Congratulations Janet Yellen for reserving a special seat in hell. You’ve managed to undo all of the good your predecessor built with Wall Street and completely abandon the Federal Reserve’s place in western finance, as protector of capital, creator of wealth. Like a villain, you’ve turned the Fed into an evil organization whose sole purpose is to destroy lives and capital and the American way.

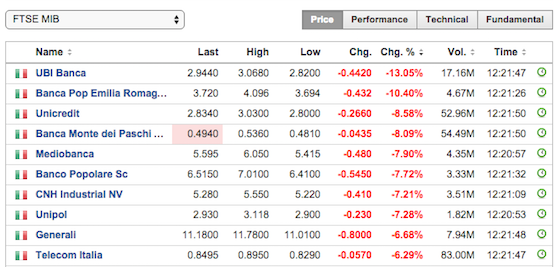

The FTSE MIB is leading the charge lower, down 5.2%, at the vanguard of Europe’s crash. Italian banks are getting hammered.

WTI crude is down more than 4% to $26.26 and gold is soaring, up 3.5%.

Over in Germany, Deutsche Bank is down 8.5% and Commerzbank -6%.

In the UK, Barclay’s is off by 6%.

In France, Socgen is down 12%.

In Switzerland, Credit Suisse is down 7%.

You get my drift.

S&P futures are lower by 300, all thanks to Janet Yellen’s absurd and childish insistence to hold the line on interest rate hikes.

Bonds are racing higher, with TLT up $2 in the pre-market.

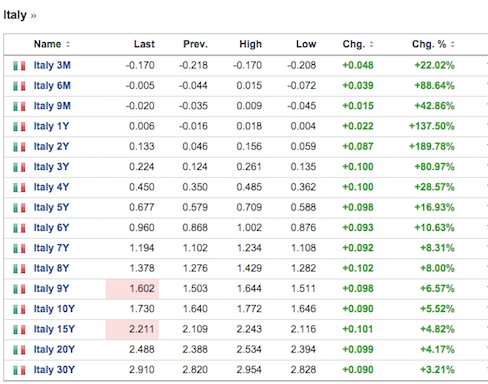

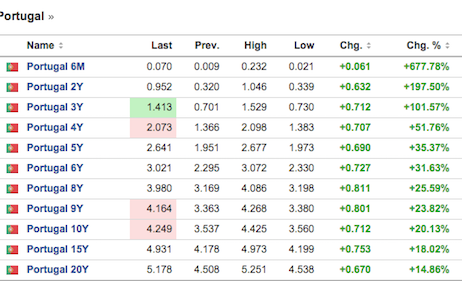

Oh, and the PIGS sovereign yields are blowing out v the rest of Europe, especially in Portugal and Italy.

Portuguese-German spreads now 399 bps.

![]()

i think i’ll cover here before janet resigns…er speaks

I think I will be taking a loss pretty soon. Thank you Janet.

Yellen is back on the hill today. Either she realizes the error of her ways or she doubles down.

+1

but at least we, the “getting older” crowd, can just enjoy the fruits of our decades of labor, frugality, prudent decision making, etc….by playing it safe and earn a nice interest check on our nest egg.

oh wait, no we can’t because of bankster fucksticks like granny. Yeah, special corner of hell is velvet roped off for them.

???

Banks want interest rates higher. Higher interest rates earn loads of cash for them via carry on their loan books. A big reason banks are getting hammered right now is because world rates are going negative.

Rates will remain low because the federal govt needs low interest costs on a rapidly growing pile of debt, currently at around $20 trillion. Blame your elected officials. FWIW federal debt was $12 trillion or so when Obama came into office. Bush ramped debt prior to him, so this isn’t exactly a partisan issue either.

If you are losing money, like me, blame yourself first. Not some omnipresent “bankster fuckstick.” Makes you sound less than informed.

It’s not the rate, but the spread. When the yield curve inverts, everyone dies, but people aboard the ark, TLT.

Is the Fed to blame for misguided oil investments in the face of oil killing technologies?

Is the Fed to blame because the ECB is only in the Feb 09 version of their financial crisis?

They are not. However trade the market’s response to a world where the “world” should not depend on the dollar at this time.

This leads us back to the path of supremacy.

yes, actually. The Fed created low rate environment, which led to oil/gas bubble.

Your buddy Bernanke.

Yellen/Fed have their hands tied. They’re nothing but tools in US economic war to decimate Russia/China through lower oil prices and an artificially inflated $US. In the calculus of US Neo Con imbeciles. all global markets are nothing but cannon fodder in this idiocy.

Be safe out there!