If the muni market is telling us anything, it’s that a great doom is just around the bend. Back in November of 2008, munis dropped by about 7%. Last month, following the rout in bonds, munis dropped by about 7%.

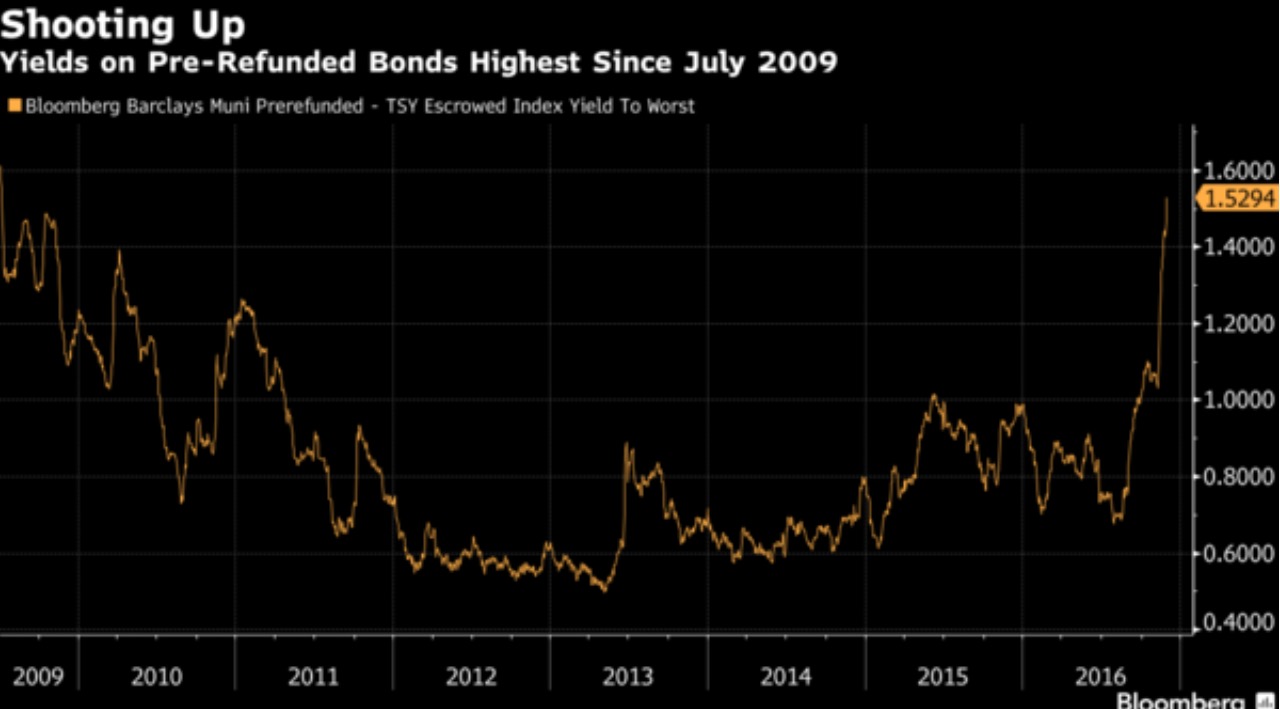

The dollar value on the sell off equates to about $5b. The pre-funded munis, which are munis paid off with treasuries, are now yielding 1.53% — the highest since Lehman’s collapse.

I don’t care how awesome Trump is going to be or how great you think the economy is now, the hockey sticking of yields is never a good thing — especially in a government bedridden by $20t in debt.

The last time this happened, markets became disjointed in January of 2009 — paving the way for a record 16% lift in munis, as investors fled stocks in search of safer havens.

If you enjoy the content at iBankCoin, please follow us on Twitter

@ 2200 s&p

Showtime has thousands of dollars in SDS, FAZ, BIS, EPV, DRV, EWV, UVXY, TECS, SDOW

Trump rally feels like a trap. Concur with your line of reasoning.

The banks will be the tell. Every time they lead the run is done. Has been that way since Mar 09 basically. If they falter we whoosh. Without fail.

Do you see a change in that trend with a new administration?

Would a change at the fed change your view on that trend?

