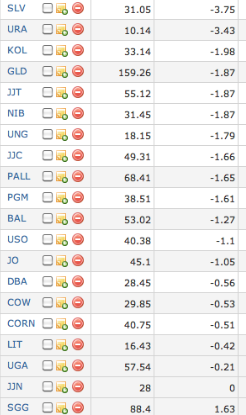

Raw Commodities Are Lower, Sans Sugar

Kyle Bass: Fed Has Made Gold a Solid Investment for Years

Gold Continues to Get Smashed Along With Other Metals

Oil Takes its Cue From China and Trades Down Slightly as Hopes are Dashed

Oil Makes a Comeback from its Recent Slump on Hopes of Higher Demand

“Oil rebounded from the lowest price in almost a week as investors bet that fuel demand may increase amid signs the U.S. and Chinese economies are strengthening.

Futures gained as much as 0.7 percent in New York after losing 1 percent yesterday. U.S. retail sales rose in February by the most in five months, according to a Bloomberg News survey before today’s Commerce Department report. China’s industrial output growth will pick up in March and April, a former industry minister said. Oil has climbed this year on concern tension with Iran may lead to military conflict in the Middle East, where more than half the world’s oil reserves are located.

“Oil prices have been bolstered by better-than-expected leading indicators and ample liquidity,” said Hannes Loacker, an analyst at Raiffeisen Bank International AG (RBI) in Vienna who predicts U.S. futures will average $104 a barrel this year. “Chinese economic growth should be strong enough to prevent the oil price from falling too sharply.”

Oil for April delivery rose as much as 79 cents to $107.13 a barrel in electronic trading on theNew York Mercantile Exchange. It was at $106.86 at 11:44 a.m. London time. The contract yesterday fell $1.06 to $106.34, the lowest settlement since March 7. Prices are 8.1 percent higher this year.

Brent crude for April settlement on the London-based ICE Futures Europe exchange was up 74 cents, or 0.6 percent, at $126.08. The European benchmark contract was at a premium of $19.22 to New York crude. The spread close at $19 yesterday, the most since Feb. 6….”

Comments »Gold Makes a Small Pullback Before The Fed Meeting

“Gold declined before a Federal Open Market Committee meeting and as Greece prepares to receive a second bailout. Platinum rose above gold for a second day.

The best six months of job gains since 2006 have helped reduce the odds of a third round of asset purchases by the U.S. Federal Reserve, according to a Bloomberg News survey. Bullion had the biggest one-day decline since 2008 on Feb. 29 after Fed Chairman Ben S. Bernankegave no signal of a third round of quantitative easing, or QE3, sending the dollar higher. The dollar gained today against a six-currency basket including the euro and yen….”

Comments »Do the Sardine Can Shuffle

“NEW YORK (CNNMoney) — Ridership on the nation’s trains and buses hit one of the highest levels in decades, with officials crediting high gas prices, a stronger economy and new technology that makes riding public transit easier.

In 2011, Americans took 10.4 billion trips on mass transit — which includes buses, trains, street cars and ferries, according to the American Public Transportation Association.

That’s a 2.3% increase over 2010 and just shy of the number of trips in 2008, when gasoline spiked to a record national average of $4.11 a gallon.

“As people get jobs and go back to work, they get on mass transit more,” said Michael Melaniphy, president of APTA. “And then when people look at gas prices, they really get on transit more.”

Melaniphy said gas prices near $4 a gallon tends to be the tipping point that pushes more people onto mass transit.

Obama makes alternative-fuel vehicle push

Comments »

Exxon Mobil and Other Majors Agree Upon Free Oil in Exchange for Services in Iraq

Hedge Funds Cut Allocation to Gold

“Gold dropped for the first time in four days alongside equities and commodities on concern thatChina’s economy is slowing as speculators cut their positions by the most since August 2008.

China’s exports grew at a slower pace than forecast, contributing to the biggest trade deficit in at least 22 years last month, data showed March 10, adding to figures last week on factory output and retail sales that signaled slowing economic growth. That sent equities and commodities lower. Physical gold markets are “still keeping their distance,” according to UBS AG. The U.S. Federal Open Market Committee, which sets U.S. interest-rate policy, meets tomorrow….”

Comments »Liberal Women Use Sex as a Commodity

OPEC Reiterates They are Still Pumping Record Volume

“Europe’s debt crisis and an oil price rally are the biggest threats to global oil demand this year, OPEC said on Friday, adding it was still pumping above its target despite a slide in Iranian production.

The Organization of the Petroleum Exporting Countries (OPEC) retained its view that world oil demand will grow by 900,000 barrels per day (bpd) this year, unchanged from last month, but warned the weak pace of growth in developed economies could crimp global appetite for oil….”

Comments »Oil Ticks A Bit Higher on Demand Outlook and Hopes of Growth

Natural Gas Hits New Decade Low

BY CHRISTIAN BERTHELSEN

NEW YORK—A tepid report on natural-gas inventories was enough to send futures swooning Thursday, closing at another 10-year low.

The reaction in the market shows just how bearish traders have become about the prospects for natural gas, which is suffering through a dismal end to the heating season because of a supply glut caused by robust production and slack demand. Gas is a key component in heating, and demand typically rises as temperatures fall.

