The energetic enthusiasm that enthralled the masses to go long infrastructure stocks like $CLF, $X and $CAT has faded like a bright star being eclipsed by the rising sun. Weak traders are getting blown out of these stocks, pressing most oil stocks into bear market territory for the year.

As a point in fact, commodity related stocks are materially lower for 2017, something often ignored by the incompetents at CNBC.

Here’s my custom commodity index inside Exodus, buoyed only by the precious metal stocks in it.

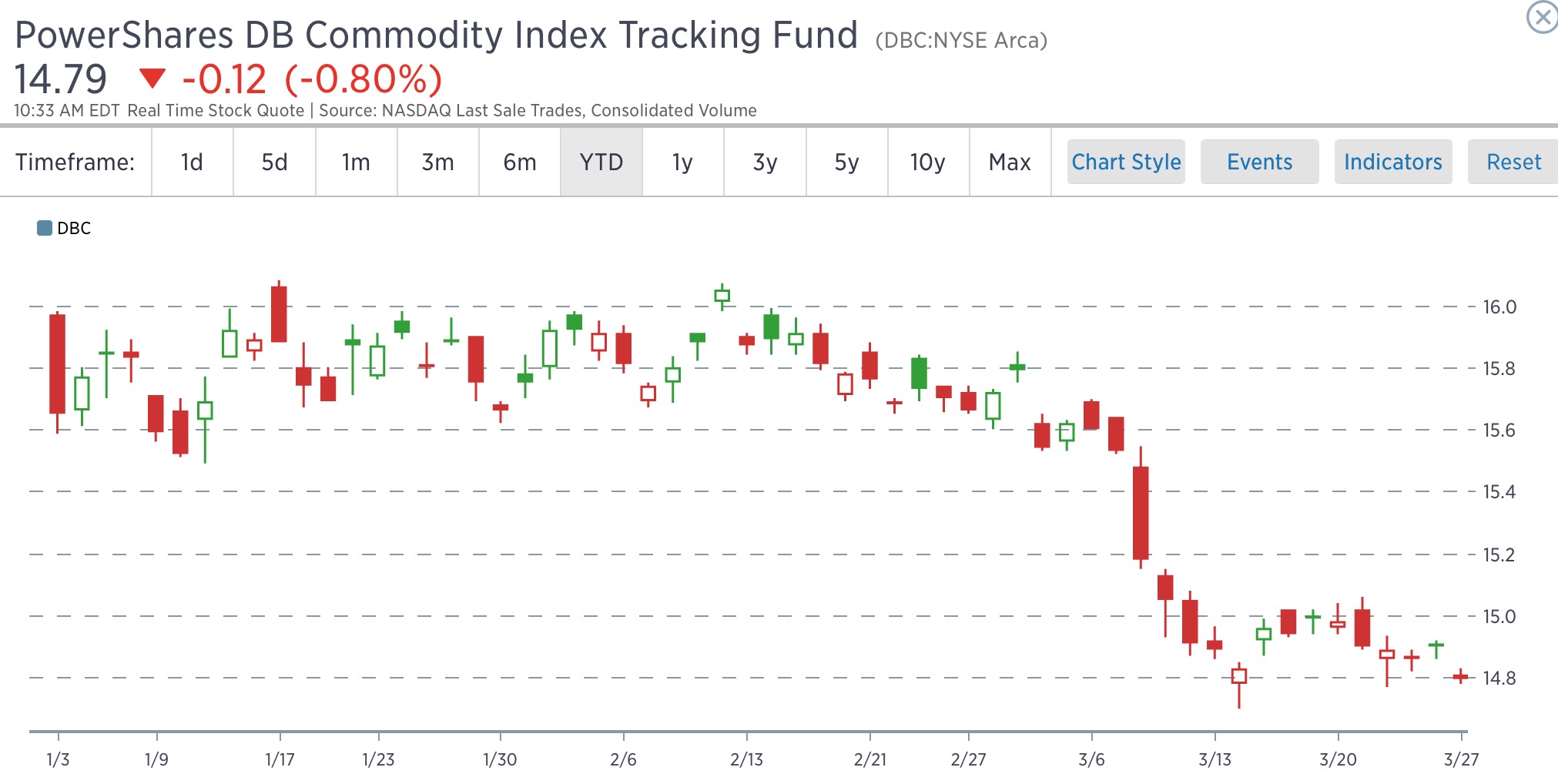

Here’s the most popular commodity ETF, $DBC, sharply lower into 2017.

