Netflix is higher by 19% in the after-hours, on an earnings beat for the ages. If you recall, I highlighted the idiot nature of Wedbush and the people that work there about a week ago — who made just about the worst call in the history of stocks — suggesting NFLX was to be cut in half.

Here are the headlines, via Briefing.com.

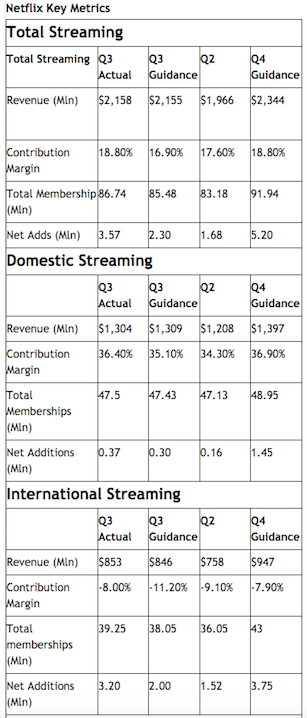

Netflix Q3 Domestic Net Additions 0.370 mln vs 0.30 mln guidance; Q4 guidance is for 1.45 mln, expectations were for ~1.00 mln; Q2 adds was 0.16 mln

Netflix prelim Q3 $0.12 vs $0.05 Capital IQ Consensus Estimate; revs $2.29 bln vs $2.28 bln Capital IQ Consensus Estimate

Netflix sees Q4 $0.13 vs $0.08 Capital IQ Consensus

Netflix Q3 International Net Additions 3.20 mln vs 2.00 mln guidance; For Q4 NFLX expects addition of 3.75 mln, expectations were for ~3.00 mln; Q2 Adds was 1.52 mln

In Q3, we added 0.4 million members in the US vs. our forecast of 0.3 million and 3.2 million members internationally vs. our forecast of 2.0 million. Our over-performance against forecast (86.7m total streaming members vs. forecast of 85.5m) was driven primarily by stronger than expected acquisition due to excitement around Netflix original content.

By the end of Q3’16, we had un-grandfathered 75% of the members that are being un-grandfathered this year and the impact has been consistent with our expectations. ASP grew over 10% year-over-year in both the US and international segments (excluding a $35 million F/X impact).

In the international segment, we exceeded our internal projection for net adds as the acquisition impact of our originals was greater than anticipated across many of our markets.We are investing in more content across multiple international markets in Q4 and, as a result, we project international contribution loss to grow moderately to $75 million.For Q4, we forecast 5.2 million global net adds, with 1.45 million net adds in the US and 3.75 million new members internationally. Our expectation for a moderate year-over-year decline in net adds reflects the completion of un-grandfathering. We are pleased with the results thus far as we expect ASP to grow 12% from Q1’16 to Q4’16. Internationally, the initial demand from our launch in Spain, Portugal and Italy in Q4’15 will also affect our year-over-year net adds comparison.

China- The regulatory environment for foreign digital content services in China has become challenging. We now plan to license content to existing online service providers in China rather than operate our own service in China in the near term. We expect revenue from this licensing will be modest. We still have a long term desire to serve the Chinese people directly, and hope to launch our service in China eventually.

Consequently, we plan on investing more, which will continue to weigh on free cash flow. We expect Q4’16 FCF to be similar to Q3’16 FCF. Over time, we will be able to fund more of our investment in programming through the growth in operating profit and margin already underway. Streaming content obligations at quarter end were $14.4 billion, up $1 billion sequentially.

We finished the quarter with $1.3 billion in cash and equivalents. As we have often done over the past few years, we plan to raise additional debt in the coming weeks. With a debt to total capitalization ratio of about 5%, we remain underleveraged compared both to similar firms and to our view of an efficient capital structure.

The stock is trading at $119 in the after- hours. The 52 week high is $133. Look for the stock to squeeze towards and above that high in the days and weeks ahead. There are a lot of bears marooned in this stock.

The one caveat here: cash burn is up big, doubling from $250m to over $500m for the quarter. Look for the company to announce a secondary soon. After the price drops from the offering, get back in for the lift higher.

If you enjoy the content at iBankCoin, please follow us on Twitter

Damn took my profits this afternoon and didn’t hold into earnings.