Many people are now fully believing in a true recovery. Admittedly, it seems the data has been getting better in dribs and drabs. Dribs and drabs is precisely the problem. All the data we collate comes to us in dribs and drabs.

As humans it is hard wired in our brains to hope, be optimistic, to offset negativity with something positive in the moment that we can grab onto.

It is only when you take a step back and look at the complete picture should we realize where we came from and where we are headed. When looking at the entire picture one begins to understand the gravity of our economy and reality at hand. Take it from the S&P, the road ahead is not looking so hot!

While i remain hopeful and optimistic that the future will bring better times not just for myself , but for the country as a whole; I have a hard time swallowing all the data and digesting it away as trivial.

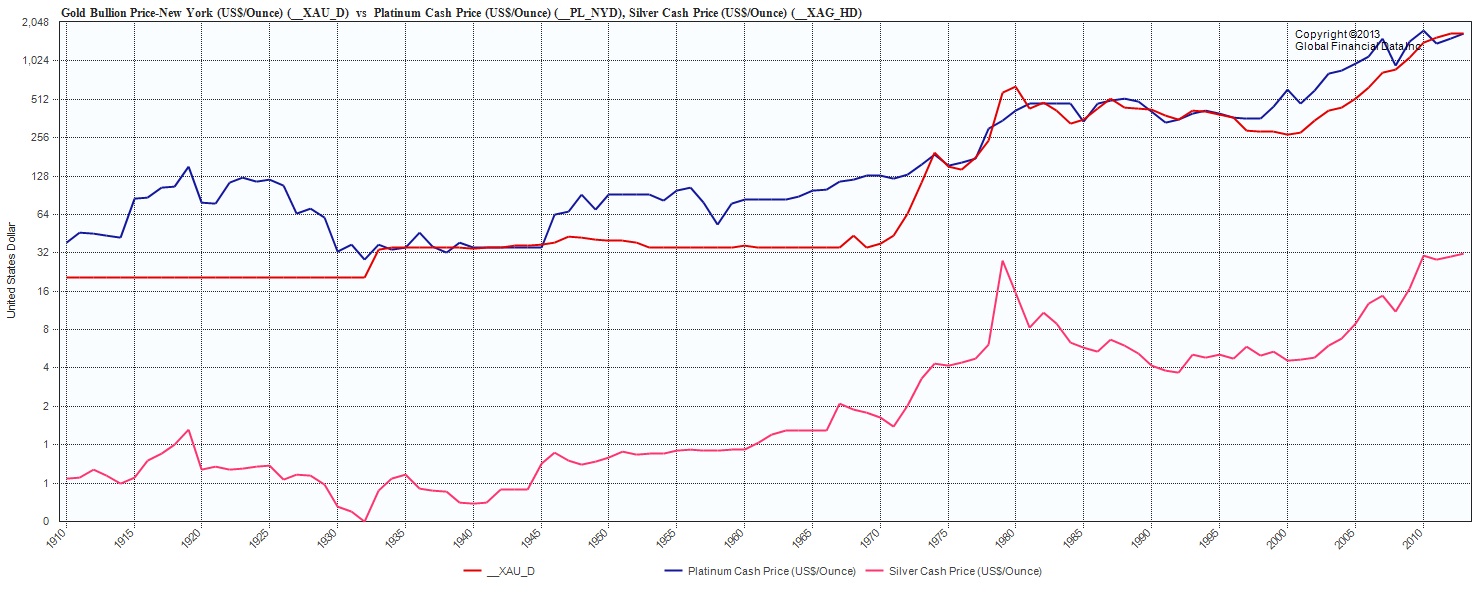

The following presentation is a collection of graphs and facts that snowball into a real horror story.

It is presented in a neutral fashion with little opinion outside of being amazed and alarmed of the state of the statistics.

When taken in as a whole body of results, it can not be shrugged off or talked away like the pundits on t.v. who keep pounding into our brains that the recovery is real, getting better, etc.

It also justifies the fears of the blogosphere.

Remember everything is about timing.

At this time when the markets are starting to hit new highs we have talk about currency wars, repatriation and hoarding of gold by central banks, small investors unanimously jumping into equities, millionaires coming back to the tables, analysts agreeing about it being the best time to invest, etc.

Perhaps “doing what ever it takes,” as a remedy is really what is ultimately killing us.

Central banks should be feeding all of society as opposed to the banks who take our grandchildren’s money to bid up the prices of all assets while being stingy in the lending department to society.

While i believe the S&P could go as high as 1525ish -1550 it would be foolish not to hedge yourself and to be ready for a major correction.

As a last note, i think it is time for all corporations to follow the $COST model.

If all corporations followed this model we would have a healthier society and could look forward to a real recovery. After all, the rise of the middle class is a major component to the success of this empire. Bifurcation, having a two class system will only end in the fall of the empire.

Greed is no longer a good thing!

Cheers on your weekend !

If you click the title it will bring you to youtube and you can then full screen the video. Definitely recommended to view all the charts properly.

[youtube://http://www.youtube.com/watch?v=bYkl3XlEneA 450 300]

[youtube://http://www.youtube.com/watch?v=n2bYJQFQMs8 450 300]

Comments »

Al GoreAccording to a filing with the Securities and Exchanges Commission, Gore — a director on Apple’s board — exercised an option to purchase nearly 60,000 shares of the tech giant at the bargain basement price of $7.48, costing him a total of about $445,000.

Al GoreAccording to a filing with the Securities and Exchanges Commission, Gore — a director on Apple’s board — exercised an option to purchase nearly 60,000 shares of the tech giant at the bargain basement price of $7.48, costing him a total of about $445,000.