Take note. I absolutely love when this happens, because even though seemingly insignificant, it has mattered in the past.

I can recall the few times I have written on a topic, then been quickly engaged by some StockTwat or Tweeter Reader over an idea I’ve written on. Again, rarely does this happen, but the times it has it ended up being significant.

That quick reply I get from that crowd usually comes from a place of inexperience. To get an instant reaction means I am thinking outside of “group think.” Or it means I have triggered an emotional reaction. That’s usually where I want to be.

Day-to-day, most leave me alone to my own opinions. They either read, or don’t read…which is where I want to be. I try not to harass other people and hope I don’t get harassed in return. I like to stay in my quiet corner of the internet so to speak.

As for some of my recent online responses to a write up, here are three of my favorites.

Most recently, @*********, who jumped me for my boolish opinion on the markets back in late February last year. Which conversely, was the bottom.

(note: the above image was created to show the resemblance of Buffalo Bill, but I felt terrible and never sent the tweet. Apologies in advance.)

(note: the above image was created to show the resemblance of Buffalo Bill, but I felt terrible and never sent the tweet. Apologies in advance.)

Remember @AlphaMatt18 who out of nowhere blew me up for wanting to buy $TWTR roughly three weeks after it’s IPO? For the love of hilarious, I can’t find the screenshot I took back in 2013.

If you remember that trade I took, it was one of my best ever. Only a few days after the comment, Twitter went on to more than double in price, as I called out here near the $TWTR IPO bottom.

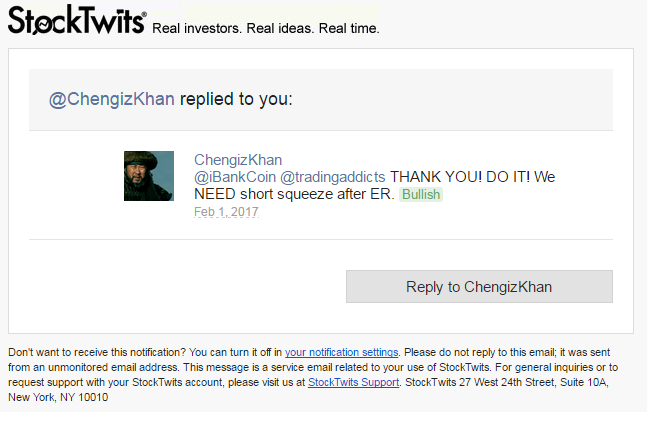

In my last post about just the idea of wanting to short $AMZN, look at what @ChengizKhan had to say to me, as well as his 4 followers.

If you are in $AMZN here, this is your company. Saturated. Over-owned. These peeps are your ‘ride-or-die’ comrades as you head into the unknown.

If you are in $AMZN here, this is your company. Saturated. Over-owned. These peeps are your ‘ride-or-die’ comrades as you head into the unknown.

Let that sink in for a minute.

If you enjoy the content at iBankCoin, please follow us on Twitter

Never commented before.

Not that you care, but I’m with you on this one.

1 qual reason I keep returning to is Trump. When will the bulbs go on re: the origin of tech employees and how Trump will react to the beaking off by executives in the space.

BTW, this isn’t a political comment, its a trading one. There won’t be any favours.

Thanks for the comment.

I have love/hate for AMZN, mostly hate. It is huge gas bag that should pop. Only 20 year old company that still acts and treated like start up. Never figure out and after getting burned, both ways, I stay away. Good luck. Would love to see Bezos get clown raped.

I bought puts at the last earnings announcement. this time I’ll be a spectator

Like the picture of the YOLO AAPL guy. I took the opposite side – got cheap calls yesterday – AAPL 125 and FB 138. Scored around 350 percent this morning on AAPL looks like FB will be a near totL loss.

That said – used some of the AAPL gain to get AMZN 900 for earnings during its morning fade. Think the odds favor AMZN popping to all-times like the other FANG stocks did but popping much higher. I think perhaps there might be a Spring 2013 possibility for an awesome play with AMZN when weekly puts purchased shortly after the open paid between 3000 and 5000 percent within 15 to 20 minutes. I think the best possible play for AMZN will be – if it pops at the open on Friday – playing it like what would have been a good play on GOOGL this last week – getting cheap puts and selling about 15 to minutes later.

