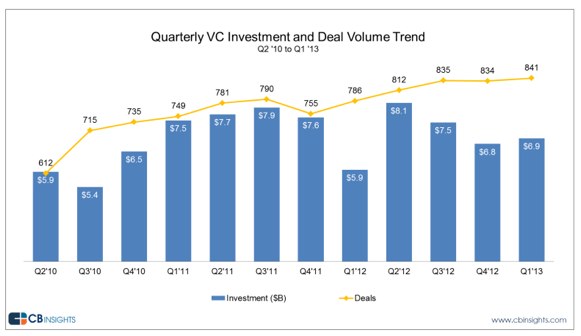

“Private company M&A and venture capital database CB Insights has issued its Q1 2013 report on venture capital and deals. According to the report, VCs invested $6.9 billion across 841 deals (eclipsing a Q3 2012 high), which is the highest level since dot-com days, says CB Insight. You can find a full copy of the report here.

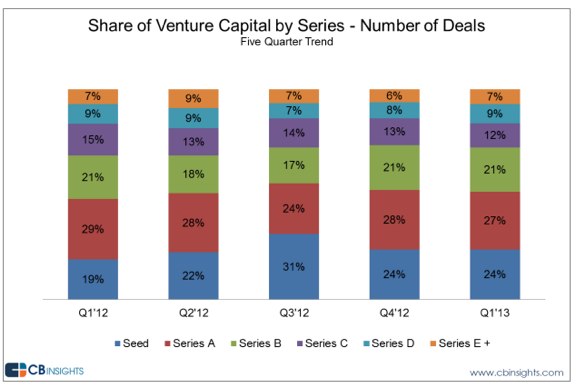

One of the most interesting data points noted by CB Insights was that Series C, D and E all saw an increase in shares of funding dollars while Series A and B both saw declines. Consistent with the reports we’ve seen over the past few months, seed funding continued relatively the same despite concerns about a Series A crunch.

Deal volume was up 7 percent from last year, and funding, relative to Q1 2012, was up 17 percent. Seed VC activity was fairly flat on a sequential basis (194 seed VC deals in Q1 2013 vs. 190 in Q4 2012) but year-over-year VC seed deals are up 31 percent (148 in Q1 2012). Internet deal activity climbed to multi-year highs hitting 379 deals (best since Q1 200), but social as a category made up only 4 percent of deals. CB Insights attributes this jump to the boom in enterprise deals. Clean-tech deals and dollars also hit multi-year lows.

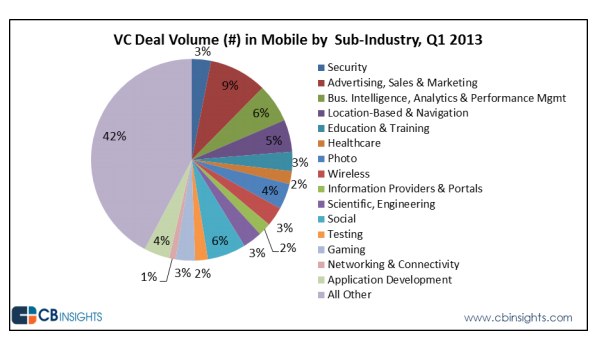

Investment dollars within mobile hit $718 million in Q1, a high beat only by Q3 2012, which saw $968 million in investment. The actual amount of deals dipped to 106 from 122. As a sub-industry in mobile, security is seeing a boom, with over 30 percent of funding dollars for the quarter.

Specifically for Internet companies, deal activity and funding to Internet companies increased 10 percent and 12 percent from Q4 2012, respectively, and climbed 16 percent and 35 percent on a year-over-year basis.

In terms of states for the second time in the last two years….”

If you enjoy the content at iBankCoin, please follow us on Twitter