If you are new to options trading, I think it’s important to understand a few things in order to develop a winning trading system. I’ve been trading options for almost half of my life, and have experienced all there is to experience.

First, options are wasting assets. Remember that before you stick half of your account in an out-the-money call option on a Chinese cardboard company.

Next, as an option buyer, it’s fair to say that buying options is a win big, lose often strategy. In order to keep in the win column, I have spent most of my career developing my stock picking and timing skills. This I feel, is my edge in trading.

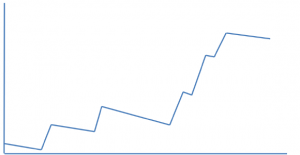

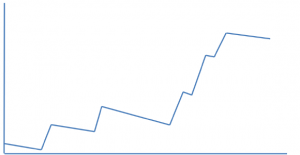

Even if you are 50/50 at picking winners, by introducing leverage you are afforded unlimited upside potential in each trade with the luxury of defined risk. All you can lose is what you put on the table. Under these circumstances, it’s fair to say your equity curve, over time, should look like this…

At the end of the year, my equity curve will look pretty similar, with the exception of the length of the drawdowns. Notice that while the account is gaining value, it is not always going up. If you had the expectation that even great traders don’t drawdown from time to time, then we ought to address your expectations.

In my experience, I go through a similar process. Take my recent winning streak here as an example. For the last couple months, I’ve gone about 70/30 in terms of win loss ratio. My equity curve has taken a huge leap in the last few months. However, the market pulled back for three days on me while having long positions on. I’m not the guy that takes off long positions just because the market is going to decline for a day or two. As result, my account has drawdown a few percentage points over the last 3 days. Was it enough to give back all of my gains over the last few weeks? Of course not.

One thing you’ll learn about my style is that I erase drawdowns faster than most. However, during the course of a drawdown, I don’t hit the panic button and look to realize losses for no reason other than emotion. If you find you are emotional, reduce position size and total number of positions. I could easily take a couple gains (BYD, MCP) and pay down a couple losses (CREE, VMW). I could then scratch two positions at breakeven (DANG, BZH) and get small. But then I would feel like a puss for taking off perfectly good trades only for a slight fluctuation in the market.

Listen, I want to make money every day I sit in front of my trading terminal; but its not realistic. I think as a whole, everyone here needs to start working on eliminating emotion, doing a better job of managing risk, and take a second to recognize that we truly have an edge here. Therefore, fix yourself in order to make it work for you.

Amen.

Comments »