Read the rest here.

Comments »Credit Suisse Say Not to Worry About Oil Prices….Not Yet at Least

“From Credit Suisse’s Andrew Garthwaite:

The impact on GDP: each 10% rise in the oil price takes 0.2% off US GDP growth and 0.1% off global growth.This time the negative impact of a high oil price on growth is limited as: oil is only 10% above its 6-month MA (changes matter more than levels for growth); other energy prices are muted (coal prices are at 12-month lows, US gas prices down 40% yoy) and CPI food price inflation should fall by 5pp from here (adding 0.7% to disposable income); critically, unlike 2008 and 2011, neither the ECB nor GEM central banks are likely to raise rates in response to higher energy costs; and US macro momentum is currently consistent with GDP 0.8% above 2012 consensus, suggesting some buffer before consensus estimates get downgraded.

Impact on equities: since 2007, equities have tended to fall when oil prices rise by 40% yoy (i.e. an oil price of c$150/bbl). From a macro perspective, we would start worrying if the rise in the oil price pushed up US CPI above 4% (that is when equities de-rate, c$160/bbl), US GDP started being revised down (c$150/bbl) or European inflation rose above 2% year-end (c$140/bbl). Another warning signal is when inflation expectations decouple and start falling as oil continues to rise (as has happened in the past week). Each 10% rise in the oil price takes 2% off European EPS and c1% in the US, on our estimates (yet current valuations can accommodate a c10% fall in earnings).”

Comments »Gasoline Hits $6.19 in LA

Oil Lifts On Hopes Employment and Demand Pick Up

Bargain Hunters Step In and Lift Gold From Three Week Lows

Gold Falls 2 Percent, Breaches Support on Greece Fears

By Frank Tang and Jan Harvey

NEW YORK/LONDON | Tue Mar 6, 2012 3:53pm EST

(Reuters) – Gold fell 2 percent in heavy volume on Tuesday, breaching technical support as investors worried more about a possible Greek default, but some analysts said the metal looked oversold and was poised for a rebound.

Silver fell 3.5 percent, and platinum and palladium posted their largest daily declines this year, as investors grew more cautious about the global economic outlook a day after China cut its growth forecast and data showed the European Union was not likely to avoid a recession.

Bullion broke below its 200-day moving average for the first time since mid-January, tracking U.S. equities’ slide on worries Greece could miss a deadline to complete a bond swap that is part of a bailout and restructuring deal to avert a default.

Gold investors were already cautious after the precious metal tumbled 5 percent last Wednesday on dimmer near-term prospects for another round of quantitative easing from the U.S. Federal Reserve. Gold rebounded to near $1,660 an ounce but investors remained uneasy.

“People who are long gold are getting out. They don’t like what’s going on with Greece and the stock market is decisively lower. It’s a matter of raising money,” said Jonathan Jossen, COMEX gold options floor trader.

“But the bullish option flow usually tells me we could be near a bottom,” Jossen said.

Spot gold was down 2.1 percent at $1,670.41 an ounce by 2:52 PM EST (1952 GMT) , having hit a six-week low of $1,663.95.

U.S. gold futures for April delivery settled down $31.80 at $1,672.10.

Read the rest here.

Comments »Do You Need to Buy Big Oil Stocks?

By BRETT ARENDS

Be honest. When you are standing at the gas pump, refilling your car and watching the numbers spin higher and higher, don’t you wish you had some stock in Exxon or BP?

Of course you do.

Is it a good idea?

Let’s do the math.

Fuel prices are rocketing — again. Gasoline is up to $3.64 a gallon nationwide. It’s doubled in ten years and trebled in twenty.

You can blame Iran. You can blame China. You can blame quantitative easing.

But whoever you blame, the problem’s the same. Your costs are rising, but your income probably isn’t. Fuel prices have outpaced incomes for generations. Today the average worker earns enough each week to buy just 200 gallons of gas. Back in the late 1970s the figure was 300 gallons.

In the parlance of finance, you have a liability without a corresponding financial asset. A bad move. When prices rise, you either have to cut back on what you spend on fuel, or cut back elsewhere.

According to Labor Department data, gasoline makes up about 5% of consumer spending. In 2010, the most recent year for which we have data, the bill came to about $2,100.

Since then it has risen about 30%. By some crude math, that’s costing a typical household another $600 or so.

Michael Willis, chief executive of niche fund company The Willis Group, is among those who has been arguing for some time that we ought to invest where we spend. He calls it “consumption-based asset allocation.” (His firm even runs two small mutual funds, the Giant 5 Total Investment System (FIVEX) and the Giant 5 Total Index System (INDEX), based around the idea.) “If you buy it,” he says, “we really think you ought to own it.”

When it comes to energy, you can take matters into your own hands pretty easily.

Integrated oil companies are probably the easiest way for ordinary investors to play the energy sector. They are less volatile than smaller energy companies, or the companies which provide services, or lease deep-sea rigs.

The iShares S&P Global Index fund (IXC) is an exchange-traded fund, which owns foreign oil giants like Total, BP and Shell as well as the likes of Exxon and Chevron.

Read the rest here.

Comments »