Moving forward I will randomly select topic requests from reader requests and work up some analysis. Tonight’s topic: Gold Miners.

For the record, I am and have been avoiding the metals and all things related. I have however acknowledged that on a long term time horizon, the best case scenario for the miners would be to see the metals move down to new lows while the miners do not. That seems to be setting up as we speak.

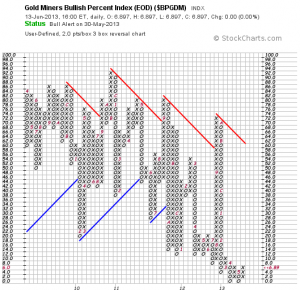

For long term analysis I follow point and figure charts religiously. Take a quick look at the bullish percent chart for the miners: $BPGDM.

This means that well over 90% of the miners are on a sell signal using PnF charts. While not actionable, this has been the case all year. It is an oversold signal of sorts.

I have been all out bearish on the metals for quite some time. In fact, I have long term target prices for Gold at $900, and Silver at $13. Below you’ll see how the metals left very thin volume structure down below, and how a lot of unfortunate longs are in from horrible prices. The type of stuff crashes are made from.

I do however like the miners paired against a short position in the metals. The spread is actually starting to look profitable. And over the last decade, this trade has been totally non-profitable.

Here is the spread between a LONG GDX, SHORT GLD position. If you are unfamiliar with “pairs” trading, you would take an equal dollar amount invested in both sides of this trade, and then earn the spread between the two. That spread is starting to appreciate in value lately.

Bottom line, while I have little interest in shiny stuff here, I believe that moving forward, should Gold prices tumble, the miners will hold up a little better than Gold. Should Gold prices rally, the miners will outperform. Perfect environment for a pairs trade.

I like the set-up in the GDX, but would also consider NEM, GOLD, or NG.

If you enjoy the content at iBankCoin, please follow us on Twitter

Thanks OA ! So overall PM & miners are still not bullish, not turning the trend, right?

Good analysis, OA. Trading long GDX against short GLD looks like it may finally be a good idea.

May I add that you might want to adjust the position sizes for the relative volatility of the pairs – GDX has been more volatile than GLD, so generally you would have a smaller GDX position than the GLD position (say 70%).

Great add.

Good stuff, aside from the fact that gold is heading for $200

True.

They would rather hear that from you though.

Lol. If the shiny stuff gets anywhere close to 200 the country will split in two.

NUGT 4TW!

How would that work with options? Would you provide an example?

Jeff,,,for your next analysis. How about Utilities? XLU etc.?

What’s your view on Deck? Still holding June 55 calls.

I booked a loss. Will revisit soon.

hmmm what happened there in bidu

Same pattern, over and over.

Buy dips, sell rips.

did u hold your position or did u sell? is this info available on ur site if i sub?

I own BIDU, yes. This info is available. All real time buys and sales.

cool. how do you usually decide to get in or out of your option plays? thx for the help! hope im not being too annoying…jus tryna learn

Its complex, but let me try to summarize.

You’ve seen how I analyze the market. Based on where sentiment is, I try to pick my stocks based on the markets appetite for risk. I am pretty good at anticipating and timing big moves. I’ve learned to see these things coming in the charts.

My entries are anticipatory, and I take profits at predetermined price objectives.

I try to buy options that are mispriced in the sense that the market doesn’t see a big swing coming yet, and I sell into the chase.

^ retweet / favorite thx!