively. More deficits then and less now would have been helpful.

The largest remaining legacy is QE, a grossly overestimated program. It was an asset swap designed to remove some bonds from circulation in order to provide asset price support and promote somewhat lower interest rates. Banks bought bonds in the open market and sold them to the Fed, which paid the banks with reserves. So, there was no net change in the private sector cash position in banks’ assets. It was not a big deal. Fears raged at the end of QE2 that rates would skyrocket. They fell.

Unwinding is not a big deal. Bonds are sold in the open market by the Fed, which uses the cash to pay the bank which sold the bond; the reserves are then deleted. There is no reason why the Fed has to sell the bonds anyway. They could be held to maturity.

I take the middle ground in most of these 2008 debates: I do think that extraordinary intervention was necessary to avoid a Depression. There is a cascading effect that many don’t understand. Banks are like the nuts that hold the wheels to the car. Yes, a wheel nut failure won’t affect the engine, but the car still won’t move without wheels.

However, the big mistake was in not holding financial executives and their companies to account for their mistakes. Fines paid by their companeis do not affect their wallets enough to change behavior, only prison for execs and sanctions (banning from certain markets, etc.) will do that

And for those that think QE ended, you’re wrong. The banks have never stopped sipping on the tax-payers tither.

https://www.federalreserve.gov/monetarypolicy/20081006a.htm

10 years later and payments are ***increasing***

The Fed needed to pay more on excess reserves since this is the way they planned on buying the bonds during QE. Banks were getting a low rate of return on their cash spent during QE even with this new rule. The money paid on the interest comes out of the FED profits they’re allowed to keep, but by law 95% of their profits are paid to the treasury.

The IOR will likely remain in place since it made the job of managing the overnight rate much easier. In order to keep rates from collapsing, every evening the fed had to frantically trade reserves to keep supply in balance with demand. Now there is simply a set rate.

BTW- Don’t know what we can do about TBTF, but prison time is obviously needed.

Thanks for a thoughtful post, but “They simply did not understand, or underestimated, the toxicity of budget surpluses. Attempts to deal with the apparant unraveling were inadequate due to other economic misunderstandings” is the craziest thing I’ve ever read.

“TBTF” institutions levered to the point that a 2% hiccup would wipe out their equity. Years of taking on junk paper, levering up …to the point that any of the more prudent bank’s chiefs were under pressure from their stockholders (“WhyTF aren’t you killing it like them other banks are?”) ..and so they too would join in the party. No one who should have been regulating this was doing their job …or were they doing exactly what their employer wanted? …not only did the bad actors not get punished, they were rewarded. Bernanke, over objections from some of his Fed colleagues, saw to it that AIG was bailed out so that GS and others could get paid 100% on the insurance they took out against the crap they were selling. Further, the very mechanism of QE funneled money to GS and other primary dealers ..to the point where GS’s trading operations made serious money every single day …unprecedented. Ben could have used his helicopter, but instead he use a rifle shot to make sure that the money went exactly where he wanted and not to the unwashed.

Straw man alert: No one here is arguing against credit. Yeesh.

The budget surpluses put the economy on a recessionary course. The Fed officials said so later. Greenspan admitted that his mistaken belief in the reserve money multiplier theory was a major reason why recession wasn’t averted.

YOU mentioned paying down the debt. Did you mean reducing the yearly deficit?

I agree with the rest of your post, but privately owned banks will always be problematic; it’s either that or nationalization.

Last post:

“A Secure 8% No Withdrawal Retirement Portfolio”

https://contrarianoutlook.com/new-no-withdrawal-portfolio/feeder-sites

I saw that headline and was immediately drawn to it. I struck gold! They actually named their investment vehicles. Among them, GDV, CSV, and EVV. I only wish I had spotted this article sooner. Now I know what to short.

PS: The 1st Overbought signal in a Bull market means buy, but in a Bear market means sell. In all likelihood, I’ll liquidate my long holdings COB monday.

Btw- just noticed an article at Marketwatch that touches on our fed debate. I think it’s bs but ymmv.

Moving on now, sold spy puts for a loss, bought a few more and sold quickly for + Added to apple and apa. sold xop calls at open. Everything, dvn, hp, sq, oled, stmp,bmy, wdc moving higher.

Sold some APA, ESV, DVN, Bought a little ins sp 253 puts. up 16%. AAPL and OLED limping., WDC moving up.