If we’re lucky, Barney Frank will make a 2nd appearance and we’ll get to hear him speak for hours questioning various individuals on the 2nd crash. He’s got such a great radio voice wouldn’t you agree?

A Barney Frank Xmas CD would be a huge hit.

I couldn’t help it and bought a little MAB, VGM, and a sliver of PCK. Also picked up BBN for ye old IRA with it’s Harambe dicked taxable 6.81% yield (currently oversold in Exodus). I’ll probably get all fingers diced off and start typing with my elbows.

Marc, in addition to an Xmas CD, Barney Frank should narrate books on tape about Lenin.

“Wennin was a gweat weader. Some peopow say that kiwwing Fow Miwwion men, wiimen, and chiwdren was an evow act, but wike my wadico hewo Bill Ayers says, sometimes you just have to extowminate die hawd capitawists”

http://www.thenewamerican.com/usnews/politics/item/2455-obamas-friend-ayers-kill-25-million-americans

You’re stuck good aren’t you fly? Problem is you don’t understand debt. Governments, municipalities, corporations have sold trillions of 0%+ long term debt, to people like you, among many. They are fully funded for a few years.

So now if rates explode higher, who loses? You or the governments, municipalities and corporations? Hmm

If you consider a balance sheet with a ton of 0% long term debt on the liabilities side and some hard assets on the other side. If you take that yield up to 6%. Who wins?

If governments sell 0% long term paper to retirees. 5 years later, accumulated inflation has been 40% and yields are 6%, incomes are up 40%, tax returns follow. Who wins?

You got fooled fly. Badly. And you have no excuses having been in the game for so long. You should have known better. Let’s see how long it takes you to admit it.

Answer your own questions, rather than having us guess.

Superbus – a thought experiment: What type of aquatic vessel do you think panicked money is going to hop aboard when the EU breaks up because of #FREXIT, #ITALEXIT, and now #GEREXIT and has to convert back to like a dozen currencies? What do you think this will do to US interest rates?

http://www.dailymail.co.uk/news/article-3985260/Nearly-half-Germans-want-follow-UK-hold-Brexit-style-referendum-EU-membership.html

If the Daily Mail is saying 42% of Germans want a referendum, it’s probably well over half. All that has to happen is for rumors to become serious. Toss in a few warnings from the low hanging EU fruit with shitty debt/gdp ratios, and rates aren’t going anywhere for a while as long as the USD is still the global reserve.

http://www.wsj.com/articles/a-potential-banking-crisis-awaits-the-next-eurozone-exit-1480624261

http://debtclocks.eu/comparison

Merkel is still favorite to win the elections. There will be no frexit or italyxit because the people there are attached to their euro savings, mind you.

The only way euro goes away is if germans want out. They might, eventually. But that point is far away and will be triggered by surging inflation not deflation. If inflation explodes, bonds, including treasuries lose.

The problem will all your deflationary thinking is you are looking at the past and can’t imagine a different future. To the point that you now justify a third of world bonds having negative yields. Governments getting paid to borrow. Your beliefs are so deeply ingrained. Markets are going to feast on you people for a long time.

I don’t even know where to begin with this post…

Have you seen this before?

http://www.usinflationcalculator.com/inflation/historical-inflation-rates/

Shit, FIG doesn’t understand debt?

Say it isn’t so Dr.

LOL what a fucking troll.

Who cares? It’s part of the fix, it has to be broken solidly before it can be restored/rebuilt. Bring it all down. Sooner the better.

Could this be a sanctuary city thing? The news is all horseshit these days but… Sounds like the Man God can break these motherfuckers if he wants. Just like Silicon Valley with those visas. Good luck Cali without that Federal welfare.

In the next several years most of you will be crushed by the coming deflationary spiral as this debt cycle comes to an end. You’re being played. Interest rates are going back down. Treasuries and IG credit will outperform stocks. The talk about the demise of the bond bull market is a bit premature. The problem is structural and can’t be fixed by monetary policy. Look it up. Debt cycles always end with deflation.

http://hectorsalamanca.com/img/bell_down_2.jpg

There is every incentive in the world for govts to print paper endlessly, deflation will be guarded as tightly as Cameron’s ass from Ferris Bueller.

Not to say deflation won’t happen, but they will literally give money to citizens before they allow their debts to become unpayable or end up in default.