Comments »

Market Update

U.S. equities found a pitfall that got underway in Asia and then spread to Europe after the Bank of Japan failed to pour more gasoline on the stimulus fire.

We did have an amazing paring of losses over the past hour briefly going positive for a tick or two.

Financials lead the negativity putting in the worst performance, while commodities also remain weak due to a slowdown in China.

The markets seem to have a problem breaking out above 1640 S&P, but seem to hold the 1620 level for now. Soon come, longer term direction will be had once the markets decide how to deal with tapering possibilities.

2 4 2sday

[youtube://http://www.youtube.com/watch?v=XJoZe5vkxws 450 300] [youtube://http://www.youtube.com/watch?v=oZdiXvDU4P0 450 300]Comments »

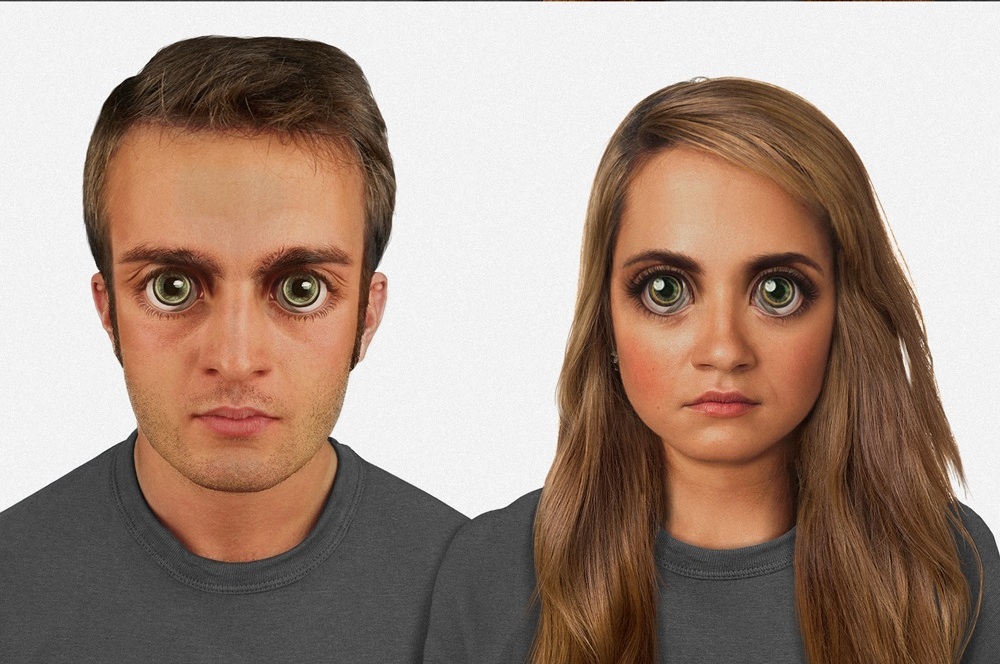

How $GOOG Glass Will Make Us Look in a 100k Years

$NWSA Shareholders Approve Breakup

“News Corp.’s shareholders on Tuesday voted to advance the media company’s plans to split off its publishing assets into a separate publicly traded entity and rename the remaining TV and film-focused business 21st Century Fox.

At a meeting in New York, shareholders easily approved three amendments to News Corp.’s certificate of incorporation that position the company to complete the separation on June 28, News Corp. Chairman Rupert Murdoch said at the meeting.

Following the separation, the new print media company, which will take the name News Corp., will have assets including The Wall Street Journal, New York Post, and Times of London, plus book publisher HarperCollins. 21stCentury Fox will house the Fox broadcast and cable networks and the 20th Century Fox studio, among other properties.

Shares in the two companies will begin trading separately on July 1.

Mr. Murdoch said the separation will “enable us to respond more rapidly to fast-evolving markets.” Mr. Murdoch will continue as chairman and CEO of 21st Century Fox and will become executive chairman of the print media spin-off. The Murdoch family will effectively control both companies.

News Corp.’s board approved the separation late last month. As part of the deal, shareholders will get one share of the new publishing-focused company for every four shares of News Corp. they now own.

The move has been popular with investors who believe the print businesses are a drag on the growing media and entertainment assets. News Corp.’s stock is up about 45% since the company announced the separation nearly a year ago.

Mr. Murdoch and other News Corp. executives have sought to persuade investors that despite the long-term challenges of the publishing and newspaper world—most notably, the continuing shift of advertising from print to online— the print media assets can thrive in a separate company….”

Comments »$GOOG Completes its Acquisition of Waze

“We’ve all been there: stuck in traffic, frustrated that you chose the wrong route on the drive to work. But imagine if you could see real-time traffic updates from friends and fellow travelers ahead of you, calling out “fender bender…totally stuck in left lane!” and showing faster routes that others are taking.

