Facebook’s Sec filing for ipo.

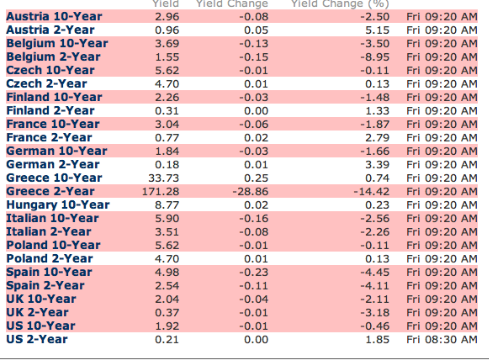

Comments »RISK ON: ITALIAN YIELDS UNDER 6%, SPANISH YIELDS UNDER 5%

Italy 5.75%

Spain 4.89%

Listen: Q4 Conference Call X

Listen: Q4 Conference Call BRCM

Listen: Q4 Conference Call AMZN

Listen: Q1 Conference Call for DLB

NYPD TAKES DOWN ‘MARIJUANA MEGA-MANSION’

Biggest Gains in 15 Years, Now What? (history lesson)

+4.7% on the S&P.

The last time the market went up this much in January was in 1997, when it soared 6.18%. It’s worth noting, the market followed through with strength in February of 1997, gaining 0.96%. But, in March of ’97, the market plunged by 4.38%.

The last time we had similar gains was in 2001, when the market moved ahead by 4.45%. In February of 2001, the market crashed by 9.54% and fell some more in March by 5.6%.

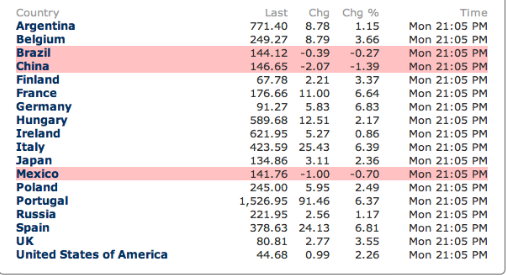

Comments »GLOBAL CDS SPREADS RISE SHARPLY

Today’s Biggest Winners

No. Ticker % Change

1 GTXI 49.24

2 ONCY 29.01

3 DHT 26.44

4 PNCL 23.46

5 PBY 23.34

6 TNB 23.07

7 FFN 20.22

8 YMI 19.88

9 RENN 19.24

10 AMLN 18.95

11 NGSX 17.58

12 SVVC 17.10

13 LZEN 16.45

14 MELA 13.73

15 MCOX 13.67

16 OTIV 12.93

17 DEJ 12.86

18 INVN 12.26

19 HTCH 11.88

20 PIP 11.28

21 VHGI.PK 10.77

22 MILL 10.28

23 ARNA 10.06

24 CT 9.13

25 IFON 9.09

ALERT: EUROPE NEEDS TO RAISE $29 BILLION IN BOND SALES THIS WEEK

Italy auctions as much as 6 billion euros of five- and 10- year debt today, along with securities due in April 2016 and March 2021. Belgium sells as much as 3 billion euros of bills tomorrow, with Spain, Portugal, Germany and France issuing 13 different maturities in the five days.

Comments »

CHICKEN McNUGGETS ARE HEALTHY FOR YOU, IN AN INVERSE WORLD

Fitch Downgrades Italy, Spain, Ireland, Belgium, Cyprus and Slovenia

Fitch downgrades Italy, Spain, Ireland, Belgium, Cyprus and Slovenia

Fitch Ratings has today concluded its review of the six eurozone sovereigns it placed on Rating Watch Negative (RWN) on 16 December 2011. The rating actions on the long-term (LT) and short-term (ST) Issuer Default Ratings (IDRs) are as follows: -Belgium LT IDR downgraded to ‘AA’ from ‘AA+’; Negative Outlook; ST IDR affirmed at ‘F1+’ -Cyprus LT IDR downgraded to ‘BBB-‘ from ‘BBB’; Negative Outlook; ST IDR affirmed at ‘F3’ -Ireland LT IDR affirmed at ‘BBB+’; Negative Outlook; ST IDR affirmed at ‘F2’ -Italy LT IDR downgraded to ‘A-‘ from ‘A+’; Negative Outlook; ST IDR downgraded to ‘F2’ from ‘F1’ -Slovenia LT IDR downgraded to ‘A’ from ‘AA-‘; Negative Outlook; ST IDR downgraded to ‘F1’ from ‘F1+’ – Spain LT IDR downgraded ‘A’ from ‘AA-‘; Negative Outlook; ST IDR downgraded to ‘F1’ from ‘F1+’

