Reports Q1 (Mar) earnings of $0.40 per share, excluding non-recurring items, $0.09 better than the Thomson Reuters consensus of $0.31; revenues rose 24.7% year/year to $1.48 bln vs the $1.44 bln consensus.

Comments »Flash: Shutterfly misses by $0.01, beats on revs; guides Q2 EPS below consensus, revs above consensus; guides FY11 EPS below consensus, revs above consensus

Reports Q1 (Mar) GAAP loss of $0.27 per share, $0.01 worse than the Thomson Reuters consensus of ($0.26); revenues rose 25.2% year/year to $57.2 mln vs the $53.4 mln consensus. Co issues mixed guidance for Q2, sees GAAP EPS of $(0.35-0.46) vs. ($0.21) Thomson Reuters consensus; sees Q2 revs of $68-72 mln vs. $56.67 mln Thomson Reuters consensus. Co issues mixed guidance for FY11, sees GAAP EPS of $0.39-0.44 vs. $0.79 Thomson Reuters consensus; sees FY11 revs of $468-478 mln vs. $374.04 mln Thomson Reuters consensus.

Comments »Flash: Equinix beats by $0.23, beats on revs; guides Q2 revs above consensus; guides FY11 revs above consensus

Reports Q1 (Mar) earnings of $0.53 per share, $0.23 better than the Thomson Reuters consensus of $0.30; revenues rose 46.0% year/year to $363.0 mln vs the $355.1 mln consensus. Co issues upside guidance for Q2, sees Q2 revs of $376-378 mln vs. $369.1 mln Thomson Reuters consensus. Co issues upside guidance for FY11, sees FY11 revs of greater than $1.525 bln vs. $1.51 bln Thomson Reuters consensus.

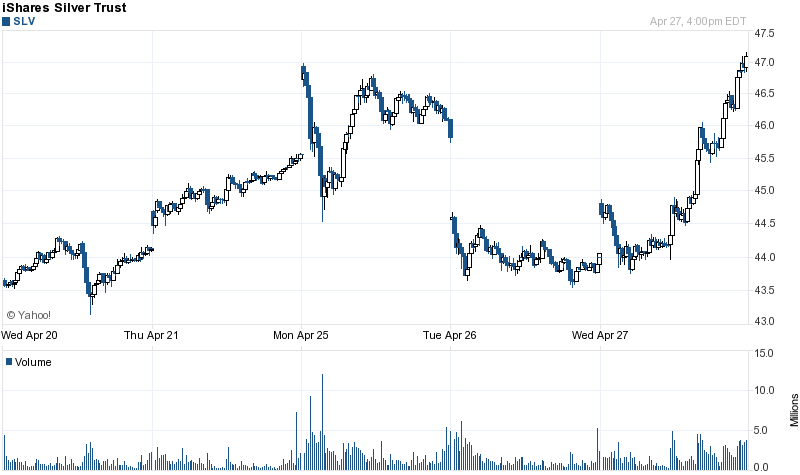

Comments »Silver Went Bananas to the Upside

Today’s Raw Commodity Winners/Losers

No. Ticker % Change Watchlist

1 SLV 6.00 Raw Commodities Index

2 NIB 2.97 Raw Commodities Index

3 UGA 2.25 Raw Commodities Index

4 PALL 1.95 Raw Commodities Index

5 GLD 1.91 Raw Commodities Index

6 PGM 1.20 Raw Commodities Index

7 USO 1.08 Raw Commodities Index

8 COW 0.65 Raw Commodities Index

9 JJN 0.46 Raw Commodities Index

10 JJU 0.22 Raw Commodities Index

11 JO 0.10 Raw Commodities Index

12 FUE 0.09 Raw Commodities Index

13 LD 0.00 Raw Commodities Index

14 DBA -0.15 Raw Commodities Index

15 URA -0.39 Raw Commodities Index

16 KOL -0.54 Raw Commodities Index

17 UNG -0.78 Raw Commodities Index

18 CORN -0.83 Raw Commodities Index

19 LIT -0.86 Raw Commodities Index

20 SGG -1.23 Raw Commodities Index

21 JJT -1.31 Raw Commodities Index

22 JJC -1.48 Raw Commodities Index

23 BAL -4.52 Raw Commodities Index

Crack Spreads Break $27

Spreads are now up nearly 6% for the day, yet refinery related shares are lower.

