Australia’s Reserve Bank Considers Cutting Interest Rates

Japan Offers $60 Billion to the IMF to Help Curb Europe’s Debt Crisis

“Japan said it will provide $60 billion to the International Monetary Fund’s effort to expand its resources and shield the global economy against any deepening of Europe’s debt crisis.

Finance Minister Jun Azumi unveiled the commitment in speaking to reporters in Tokyo today before semiannual meetings of the IMF and World Bank in Washington April 20-22. Azumi said he hopes for an early agreement among Group of 20 members, who will also gather in Washington, on contributions to the IMF.

Japan, the world’s third-largest economy, becomes the largest donor yet outside of Europe to IMF Managing Director Christine Lagarde’s campaign to bolster the fund’s resources for the second time in three years. Azumi said that the stance ofChina, the world’s largest holder of foreign-exchange reserves, is in the same direction as Japan’s and that he hopes Japan’s pledge will accelerate the commitments of others.

“It’s in everyone’s best interest that Europe gets back on its feet as soon as possible,” said Matthew Circosta, an economist at Moody’s Analytics in Sydney. The announcement may “add stability to financial markets that had been weakening over the last few weeks as the crisis flared up again, particularly in Spain.”

Comments »Jim Yong Kim Chosen to Be World Bank President

“Jim Yong Kim was chosen to be president of the World Bank, becoming the first physician and Asian-American to head the lender after emerging markets failed to rally around a challenger to the U.S. monopoly on the job.

The World Bank board of directors said today it chose Dartmouth College President Kim to succeed Robert Zoellick, whose term ends June 30. A specialist in HIV/AIDS with a Ph.D. in anthropology, Kim, 52, faced rival bids from Nigeria and Colombia.

The candidacies “enriched the discussion of the role of the president and of the World Bank Group’s future direction,” the board said in an e-mailed statement. “The final nominees received support from different member countries, which reflected the high caliber of the candidates.”

Kim, a graduate of Harvard Medical School, breaks the mold of World Bank presidents, who have been drawn from government and finance. Kim, who was born in Korea and grew up in the U.S., has pledged to be a bridge between developed and advanced economies at the poverty-fighting institution, which committed $57 billion last year on everything from building roads to taking stakes in companies in emerging economies.

Kim’s expertise on health and development issues, as well as his experience at Dartmouth, “puts him in a prime position to initiate a much-needed reorientation of the World Bank’s role in global development,” said Eswar Prasad, a senior fellow at the Brookings Institution and a former official at the International Monetary Fund.”

Comments »Europe’s Firewall is Burning

EU Leaders Go to Washington to Pitch More IMF Relief

“European officials travel to Washington this week seeking a bigger global war chest to combat the debt crisis as Spain’s government battles to quell renewed market turmoil over its finances.

Three weeks after European leaders unveiled emergency euro- area funding exceeding the symbolic $1 trillion mark, concerns about Spain’s position have ratcheted the nation’s borrowing costs to the highest levels this year. Crisis-fighting resources will dominate talks at the International Monetary Fund’s spring meeting in Washington from April 20-22. ..”

Comments »Asia stocks fall after Europe fears ratchet up

Comments »SYDNEY (MarketWatch) — Asian shares fell Monday after last week’s surge in Spanish borrowing costs brought concerns about Europe’s fiscal situation back to the fore, overshadowing a loosening of China’s currency controls.

George Washington Beats Out Collins, Napoleon and Rommel to be “Greatest Foe Ever” In Britain

Time to Put the Doomed Euro out of its Misery

Jeremy Warner

Europe can’t accept that the economics of the single currency condemn it to failure.

There is no mess quite so bad that official intervention won’t make it even worse. Nowhere is this old saw more applicable than in the eurozone, where only a month or so back, leaders were warmly congratulating themselves on having seen off the worst of the debt crisis. As is apparent from the events of the past week, these hopes were not just premature, but naive. The crisis is once again intensifying, with the focus of attention switching from Greece to Spain.