To help you outsmart traffic, today we’re excited to announce we’ve closed the acquisition of Waze. This fast-growing community of traffic-obsessed drivers is working together to find the best routes from home to work, every day.

The Waze product development team will remain in Israel and operate separately for now….”

Comments »$AAPL Takes a Bite Out of Money Manager’s Performance

“Active managers in both the mutual and hedge fund industries are badly underperforming their peers, and they have a mutual malady: heavy ownership of flailing tech giant Apple.

The Cupertino, Calif.-based maker of electronic gizmo wizardry is the fourth-most owned company by the top 50 mutual funds and the fifth-most owned by hedge funds.

With Apple shares down 16 percent this year, it’s played a heavy role in the inability of active managers to beat the basic Standard & Poor’s 500 benchmark….”

Comments »Investors Sue Uncle Sam Contesting the Takeover of $FNM and $FRE

“Amid newly energized trading in the stocks of mortgage giants Fannie Mae and Freddie Mac, shareholders filed suit Monday against the federal government, contesting its takeover of the two in 2008.

The City of Austin Police Retirement System in Texas and Seattle-based bank Washington Federal are seeking $41 billion in damages. They charge that the conservatorship of Fannie Mae and Freddie Mac was “unlawful and unwarranted,” as is the requirement instituted this year that the two pay the Treasury all of their profits.

“The government has appropriated many billions of dollars’ worth of private shareholder property, without providing any compensation for this action,” according to the filing.

Fannie Mae reported record profits in the second quarter of this year and has now paid the Treasury $95 billion in dividends, nearing the $116 billion it originally drew. Shareholders believe they should be reaping some of these profits, not the federal government….”

Comments »Black Gold Continues Downtrend Action as Supplies Rise Nearly Double Expectations

“* Reuters poll shows increase in U.S. crude stockpiles

* Central Banks could start tightening monetary policy

* OPEC trims 2013 world oil demand growth forecast

* Weaker Chinese economy continues to weigh on oil

By Peg Mackey

LONDON, June 11 (Reuters) – Brent crude tumbled below $102 per barrel on Tuesday after the United States nearly doubled the estimate of its shale oil and investors worried that central banks, following Japan, could rein in their loose monetary policy.

World share fell and yields on riskier European debt rose after the Bank of Japan’s decision not to follow up its $1.4 trillion stimulus programme announced in April.

U.S. oil production has soared as new drilling techniques have unlocked shale deposits countrywide. The Energy Information Administration now estimates such shale oil reserves at 58 billion barrels, up from 32 billion in 2011.

“With the global economy continuing to grow at a snail’s pace, the likelihood of a significant growth spurt in oil consumption in the short to even medium term is highly unlikely,” said Dominick Chirichella of Energy Management Institute.

Brent crude was off $1.79 to $102.16 a barrel by 1345 GMT, having sunk to $101.82 in earlier trade. U.S. oil shed $1.33 to $94.44.

Increasing oil supplies and waning demand in China, the world’s number two oil consumer, are likely to hold down prices.

Data from China showed a slowdown in the economy of the world’s biggest energy consumer, with May exports weak and domestic activity struggling to pick up.

Implied oil demand rose in May at its lowest annual rate since September 2012, Reuters calculations show….”

Comments »Progress for A New American Century

“The American Dream used to be a house to call your own that you paid for with a steady paycheck after an honest day’s work. But in this post-financial-crisis nation, the dream for many now means having a part-time job and being able to rent an apartment.

And with unemployment and wages stagnant, as well as uncertainty about the costs of the new health care act for employers, the pared-down expectations may be a trend for years to come.

“The quality of the jobs being added are quite low, especially relative to the jobs that were lost,” said an economist from a major Wall Street investment bank, who declined to be named because he hasn’t published on this trend yet. “Homeownership, especially for the younger, is quite low, showing perhaps some secular decline.”

The jobs report on Friday showed that May unemployment was unchanged at 7.6 percent.

But digging deeper into the data reveals a different story. The unemployment rate was just 3.8 percent for those with a bachelor’s degree and higher. Its 7.4 percent for those with only a high school degree.

The number of workers who are “part-time for economic reasons” is higher than it has ever been after every recession since 1950, according to the Department of Labor….”

Comments »In Play and On the Wires

Gapping Up and Down This Morning

Upgrades and Downgrades This Morning

Meltzer: US Can’t Avoid Inflation

“The U.S. economy has escaped inflation despite the Federal Reserve’s massive liquidity infusion … so far.

