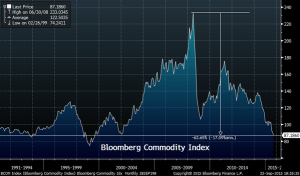

This chart is a little dated, and I am away from a Bloom spot today, but I had a request to speak on commodity prices, so let’s start with this graph below of the Bloomberg Commodity Index. Mostly made up of Nat Gas, Oil, Corn, Copper, and Gold, and is currently trading at $82, despite what the chart below shows.

I’m of the opinion that we’re heading into an era of ‘lower for longer’ commodity prices. A lot of people write on this topic and the negative impacts it could/should have, but not many talk about the stimulative impact it has on the economy.

The chart above illustrates a boom in the commodity index, and the bubble bust. All in all, it’s a return back to a historical mean. If I were near a terminal, I’d take this chart out another few decades to show the cycles in volatility across commodity prices, which I believe is due for a rally soon, but also due for some quiet time.

I also wanted to point out that while we’ve spent so much time looking at 1998 from a historical perspective in terms of oil prices, gold prices, copper prices, the dollar, and other individual commodity price correlation, this index bottomed in early 1999, which I believe is also the bottom for this bear cycle in commodity prices as well.

I think there are some screaming investments in commodity related equities down here at these prices, but I think the volatility in commodity prices themselves will be all but gone over the next 3-5 years. There will be a great move in the commodity index early next year, but that first rally will be the best opportunity for the year in my humble opinion.

I have been thinking up a list of investments in this space, but haven’t yet finalized it. What are some of your top ideas with a 3-5 year time frame?

If you enjoy the content at iBankCoin, please follow us on Twitter

KMI. I believe in natgas outperforming oil even over 3 – 5 years. Can be used as the fuel to bridge us to alternative energy which should dominate the 2020s. Taking my book.

Negated in the short term if a traditional republican like Bush somehow wins the presidency.

So are you saying that by analogy, the commodity bottom will come in 2016?

If I were to buy a basket of energy stocks right here to sit on for 3-5 years it would be the following:

1. $WLL, $OAS $BCEI (favorite high risk/reward oil E&P)

2. $MRO (favorite big cap value play)

3. $GPOR (hands down the best nat gas/Utica shale play)

4. $MWE (best pipeline/high yield play with a buyout offer from $MPLX on the table)

Why gpor over antero (ar?)?

Better assets and more growth potential. I do like AR though. Good hedges thru 2016.

Happy Thanksgiving gasman. I miss your daily updates in oil/natty, so I’m hoping you’ll bcome one of the new bloggers Fly is looking for.

❤❤❤❤

I would keep with the Big Guns $XOM $COP $CVX. They pay good divy’s while u wait. They will be buying (stealing) smaller names.

$DVN is another good long term hold.

Jeff, when you say that you think the commodity move you anticipate early next year will be the best opportunity all year, do you mean it will be the best opportunity across any asset class or, alternatively, that the best opportunity all year in the commodity space?

In that particular space. Everyone will keep playing, thinking it continues…ultimately I think it quiets down thereafter.

I’m thinking I like $LPI for a long stock pos below $14. The volatility in the oil space I think will remain due to political instability in the ME.

My opinion: “lower for longer”…exactly correct. But stimulative…no. Rather, it is indicative of a decline in manufacturing need and thereby recessive in nature. The two wild cards are gold and oil (and silver, but I don’t trade or follow it, yet). Oil is affected by potential supply, cartel, and war action. Gold, it is monetary tinkering and the associated leveraged bets.

In times past, falling commodity prices have presaged falling equity prices. Equities haven’t really gotten the memo yet. Will this time be different? I say no.

Eventually – like 3-5 years out – the govt is going to turn on the printing presses for real…after the price collapse. The tip-off will be govt bond interest rates. Nowhere near that point yet.

I’ve got some good stuff you should read on this topic. There are in fact some significant stimulative impacts.

Note that bull markets are much stronger in those era’s.