To add more details – April 26 2013 – AMZN opened about even at 270 to 272 the day after earnings – lost 20 points and faded to 252 within 15 to 20 minutes. I remember because I just missed a fill (and of course always regretted not just taking an ask fill a few minutes later) and if I had filled it would have been a position around .25 that were like 10.00 fifteen minutes later.

Sorry, my post wasn’t an opinion about earnings. Just thinking of it trades up, I’d rather bet against it,

I guess then my post was a combination of thinking about earnings and what you are saying. I am saying if it trades up on Friday after earnings – it might be a golden opportunity – like GOOGL recently was and AMZN was before in 2013 – to make some quick coin on short-dated puts.

Here is the link – the wolf mask guy would short AMZN if he had any money left – at least – that is what he says.

https://www.reddit.com/r/fscomeau/comments/5rgmhb/gentlemen_we_are_hereby_reunited_to_celebrate_the/

If you read the guys reasons for being short – he explicitly shows a lack of knowledge related to market behavior and the fundamentals of AMZN. I a person believes this guy is some kind of a contrarian indicator like he was for AAPL – it would mean he or she believes AMZN should skyrocket after earnings. On the flip slide – if people believe life is ironic – it means AMZN will completely bomb and this guy will profit nothing because he is not betting any money on it like he did for AAPL.

No disrespect, but why in the **** would you give any shits as to what this person thinks?

I don’t – I find it humorous what he thinks. Don’t you – or was the fact you used his picture as part of your title just a complete coincidence – you happened to pull the picture randomly off some image site?

I can proudly say I played no participation into that waste of time.

I got calls for AAPL for earnings not because this guy got puts but for the reasons I posted up days before on this blog – a time before people – including myself – even knew this guy was out there.

DEATH TO AMAZON

You play on third rail in subway? Take leisurely stroll through an interstate?

Those big earnings option moves tend to stick in your mind. When they happen I make a point of looking at the other side, such as puts that went from 15 dollars to .00 bid.

AMZN will see 950 before 750.

By the way did anyone ever do well shorting Walmart?

Technically the weekly chart is still bullish, so I wouldn’t short it just now. Plus, I prefer to short first the weaker players instead of leaders.

1. Buy wolf mask from Amazon.

2. Wear Amazon wolf mask while shorting Amazon.

3. ????

4. Profit

If memory serves, you called that guy a “lunatic”

Which guy?

@AlphaMatt81 @simskey Matt, you are clearly a lunatic. You should admit defeat, and realize this may have been the worst call of the year

1:28 PM – 12 Dec 2013

EPIC!!

Where did you find that? I’ll never forget that interaction. Pure gold.

I stumbled upon the exchange during that period as it was unfolding. It was so memorable that it always remained stuck in my mind. If you google twitter advanced search by date you will see links for that feature.

I love walking into emotional analysis like that. Thanks for the share. I lost the images I saved…or can’t seem to find them at least.

I just thought of Bluestar. That dude loved shorting AMZN. lol

Some day AMZN will be a short. And it will be glorious. But today is not that day. I have no position in AMZN.

@OA, what do you think of $XLE……I have accumulated a position here over the past three days. I am thinking that I am buying a dip and looking for a bounce to 74.

Sold remaining LABU to lock in nice profits. Greed kills. Will get back in if warranted.

The 1000%+ I made on TWTR remains, indelibly, my best trade ever. Hat tip to you. #Khan.

#Fillmoe

there was another trade recently that some people went emotionally ape shit on.

DB was one

Go read the $DB comments. I knew I nailed that one when people I didn’t know showed up to scoff at me.

DB remains one of my top 5 lifetime trades. Thanks again OA

That’s wassup.

CNBC is constantly echoing throughout my office, they did an entire segment on AMZN’s dominance yesterday. They harped over and over about how 53% of all online sales were attributed to AMZN and how its “uniquely” dominant in the space.

I have to believe with this crescendo in sentiment and ubiquity of discussion around it, we’re near the top. I’ve just been burned shorting it too many god damned times.

This is AMZN’s chance to stand out from FANG – either good or bad. It is following the pattern of the other 3 as far as it will print near or above all-time before earnings – the question is – will it conform like the others and burn all option players as well as have a small quick fade the morning after earnings or will it – unlike the others – open up big to the downside or to the upside.

I’m torn on this. I make almost all of my money off of AMZN and pay them a shit load on advertising and warehousing. Its by far the best e-commerce biz model I’ve ever sold on. But then again that’s probably all baked into the cake.

Good luck with it.

Jeff – you’re moving back to oracular.