The European Central Bank’s flooding of the banking system with cheap money didn’t solve the problem, or provide more than short-term relief for its symptoms. After a brief period of remission, they are returning. At best, the ECB bought a little time. This has not been used well. Instead, the eurozone has just ploughed on with the same old set of failed policies.

The Spanish government, for example, recently announced 29 billion euros of spending cuts and tax increases. It failed to do the trick, so this week a further 10 billion was added to the tally. This only succeeded in unnerving the markets even more, forcing the ECB to concede that it might have to engage in further purchases of Spanish government bonds.

By promising virtually unlimited liquidity, the ECB may have prevented a Lehman-style meltdown of the banking system. Yet it also accentuated the underlying problem. Virtually free central bank finance has enabled Spanish and Italian banks to engage in a highly profitable arbitrage, borrowing money from the ECB and then reinvesting it in government bonds. This, in turn, helped ease the fiscal travails of the European periphery. But it also increased the banks’ underlying solvency problem, since they have been buying bonds that may eventually have to take a haircut.

Read the rest here.

Documentary: The New American Century

Yesterday was a lovely day to smell the roses with my grand-kid.

I see the markets tried to mangle my portfolio while i was unable to make any decisions. That is always the dilemma between being a trader and a investor.

At any rate, as I spend time with with my grandson, I wonder in the back of my mind what type of world will he grow up into. The most important lesson for him and all kids is to remember and study history so they can bring forth a world that is not doomed to repeat itself.

This documentary should be a reminder to all of us about the preciousness of life.

Cheers on the rest of your weekend!

[youtube:http://www.youtube.com/watch?v=OIHSUJr5jeM 450 300] Comments »UN Security Council Discusses NK Missile Launch

Comments »Pyongyang, North Korea (CNN) — The U.N. Security Council met Friday to discuss North Korea’s botched rocket launch amid concerns that the secretive and often unpredictable regime will try to recover from its embarrassing failure with a nuclear test or military move.

“Members of the Security Council deplored this launch,” said U.S. Ambassador to the United Nations Susan Rice, who said she was speaking on behalf of the council. “Members of the Security Council agreed to continue consultations on an appropriate response, in accordance with its responsibilities given the urgency of the matter.”

The rocket broke apart 81 seconds into its launch Friday morning, then fell into the ocean, according to a U.S. official.

The launch drew condemnation from United States and countries in the region, as well as an unusual admission of failure from Pyongyang. The normally secretive regime has previously insisted that failed launches had actually been successful.

“Scientists, technicians and experts are now looking into the cause of the failure,” North Korea’s official Korean Central News Agency said in a report, which was also read out in a news broadcast on state-run television.

Capital Flow Shows Europes Risk Never Really Went Away; It just Traveled Along a Different Route

“The euro area’s financial troubles appear to be flaring up again, as this week’s gyrations in the Spanish bond market show. In reality, they never went away. And judging from the flood of money moving across borders in the region, Europeans are increasingly losing faith that the currency union will hold together at all.

In recent months, even as markets seemed calm, sophisticated investors and regular depositors alike have been pulling euros out of struggling countries and depositing them in the banks of countries deemed relatively safe. Such moves indicate increasing concern that a financially strapped country might dump the euro and leave depositors holding devalued drachma, lira or pesetas.

Capital flight in the euro zone (selected countries, cumulative since Feb. 2010) Source: National central banks. Data for Italy include balances related to the issuance of euro banknotes.

Illustration by Bloomberg View

The flows are tough to quantify, but they can be estimated by parsing the balance sheets of euro-area central banks. When money moves from one country to another, the central bank of the receiving sovereign must lend an offsetting amount to its counterpart in the source country — a mechanism that keeps the currency union’s accounts in balance. The Bank of Spain, for example, ends up owing the Bundesbank when Spanish depositors move their euros to German banks. By looking at the changes in such cross-border claims, we can figure out how much money is leaving which euro nation and where it’s going.