$GSVC’s Portfolio of Investments

Bloom Energy Corporation $1,771,335 Secondary marketplace and direct from stockholder Provider of solid oxide fuel cell technology that generates power onsite from a wide variety of fuel sources

Chegg, Inc. $5,999,996 Direct from stockholder Online textbook rental company serving students nationwide

Facebook, Inc. $6,587,500 Secondary marketplace Leading online social network

Gilt Groupe, Inc. $5,499,250 Secondary marketplace and direct from stockholder Online shopping destination offering its members access to discounted prices on merchandise, restaurants and vacations

Groupon, Inc. $2,035,200 Secondary marketplace Online provider of daily coupons for various consumer products

Kno, Inc. $2,250,000 Direct from issuer Provider of education software, digital textbooks and social engagement tools for students

PJB Fund LLC(3) $4,000,000 Direct from borrower Debt investment linked until maturity to the value of Zynga, Inc., a developer of online social games

Serious Energy, Inc. $712,380 Secondary marketplace Products and services to make buildings more energy-efficient

SharesPost, Inc. $2,250,000 Direct from issuer Online marketplace for the exchange of private company equity

Silver Spring Networks, Inc. $1,101,430 Secondary marketplace Hardware, software and services that connect devices on the smart grid

TrueCar, Inc. $1,999,997 Direct from issuer Online automotive research destination

Twitter, Inc. $6,932,493 Secondary marketplace and direct from stockholder Short messaging platform

ZoomSystems $250,000 Direct from stockholder Automated retail vending machines

Recent buys:

Investment Details:

Since the end of the quarter ended September 30, 2011, GSV made new investments in a number of companies, including:

ZocDoc, Inc., a free online service for patients to find and schedule doctor and dentist appointments. ZocDoc’s investors include Khosla Ventures, Bezos Expeditions, DST Global, Founders Fund, Goldman Sachs, and Marc Benioff, Chairman and CEO of Salesforce.com.

Grockit, Inc., a leading social learning game provider. Grockit’s investors include Benchmark Capital, Atlas Venture and Integral Capital Partners.

The Echo Systems Corp., a social analytics and engagement platform that enables brands to extract insights from website visitors, reward their most influential customers and drive more revenue per user.

Control 4, Inc., a leading provider of the operating system for the smart home. Control4 investors include Foundation Capital and Cisco.

The investments completed since September 30th represent approximately $21 million in investments and 30% of GSV Capital’s Net Asset Value

Comments »***TODAY’S DOUBLE DIGIT WINNERS***

No. Ticker % Change

1 SOA 41.00

2 QPSA 31.25

3 RENN 27.16

4 STVI 26.72

5 LEXG.OB 26.15

6 CPHD 25.62

7 FFN 23.35

8 ONSM 21.16

9 CNAM 19.75

10 NLS 18.65

11 SQNS 18.01

12 VHGI.PK 17.75

13 DANG 17.54

14 LSKY 17.35

15 GSVC 16.89

16 AEN 16.57

17 TWER 16.26

18 ELX 15.10

19 AMLN 15.08

20 BCRX 14.52

21 DHT 14.30

22 INVN 14.00

23 INUV 13.89

24 SPMD 13.62

25 TSON 13.43

26 WMS 13.33

27 INFA 13.22

28 YOKU 12.24

29 SINA 12.20

30 RAM 11.78

31 URZ 11.72

32 LNG 11.70

33 DATE 11.41

34 ANX 11.29

35 FSLR 11.24

36 BITA 11.11

37 WEBM 10.96

38 ISS 10.89

39 CMM 10.71

40 RMD 10.58

41 USU 10.43

42 QMM 10.34

43 MCOX 10.32

44 PCRX 10.22

45 JKS 10.06

46 SVVC 9.90

BREAKING: “The Fly” Wins Again

Carry on.

Comments »FLASH: Surging Gasoline Prices Causes Crack Spreads to Explode

FLASH: SOLAR STOCKS ARE RIPPING TO THE UPSIDE

No. Ticker % Change Industry

1 SOL 8.92 Solar

2 DQ 7.35 Solar

3 FSLR 7.13 Solar

4 CSIQ 6.41 Solar

5 LDK 5.81 Solar

6 JASO 5.14 Solar

7 HSOL 4.79 Solar

8 STP 4.32 Solar

9 TSL 4.08 Solar

10 JKS 3.89 Solar

11 SPWR 3.06 Solar

12 WFR 2.81 Solar

13 YGE 2.61 Solar

14 EMKR 2.44 Solar