The Turkish crisis is predicated upon the lira shriveling away into oblivion, taking with it Italy and Spain. Every crisis around the world seems to do the same — completely entangle Italy and Spain in a web that only Germans can solve. Said Germans are probably sitting back now, sipping on some schnapps wondering how it all went wrong.

Meanwhile, the lira is actually UP on the day — to the tune of 4.3%. Ergo and therefore, this sell off is completely bullshit. There I said it.

Other cross-currents that are plaguing stocks is GE at 9 year lows, Macy’s sales stink, and some fuck-ball of an analyst who believes the semis are in fact rolling towards a debilitating bear market.

“We think it’s going to be a messy September for trade talks, so that’s the number one warning sign. But then, if you look at the seasonal factors, there are all kinds of red flags,” including elevated inventory levels, Larry McDonald, editor of the Bear Traps Report, said Tuesday on CNBC’s “Trading Nation.”

“We think the SMH [semiconductor ETF] here could be a 20 percent drop by year-end; I think it’s a screaming sell. The risk/reward to being short is very, very positive, and the risk/reward to being long, because of the macro factors, is very, very negative.”

From a technical perspective, Micron looks primed to keep sliding, according to TradingAnalysis.com founder Todd Gordon. Examining a chart of Micron back to 2007, the gains are easy to see; the stock has gone from $2 a share to north of $60 earlier this year.

“It’s been an amazing run, but you can see that by way of a parallel channel, we’re approaching an overbought status. Further, if you look at every time Micron interacts with the upper end of the channel, it kind of does this double-top, then backs away. Then a double-top, then backs away. I kind of see that happening right now, again indicating we have some underperformance,” Gordon said Tuesday on “Trading Nation.”

Interestingly, both silver and gold are getting CRUSHED today, with silver down more than 3.7% and gold off by 1%. It’s worth noting WTI is off by 2.4% also, indicative of a deflationary wave that is likely being caused by ‘global growth fears.’ On the issue of gold and silver, perhaps Turkey is selling everything they own to support its shitty lira?

Analysts believe Turkish banks need to recap and deleverage.

“J.P. Morgan’s macro team believes that a policy response would need to consist of the following components: policy rate hikes between [5 percent and 10 percent], fiscal commitment to backstop and recapitalize banks and deal with problem loans, targeted fiscal support for the most distressed sectors – a general policy framework which acknowledges the need for deleveraging and recognizes a recession is a natural side-product of this process,” said Martins in a note Tuesday.

Where have we heard this before?

Turkish and Russian stocks are down 3%, all of Europe are screaming lower by 1.6%, in line with our Nasdaq.

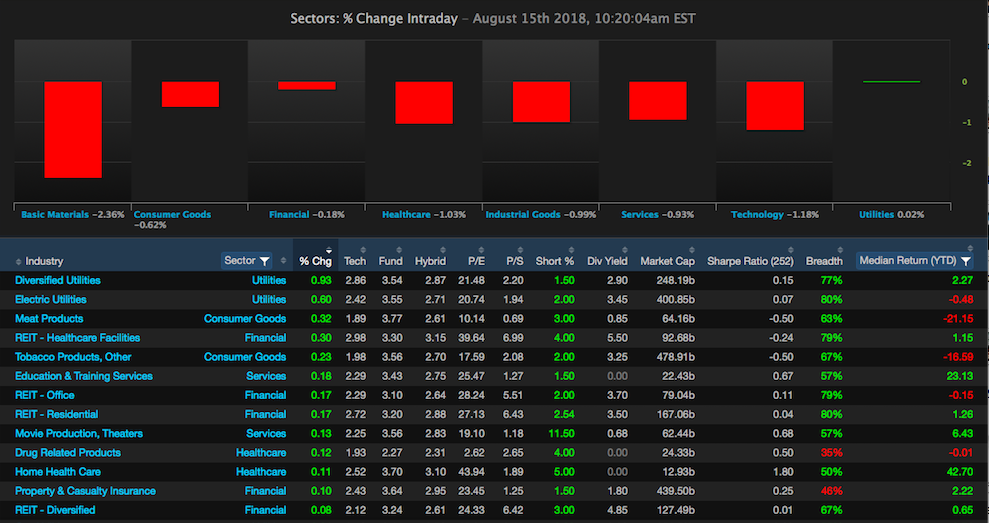

Here in the states, we have a typical risk off day, with Utes, Reits, and bonds bucking the trend — providing safe haven.

As for me, I’m getting poleaxed in my active account — which is down more than 2%. My quant isn’t fairing much better — down by 1.9%. I have 20% of that account in a permanent state of cash, which is reserved for Exodus oversold signals. We aren’t there yet. However, given the recent pin action — we might get there soon.

Botton line: Not scared. Garden variety fear mongering. Buy the dips.

If you enjoy the content at iBankCoin, please follow us on Twitter