The inflation-free economy won’t last forever, warns Allan Meltzer, a professor of political economy at Carnegie Mellon University, in an article for Project Syndicate.

The Fed has created enormous amounts money by purchasing bonds from banks in its quantitative easing (QE) program.

Yet inflation is remained low, at about 2 percent, because banks are keeping the additional liquidity as excess reserves rather than lending it out, Meltzer contends, which not only holds down inflation, but also holds down job growth. That explains why the recovery has remained so slow and unemployment has stayed high, he notes.

In response, instead of changing its tactics, the Fed launched more QE.

Yet as in the earlier QE rounds, the bulk of the additional liquidity remained idle in bank excess reserves.

“While subdued liquidity and credit growth are delaying the inflationary impact of the Fed’s determination to expand banks’ already-massive reserves, America cannot escape inflation forever,” Meltzer writes. “The reserves that the Fed — and almost all other major central banks — are building will eventually be used.”

Because banks earn 0.25 percent interest on excess reserve accounts and pay interest rates near zero to their depositors, they chose to earn risk-free interest rather than circulate it into the economy, Meltzer says. Banks may lend to the government and large stable corporations, but not to riskier borrowers like start-up companies or first-time homebuyers.

“While speculators and bankers profit from the decline in interest rates that accompanies the Fed’s asset purchases,” he writes, “the intended monetary and credit stimulus is absent.”

The problem is not lack of liquidity but insufficient investment, Meltzer argues. He blames the increase in taxes on incomes over $250,000, President’s Obama’s proposal to cap retirement entitlements and uncertainty over new regulations for hurting investment. Plus, healthcare reform has hampered employment growth because businesses are reducing hiring and cutting hours over fears of higher labor costs. …”

Comments »Dollar Volatility Erodes Currency Hedge Fund Profits

“Some investors make their biggest money in times of market volatility, but that wasn’t the case for currency hedge funds last month.

They suffered from the dollar’s moves up and down, The Wall Street Journal reports.

The Parker Global Currency Managers Index, which tracks the returns of 17 funds in which Parker Global Strategies invests, dipped 0.58 percent last month, according to preliminary data from the company.

That compares with a 2.1 percent gain for the Standard & Poor’s 500 Index.

The dollar index, which measures the currency against six major counterparts, moved up and down between 81 and 85 in May. That’s a trading band of 5 percent from bottom to top.

The volatility has come among uncertainty about when the Federal Reserve will begin tapering its quantitative easing policy….”

Comments »Too Little Too Late? Regulators Put Big Bank Fees Under The Microscope

“U.S. regulators are stepping up scrutiny of overdraft fees charged by banks, a big revenue stream that is helping the industry lessen the hit caused by low interest rates and the sluggish economy.

The Consumer Financial Protection Bureau, in a report set for release Tuesday, plans to criticize the U.S. banking industry for practices that it says range from confusing rules on overdraft fees to increasing the likelihood of multiple fees being charged to the same customer.

The agency, created by the Dodd-Frank financial-overhaul law in 2010 to be a powerful voice for consumers, said it has no immediate plans to issue or recommend new overdraft-fee rules.

But the report is the strongest signal yet that the CFPB is burrowing into the controversial fees, which generated about $32 billion in revenue in the U.S. last year, according to research firm Moebs Services Inc.

Since its creation, the CFPB has examined areas from mortgages to student loans to credit reports. The agency’s efforts come as banks and other financial institutions are struggling to regain profit momentum five years after the financial crisis erupted.

Fees are a huge revenue source for banks but have exposed them to ire from regulators and consumers.

In 2011, Bank of America Corp., BAC -0.60% the second-largest U.S. bank by assets, quickly abandoned plans for a monthly debit-card charge of $5 after it was denounced by lawmakers and mocked on “The Tonight Show.”

Richard Hunt, president and chief executive of the Consumer Bankers Association, a trade group of big and regional banks, said consumers “have the right to choose the products and features which best provide for their family’s daily needs.”

New rules by the CFPB could push some consumers to use “unregulated industries with riskier and costlier alternatives,” such as payday lenders, check cashers or pawn shops, he said….”

Comments »The NFIB Reports Small Business Sentiment is Up

“JUNE REPORT:

Small Business Optimism Edges Up in May 2013, Reaches May 2012 Level

For the second consecutive month, small-business owner confidence edged up, according to NFIB’s Index of Small Business Optimism, which increased by 2.3 points to a final reading of 94.4 in May.

For the second consecutive month, small-business owner confidence edged up, according to NFIB’s Index of Small Business Optimism, which increased by 2.3 points to a final reading of 94.4 in May.

