As many of you fuckers know, 75% of my money is managed quantitatively, a method that was very pretty and beautiful during the halcyon days of when the bull market roared, but ended up being mechanized ribald in the bear. For the past 3 months of the year, all of my gains, AND MORE, have been washed from my account. The net results for 2018 was a loss of 8.6%.

Jan: +6.1%

Feb: -6.13%

March: +0.5%

April: +1.04%

May: +4.5%

June: -0.41%

July: +2.25%

August +4.4%

September -1.08%

October -10%

November +2.79%

December -10.5%

Total return for 2018: -8.6%

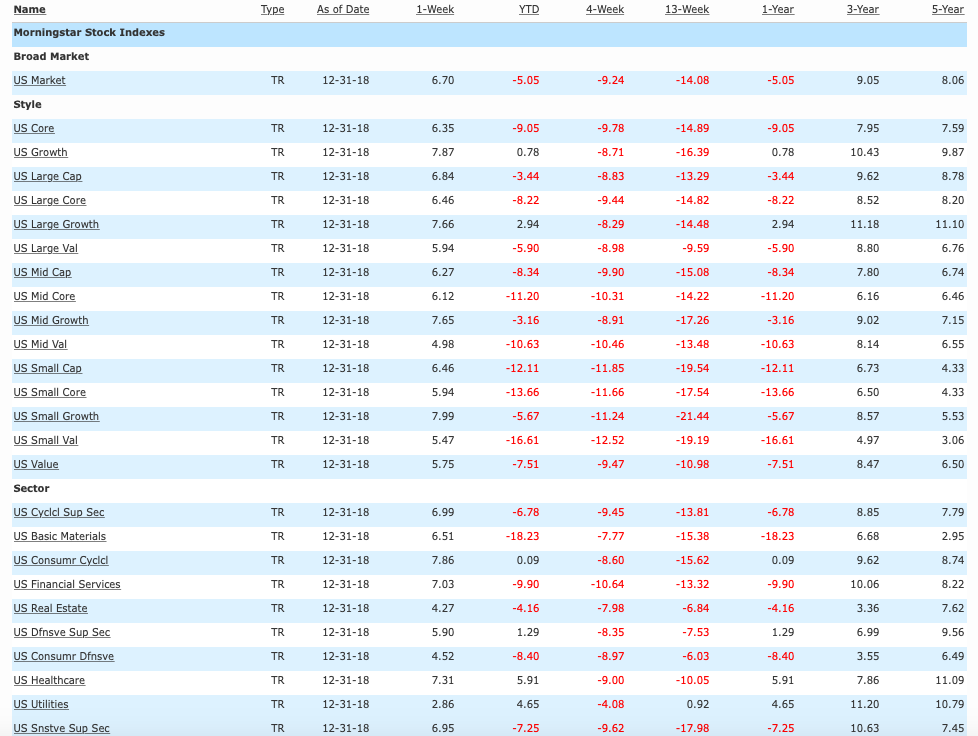

In comparison to what stocks did for 2018, this was in line with most investment strategies.

My trading account faired far better. Much of these gains were enjoyed during the summer months, especially during my winning streaks of 28 for 31 and 31 for 34. Net net, I had a profitable 2018 and have made adjustments to the Quant strategy to protect against further downside in the broader markets. The details of this plan, AND MORE, are in the Exodus blog now.

My methodology going forward is to be more defensive in the Quant and more aggressive with my discretionary account. I’ve been catacombed in cash for the past 3 months, placing small bets which have, more or less, resulted in marginal returns. A lot of circle jerking, if I can say so myself.

Over in my other service, The Capstone Programme, I intend to review long term portfolios for January. If interested in an annual plan, the discount code INDEUD will be effective for approximately 1 day.

Starting tomorrow, I expect markets to set a tone early on and I will attempt to position aggressively, either long or short. Market price action will be my guiding star.

If you enjoy the content at iBankCoin, please follow us on Twitter

GEEZ, given your propensity to advocate we are going lower, am surprised you did not expound on this theme.

but we will see what happens tomorrow!!

You’ll need to be quick on your feet here. I’m cash heavy, net bear.

If you dig Philip Glass then I recommend you listen to Terry Riley.

20% in each FAANG is still up on the year,.

AMZN and NFLX are solely momentum plays. They are great companies, but their stock is like buying a buying a an iPhone for $2000: great product, overpriced.

I come at this not from a perspective that theoir growth wil ldecrease, but from the conclusion that based on past revenues and costs, their profit margins will be far too narrow to justify the price **even if they do meet growth expectations.**

According to their reported numbers:, AMZN cloud business accounts for only a samll part of their revenue to justify their price and their on-line sales business has samm margins. As for NFLX, they can’t seem to get control of their contetn spend and they still produce very little of it in-house.

Great companies always appear “overpriced”, people have been making your same argument about AMZN for 5 years

Will the market make it back to test the fag box? Not waiting. Will look to build back possitions into tvix, tza and faz.

We’re going to test the lows as liquidity returns. In other words, it’s summer time in Jan, put on your shorts.

Given the futures today, the big question is: will th talking “professionals” in finance gain say “who coulda known?’ as Finacial Professioanls watch their clients’ portfolios fall.?