Comments »Gasoline Inventories are in Rapid Decline

Flash: InterActive target raised to $40 from $38 at RBC Capital Mkts

Ticker IACI.

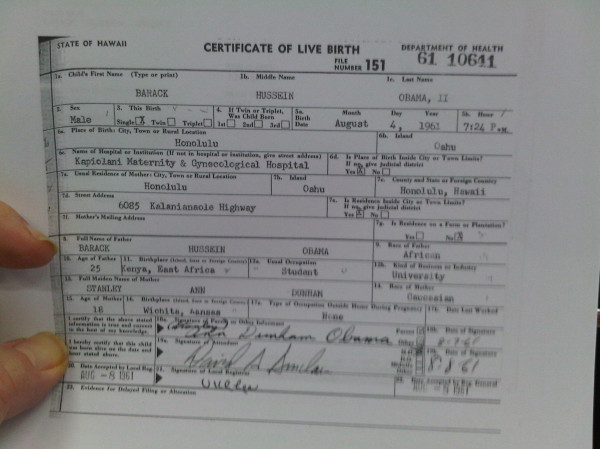

Comments »Obama Releases Birth Certificate (image)

WTI/Brent Crude Spreads Stay Wide

The difference between WTI and Brent crude is sustaining a double digit spread, with Brent more than $12 premium to WTI.

Comments »Crack Spreads Are on the Rise

Spreads are up 1.6% to $26.

Comments »JNJ Wraps Up Synthes Buyout

The transaction valued at $21.3 bln. Each share of Synthes common stock, will be exchanged for CHF55.65 in cash and CHF103.35 in JNJ common stock.

Comments »Images of Destruction from Misrata, Libya

Yelp to Come Public

Silver is Now Trading Like a Chinese Burrito Stock

I am seeing silver down 4% in after hours trading. That’s absurd and entirely undistinguished.

Comments »Flash: ReachLocal beats by $0.16, reports revs in-line; guides Q2 revs in-line; guides FY11 revs in-line (17.99 +0.89)

And the reached a strategic agreement with GOOG.

Comments »Flash: Amazon.com sees Q2 operating income of $95-245 vs $356 mln consensus (32% y/y consensus growth)

Flash: FormFactor beats by $0.10, beats on revs (10.70 +0.78) Reports Q1 (Mar) loss of $0.32 per share, ex-items, $0.10 better than the Thomson Reuters consensus of ($0.42); revenues fell 8.0% year/year to $40.4 mln vs the $36.9 mln consensus.

Reports Q1 (Mar) loss of $0.32 per share, ex-items, $0.10 better than the Thomson Reuters consensus of ($0.42); revenues fell 8.0% year/year to $40.4 mln vs the $36.9 mln consensus.

Comments »Flash: Broadcom prelim GAAP $0.40 vs GAAP $0.35 Thomson Reuters consensus; revs $1.82 bln vs $1.81 bln Thomson Reuters consensus

Broadcom sees Q2 revs $1.75-1.85 bln vs $1.90 bln Thomson Reuters consensus; GAAP product margin up ~50 bps QoQ

Flash: Acme Packet prelim $0.27 vs $0.25 Thomson Reuters consensus; revs $74.0 mln vs $71.37 mln Thomson Reuters consensus

|

Acme Packet sees FY11 $1.10-1.15 vs $1.10 Thomson Reuters consensus; sees revs $310-315 mln vs $313.14 mln Thomson Reuters consensus

|