We are truly living through interesting times. Let me remind you that Exodus hasn’t flashed an oversold signal since the beginning of summer, representative of a market that doesn’t go down. Literally nothing is able to derail the bull run.

We’ve gone through BREXIT, Trump winning, Italian referendum and Trump menacing China and markets still climb to new highs.

NOTHING CAN STOP THE MARKET FROM GOING UP.

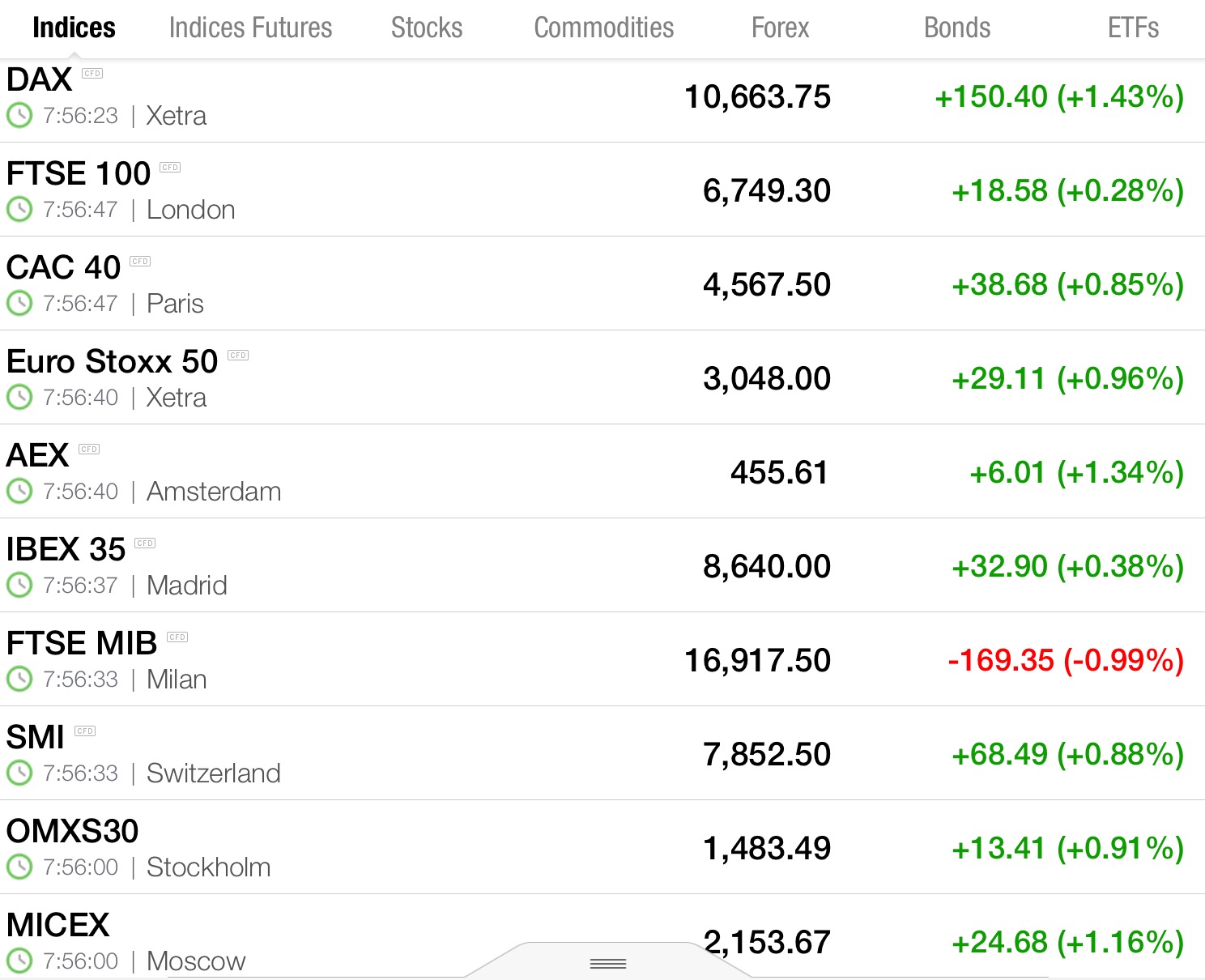

European markets, save Italy, are rallying. Future are up and all of the risk on trimmings are in effect.

If a nuclear device detonated in NYC, stocks would trade up.

All currencies could be rendered worthless, a Black Plague could breakout and the anti christ himself could step forth and declare hell on earth to commence and stocks would still trade up.

Holiday shopping season is upon us and the mall is dead. Will that matter? Perhaps for a few individual names. Certain stocks will succumb to reality and plunge. But on the whole, I suspect we’re gonna glide into the New Year’s — right through retarded Federal Reserve hikes, and live happily ever after.

Motherfuckers.

If you enjoy the content at iBankCoin, please follow us on Twitter

October 2014 – end of QE, if i recall markets were down shortly after by about 12%.

December 2015 – 1st annual interest rate hike, celebrated by down 20% shortly thereafter

December 2016 – 2nd annual interest rate hike – no doubt January and possibly even December is going to be rough

BUT, the lesson here is to buy the dip and if you’re scared of a recession induced 30% deep freeze simply hedge your triple leveraged ETFs with some nice options. Merry Christmas.