Capital Flight

This analysis suggests that capital flight is happening on a scale unprecedented in the euro era — mainly from Spain andItaly to Germany, the Netherlands and Luxembourg (see chart). In March alone, about 65 billion euros left Spain for other euro- zone countries. In the seven months through February, the relevant debts of the central banks of Spain and Italy increased by 155 billion euros and 180 billion euros, respectively. Over the same period, the central banks of Germany, the Netherlands and Luxembourg saw their corresponding credits to other euro- area central banks grow by about 360 billion euros….”

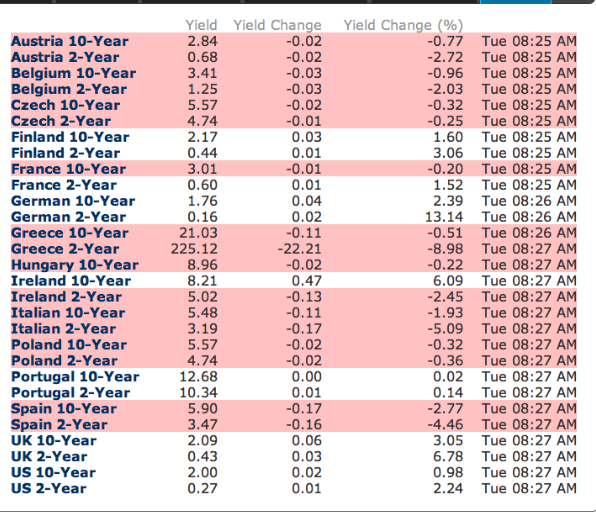

Comments »Spanish Yields Tick Higher as German Bunds Tick Lower

Spanish 10-year debt fell as the euro-region’s higher-yielding sovereign bonds underperformed German securities amid concern budget cuts and European Central Bank measures are failing to stem the financial crisis.

Ten-year German bunds advanced, pushing yields toward record lows, after government reports added to evidence the global expansion is slowing and spurred demand for the safest assets. Spain’s 10-year yield climbed toward 6 percent after data showed Spanish banks’ borrowings from the ECB jumped by almost 50 percent in March. The nation’s government will today approve measures to crack down on tax fraud.

“Spain’s significant budget measures have proved unable to convince the market that the new government has the fiscal situation fully under control,” said Norbert Aul, a fixed- income strategist at Royal Bank of Canada in London. “The market reaction to the more-or-less-expected borrowing increase only shows the nervousness in the current environment. Spain should remain under pressure and 10-year Spanish yields could move above 6 percent.”

Spain’s 10-year bond yield rose nine basis points to 5.91 percent at 11:22 a.m. London time. The 5.85 percent bond due in January 2022 slid 0.62, or 6.20 euros per 1,000-euro ($1,316) face amount, to 99.575. The rate has climbed 55 basis points over the past two weeks.

The 10-year bund yield fell four basis points, or 0.04 percentage point, to 1.75 percent. The benchmark yield slid to 1.639 percent on April 10, within a basis point of the record 1.636 percent set Sept. 23….”

Comments »Welcome to the New 700 Club: Power and Sex

‘Humans Will Need Two Planets by 2030’

What do you think ?

“LONDON: Human being are overusing the planet’s resources and will need two Earths by 2030,a new report warns.

According to the Living Planet Report, human demands on natural resources have doubled in under 50 years and are now outstripping what the Earth can provide by more than half; and humanity carries on as it is in use of resources, globally it will need the capacity of two Earths by 2030. The report said that wildlife in tropical countries is also under huge pressure, with populations of species falling by 60% in three decades, the Daily Mail reported on Friday.

And the report, from the WWF, the Zoological Society of London and the Global Footprint Network, said that British people are still consuming far more than the Earth can cope with.