While May’s reading is the second highest since the recession started December 2007, the Index does not signal strong economic growth for the sector. Eight of 10 Index components gained momentum, showing some moderation in pessimism about the economy and future sales, but planned job creation fell 1 point and reported job creation stalled after five months of gains.

“Small business confidence rising is always a good thing, but it’s tough to be excited by meager growth in an otherwise tepid economy. Washington remains in a state of policy paralysis, and while the stock market sets records, GDP posts mediocre growth. The unemployment rate remains in the mid-7s and it is departures from the labor force —- not job creation — that is contributing to its decline when it does fall. It’s nice to see confidence not shrinking, but there isn’t much to hang your hat on in this report. We are back to where we were in May 2012. Two good months don’t make a trend, but we can’t have a trend without them, so it’s a start.” – NFIB chief economist Bill Dunkelberg….”

Comments »Manpower Says Employers Plan on Hiring the Most Workers Since 2008

“NEW YORK (Reuters) – More employers in the United States plan to hire workers next quarter than in any period since the fourth quarter of 2008, according to a survey by Manpower Group, the global employment services giant.

Manpower’s quarterly survey released Tuesday found most employers around the globe were uncertain about hiring more workers in the July through September period given tepid consumer demand. There were certain bright spots, however, with employers in the United States and some parts of Europe feeling cautiously optimistic.

“If you look at it from a global perspective, the overall feeling is that there are definitely challenges,” said Manpower’s CEO Jeff Joerres. But he said employers are more optimistic than in past months about global economic prospects.

Manpower, which surveyed 42 economies, found that employers in 31 countries and territories planned to hire next quarter. Hiring intentions strengthened in 17 economies, including Spain, Greece and the United States, compared to the previous quarter.

Hiring intentions remained unchanged in four economies and weakened in 21, including France, China and India….”

Comments »Here is Everything $AAPL Released at Yesterday’s Conference in Case You Missed It

“…The company announced new products, features, and a drastically redesigned iPhone and iPad operating system called iOS 7.

Here’s a quick round up of everything you missed…”

Comments »Banks Serve as a Gateway to Fraud

“The pitch arrived, as so many do, with a friendly cold call.

Bruno Koch, 83, told the telemarketer on the line that, yes, of course he would like to update his health insurance card. Then Mr. Koch, of Newport News, Va., slipped up: he divulged his bank account information.

What happened next is all too familiar. Money was withdrawn from Mr. Koch’s account for something that he now says he never authorized. The new health insurance card never arrived.

What is less familiar — and what federal authorities say occurs with alarming frequency — is that a reputable bank played a crucial role in parting Mr. Koch from his money. The bank was the 140-year-old Zions Bank of Salt Lake City. Despite spotting suspicious activity, Zions served as a gateway between dubious Internet merchants and their marks — and made money for itself in the process, according to newly unsealed court documents reviewed by The New York Times.

The Times reviewed hundreds of filings in connection with civil lawsuits brought by federal authorities and a consumer law firm against Zions and another regional bank that has drawn even more scrutiny, First Bank of Delaware. Last November, First Delaware reached a $15 million settlement with the Justice Department after the bank was accused of allowing merchants to illegally debit accounts more than two million times and siphon more than $100 million.

The documents, as well as interviews with state and federal officials, paint a troubling picture. They outline how banks profit handsomely by collecting fees while ignoring warnings of potential fraud and, in some instances, enabling dubious merchants to prey on consumers….”

Comments »$BA Raises 20 Year Jet Order Outlook by 3.8%

“Boeing Co. (BA) raised its 20-year forecast for commercial jet demand by 3.8 percent as air traffic outstrips global economic growth and airlines refresh their fleets with $4.8 trillion in new planes.

Airliner sales will total 35,280 new jets during the next two decades, compared with a 2012 projection of 34,000 planes, Boeing said today in Paris before next week’s Paris Air Show. All the gain will come from purchases of the single-aisle models that are the workhorses of carriers’ fleets, Boeing said.

Boeing is betting on the durability of that expansion as it considers boosting output beyond the record pace already set for narrow- and wide-body planes. There’s no sign of a bubble, Randy Tinseth, marketing vice president for commercial airplanes at Chicago-based Boeing, said in a briefing ahead of the forecast.

“Passenger traffic has been very resilient,” Tinseth said. “Every indicator that we see in the market says that demand is real and there’s a need to increase production.”

Boeing’s order estimate is more important than the projected gain in value — up 8.3 percent from last year’s estimate — because that tally is based on list prices typically subject to discounts. The planemaker’s rivalry with Airbus SAS will change over the coming decades with the arrival of new models such as Bombardier Inc. (BBD/B)’s CSeries and Commercial Aircraft Corp. of China’s C919….”

Comments »