I found this document to be rather interesting.

Anyone involved with banking, real estate, law, and the purchase of a home should consider the following information.

Since i’m not an authority to give an opinion as to the validity or value of said information, it would be greatly appreciated that the readership offer any knowledge of the topic and or refer this to anyone they might know who could shine a light on these here matters.

Selected excerpts:

“WHERE DOES THE FRAUD BEGIN?

This document is meant to take the reader down a road they have

likely never traveled. This is a layman’s explanation of what has

been happening in this country that most have no idea or inkling

of. It is intended to give the reader an overview of a systemic

Fraud in this country that has reached epic proportions and

provoke action to eradicate this scourge that has descended upon

the people of America. Depending on what your situation is, you

may react with disbelief, fear, anger or outright disgust at what you

are about to learn. The following information is supported with

facts, exhibits, law and is not mere opinion.

Let’s start our journey of discovery with the purchase of a home

and subsequent steps in the financial process……

….THE DOCUMENTS INVOLVED

The two most important and valuable documents that are signed

at a closing are the “Note” and the “Deed” in various forms. When

looking at the definition of a “Mortgage Note” it is obvious that it is

a “Security Instrument”. It is a promise to pay made by the maker

of that “Note”.

When looking at a copy of a “Deed of Trust” such as

the attached Exhibit “A”, which is a template of a Tennessee “Deed

of Trust” form that is directly from the freddiemac.com website, it

is very obvious that this document is also a “Security Instrument”.

This is a template that is used for MOST government purchased

loans. You will note that the words “Security Instrument” are

mentioned no less than 90 times in that document. Is there ANY

doubt it is a “Security”? When at the closing, the “borrower” is led to believe that

the “Mortgage Note”that he signs is a document that

binds him to make repayment of “money” that the “lender” is

loaning him to purchase the property he is acquiring. Is there

disclosure to the “borrower” to the effect that the “lender” is not

really loaning any of their money to the “borrower” and therefore

is taking no risk whatsoever in the transaction? Is it disclosed to

the “borrower” that according to FEDERAL LAW, banks are not

allowed to loan credit and are also not allowed to loan their own or

their depositor’s money? If that is the case, then how could this

transaction possibly take place? Where does the money come

from? Is there really any money to be loaned? The answer to this

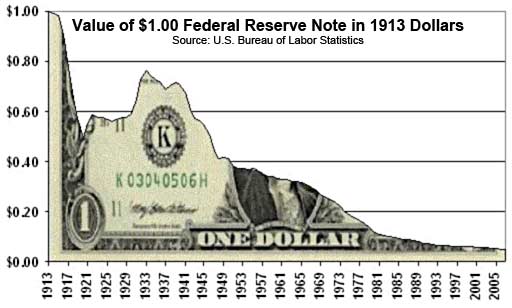

last question is a resounding NO! Most people are not aware that

there has been no lawful money since the bankruptcy of the United

States in 1933……..

……When you sit down at the closing table to complete the

transaction to purchase your home aren’t you tendering a “Note”

with your signature which would be considered money? That is

exactly what you are doing. A “Note” is money in our monetary

system today! You can deposit the “Federal Reserve Note” (a

promise to pay) with a denomination of $10 at the bank and they

will credit your account in that same amount. Why is it that when

you tender your “Note” at the closing that they don’t tell you that

your home is paid for right on the spot? The fact is that it IS PAID

FOR ON THE SPOT. Your signature on a “Note” makes that “Note”

money in the amount that is stated on the “Note”! Was this

disclosed to you at the “closing” in either verbal or written form?

Could this be the place where the other players come into the

transaction at or near the time of closing?

What happens to the

“Note” (promise to pay) that you sign at the closing table? Do they

put it in their vault for safe keeping as evidence of a debt that you

owe them as you are led to believe? Do they return that note to you

if you pay off your mortgage in 5, 10 or 20 years? Do they disclose

to you that they do anything other than put it away for safe keeping

once it is in their possession?

WHAT ACTUALLY HAPPENS TO THE “NOTE”?

Unknown to almost everyone,there is something VERY different

that happens with your “Mortgage Note” immediately after closing.

Your “Mortgage Note” is endorsed and deposited in the bank as a

check and becomes “MONEY”!……

……How can it be that you could just write a “Note” and pay for your

home? This leads us back to the bankruptcy of the United States in

1933. When FDR and Congress took all the property and gold from

the people in 1933 they had to give something in return for that

confiscation of property. See attached (Exhibit “B” para 6) What

the people got in return was the promise that all of their needs

would be met by the government because the assets and the labor

of the people were collateral for the debt of the United States in the bankruptcy.

All of their debts would be “discharged”. This was

done without the consent of the people of America and was an act

of Treason by President Franklin Delano Roosevelt. The problem

comes in where they never told us how we could accomplish that

discharge and have what we were entitled to after the bankruptcy.

Why has this never been taught in the schools in this country?

Could it be that it would expose the biggest fraud in the history of

this entire country and in the world?

If the public is purposely not

educated about certain things then certain individuals and entities

can take full financial advantage of virtually the entire population.

Isn’t this “selective education” more like “indoctrination”? Could

this be what has happened? In Fina Supply, Inc. v. Abilene Nat.

Bank, 726 S.W.2d 537, 1987 it says “Party having superior

knowledge who takes advantage of another’s ignorance of the law

to deceive him by studied concealment or misrepresentation can

be held responsible for that conduct.”

Does this mean that if there

are people with superior knowledge as a party in this “Loan

Transaction” that take advantage of the “ignorance of the law”,

(through indoctrination) of the public to unjustly enrich

themselves, that they can be held responsible? Can they be held

responsible in only a civil manner or is there a more serious

accountability that falls into the category of criminal conduct? ….”

Full document

Comments »