If everyone lived such a lifestyle , humans would need 2.75 planets to survive, it warned.

The study’s authors looked at 8,000 populations of 2,500 species and studied the change in land use and water consumption across the globe.

Britain comes 31st in a list of countries based on their “ecological footprint” — the amount of land and sea each person needs to provide the food, clothes and other products they consume and to absorb the carbon dioxide they emit. The country has fallen down the league table from having the 15th biggest footprint in the last report two years ago, but WWF attributes this to an increase in other countries’ impact rather than a reduction in the UK’s use of resources.

Ireland had the 10th highest ecological footprint, while UAE, Qatar, Denmark, Belgium and the US were the five worst countries for over-consumption of resources . “

Comments »FLASH: European Indices Knife Lower as Sovereign Bond Yields Head Higher

Russia Leaves Rates Unchanged @ 8% Sighting Medium Term Inflation Risks

“Russia’s central bank refrained from cutting interest rates for a fourth month after signaling that “medium-term” inflation risks are increasing.

Bank Rossii left the refinancing rate at 8 percent, as predicted by 21 of 22 economists in a Bloomberg News survey. The overnight auction-based repurchase rate was kept at 5.25 percent and the overnight deposit rate will remain at 4 percent.

The world’s largest energy exporter is keeping borrowing costs unchanged even after the inflation rate fell to the lowest in two decades. Current market interest rates are “acceptable for the coming months,” Bank Rossii said. China may ease policy to boost faltering growth andBrazil has cut its benchmark rate five times since August.

“Medium-term inflation risks are rising because of uncertainty over the impact on consumer prices of the planned increase in most of the regulated prices and tariffs in July,” the central bank said in the statement.

Consumer prices rose 3.7 percent from year earlier in March and core inflation, which excludes volatile costs such as energy, decelerated to 5.5 percent, the regulator said today.

Russia’s benchmark 30-stock Micex Index reversed gains, dropping 0.4 percent to 1,491.45 in Moscow after the announcement. The gauge had risen as much as 0.6 percent before the decision. The ruble remained little changed at 29.63 against the dollar and was steady at 38.7080 versus the euro….”

Comments »Japan Goes From a Current Account Deficit to a Surplus

“Japan swung to a current-account surplus in February after a record deficit in January, lending support to a currency that officials have sought to weaken to aid exporters and economic growth.

The excess in the widest measure of trade was 1.18 trillion yen ($14.5 billion) the Ministry of Finance said in Tokyo today. The median estimate of 25 economists surveyed by Bloomberg News was for a surplus of 1.12 trillion yen.

The yen is rebounding even after interventions by the finance ministry and monetary easing by the Bank of Japan helped to bring the currency down from October’s post World War II high against the dollar. Governor Masaaki Shirakawa’s policy makers are meeting today and tomorrow to decide whether the world’s third-biggest economy needs more support as it recovers from last year’s earthquake and tsunami.

“There is no doubt that the yen is still too strong for companies to become optimistic, which leads to less investment and weak growth,” said Yoshimasa Maruyama, chief economist at Itochu Corp. in Tokyo. “The BOJ will have to be mindful about the recent yen appreciation.”

The yen traded at 81.48 per dollar, up 0.2 percent as of 10:40 a.m. in Tokyo, strengthening for a fourth day. The Japanese currency hit a postwar high of 75.35 per dollar in October before expanded monetary stimulus by the central bank on Feb. 14 aided weakening….”

Comments »The Passion of the Christ

[youtube://http://www.youtube.com/watch?v=5V6l2-AHAqA&feature=related 450 300]

Comments »Gentlemen Take Over Large Portion of Libya, Exercise Their Religious Rights

They put up their black flags over the three main cities of the north, Timbuktu, Gao, and Kidal, and strutted in the streets. Rare television pictures shot in the northern cities showed tough-looking men in turbans driving pick-up trucks, armed to the teeth with automatic weapons as crowds looked on nervously.

Comments »