The interesting thing about all of this commodity weakness is that it’s happening as the dollar gets slammed. This is not a traditional correlation, lending to the idea that the stocks have overextended to the downside and are overdue a reversion to the upside.

If you enjoy the content at iBankCoin, please follow us on Twitter

Finally an alt-right satire site

Primo-Idiot

Learn to make money chump

Let’s try to keep the shilling down to a minimum during market hours. I’m all for your wacky ideas at night.

You’re pretty quiet about $WLK. What’s going on with that..?

I discussed it Friday. It trades up and down, like a normal stock.

X went from 17 to almost 42 from election night so that is pretty far pretty fast. there is an air pocket just below the current level. Ideally the shorts press here drive it down and then get ready for the rebound.

Anecdotally I see names like TS restarting manufacturing facilities.

http://globalnews.ca/news/3330668/oil-and-gas-company-tenaris-reopens-calgary-prudential-pipe-manufacturing-plant/

The retracement looks sufficient.

right now the Feb1st trading day is holding…. stop on the other side of that would give you an entry with defined risk. My preferred scenario is a fast hard flush that emboldens the shorts scares the sweet baby Jesus out of the longs and opens the door for the contrarians.

Sell all the foreign’s vs the buck this morning, save for the Cable. Cable may pull back some, but still long term bullish there. Like XLF at the moment as well, but may wait. Gundlach’s 2.25% on the 10yr yield may come to fruition early in Q2.

Good call Fly. I’m a buyer.

Finished going all in long this am, except for my crash insurance cash which is in reserve if needed for hedging. This sell off is all BS.

wasnt a selloff. gap down with flat-dow-close flat-spy-close destination targets

1. persistant intraday automation 2. any and all drifts or drops prompty negated

3. nasdaq-lift leads dow and spy because it can pull both 4. low volume

(vix is their big problem in terms of close. may not fully cooperate to obtain flat)

That’s not a selloff. It’s a gap down with uniform programming pump.

SELLOFF WOULD HAVE MORE DIPS, AND HINDRANCES, TO GOING RIGHT UP

Federal government unfunded liabilities in the 10s of trillions, enjoy it while it lasts. More people dying in debt averaging about $60K. It’s all just funny money.

I will continue to use the currency I am given to make more of said currency.

this selloff is all bullshit got me scared

You should join Exodus

and find out

how much I’m

Winning

I’m a rookie I get scared every 2 weeks even with exodus

Think I’ll short Trader Confessions long ADSK call.

Fly the sand stocks got crushed- punny- but the reality is that the volume are increasing and the price per tonne has moved from 25 per tonne to 50 per tonne from what I have been able to determine. The market got ahead of itself and ran the sand cos up too fast..this pullback is an excellent opportunity to enter into the space. Risk can be defined by a stop 10%m ( or tighter in some cases) below the current prices on many of the names

Long FMSA and SNS.to

“It’s the right time for the combination [with Canyon]. We’re seeing an improvement in our business. We’re seeing a situation in our industry right now where horsepower per job is increasing rapidly, the sand per well is increasing rapidly and these trends are putting a strain on both of our respective companies.”

—Trican CEO Dale Dusterhoft, speaking about the company’s acquisition of fellow pressure pumper Canyon Energy Services.

My friend my friend he’s got a knife!

The Phish blows

hey fly as a stock brokers is it easier to do more sales in the morning or the afternoon ?