Monthly Archives: May 2012

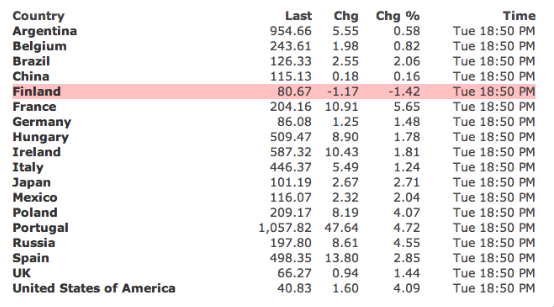

The B in BRIC Sucks Dick: Brazilian Borrowing Costs Slightly Better than Pakistan.

Brazilian borrowing costs are slightly better than that of Pakistan, 3rd worst of all developed nations.

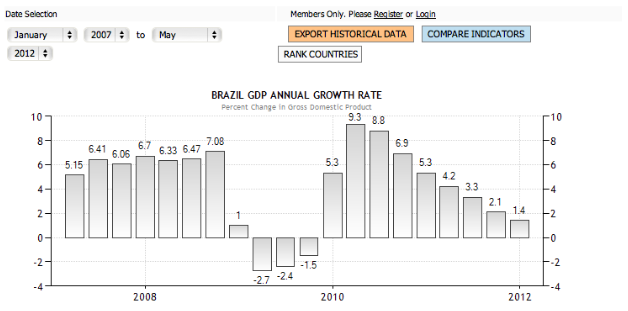

Oh, and their GDP sucks too.

Comments »Think Your Trading Has Been Rough? Check Out the 1 Month Returns of these Dogs

FLASH: The Chairman of GMCR Just Got Margin Called the Fuck Out of His Company

These changes are the result of the actions taken by the Board to address stock sales by Mr. Stiller’s and Mr. Davis’ brokerage firm, which sales were inconsistent with the Company’s internal trading policies. Specifically, Mr. Stiller and Mr. Davis had margin call-related stock sales totaling 5.548 million shares, reflected in Form 4 filings filed with the Securities and Exchange Commission today. These forced sales were related to margin loans, which were secured by pledges of Mr. Stiller’s and Mr. Davis’ GMCR stock and triggered by recent GMCR stock price activity.

Comments »

SHOCKER: A 2ND MASSEUSE STEPS FORWARD TO SUE JOHN TRAVOLTA

On the morning of the massage Travolta had “a strange demeanor, bloodshot eyes and climbed onto the already setup massage table…Travolta removed the entire sheet from his body, and he claimed the sheets were sticky and could not tolerate the heat…Travolta further indicated that he likes a lot of “Glutes” work meaning a massage on his buttocks…While he was massaging near Travolta’s buttocks area, Travolta would open his legs and spread his butt cheeks open and had a full erection and would maneuver in a way to try to force Doe Plaintiff No. 2 to touch his anus and around his anus.”

As the massage came to an end “Travolta suddenly turned on his stomach with his legs wide open with a full erection. He then tried to force Doe Plaintiff No. 2’s hand on Travolta’s scrotum. Then, Travolta started to grab, rub and caress Doe Plaintiff no. 2’s upper thighs and buttocks….Travolta still had an erection and wanted his abdominals done, but Travolta’s erection was in the way and he refused to have his penis covered by a sheet of a pillow case cover…Travolta started masturbating about 15 minutes left in the session, and Doe Plaintiff No.2, said he had to go,” the docs state.

The masseur “complained to all of his supervisors and many coworkers to no avail.” Travolta allegedly went down “to the spa that Plaintiff No. 2 worked at, which is part of the resort Travolta was staying at, as opposed to having Doe Plaintiff No. 2 go to his room. Travolta DEMANDED that Doe Plaintiff No. 2 come back and do it again, and he refused,” the lawsuit asserts.

According to Access Atlanta, Travolta was spotted eating dinner at The Palm restaurant in the swanky enclave of Atlanta, Buckhead aroound January 25 2012, and he was in town filming the movie Killing Season with Robert De Niro in Georgia.

Travolta’s pit-bull attorney, Marty Singer, told us on Monday, that “The problem in America is anyone can sue anyone. However, in this case this unidentified plaintiff and his lawyer will regret they filed this fabricated suit. We intend to sue both of them for malicious prosecution.”

Comments »

A 6 Month View of The PPT’s Risk Appetite Index

SAC Declares Stake in Zillow: $Z

S.A.C. Capital discloses 5.0% stake in 13G filing

Comments »The Bulls Win Tug of War

A great comeback for the markets today. Down as much as 200 on the day with the DOW closing down a mere 76 pirnts (sic.)

NASDAQ down 11

S&P down 6

Oil down $0.50

Gold down $32ish

[youtube://http://www.youtube.com/watch?v=bku8hsC-BvE&feature=fvst 450 300]Comments »

Rahn: Denial is leading to collective economic suicide in Europe and the United States

“Denial is leading to collective economic suicide in Europe and the United States. The French on Sunday elected a socialist president who wants to raise taxes on those elusive rich and keep spending as if there is no tomorrow.

Many on the left, including European socialists, The New York Times and its economist Paul Krugman, are falsely claiming that Europe and even the United States are being saddled with austerity. ”

Comments »Gridlock Until Elections:( GOP Blocks Bill to Extend Student Loans With Low Interest

Good Old Abe Lincoln Really Started Facebook

Small Cities and Even ‘Slums’ Have Become the Beacon of Hiring

Monster Traders Leave Wall Street for Cash Payouts at Hedge Funds

Traders at various banks have seen their pay and or bonuses cut over the past few years. Hedge funds have the cash to entice the move of these star traders.

Comments »Market Update

Markets are trying desperately to pare losses. While off the lows of the day the S&P remains below 1360; which some traders say is a crucial level to have hope for upside. 1354 is a support level with 1345 below that.

Oil has pare half its losses while gold is getting smashed. Gold bugs are targeting $1,581 as a good place to buy.

Comments »Energy Department Cuts Summer Gasoline Price Forecast

NEW YORK (AP) — The government says gasoline will be cheaper this summer than previously expected thanks to a drop in the price of oil.

The Energy Department says drivers should pay an average of $3.79 per gallon at the pump from April through September. That’s down 16 cents from last month’s outlook and not that dramatic an increase from last summer’s average of $3.71 per gallon.

This month’s forecast is a reversal from previous warnings of a sharp rise in gasoline prices. The government had said last month that gasoline prices in May could jump above a monthly average of $4.01 per gallon.

Read more here:

Comments »Moody’s: Half of Brazilian Companies Remain Exposed To Liquidity Risks

Sao Paulo, May 07, 2012 — While corporate liquidity in Brazil has improved modestly over the last year, practices continue to lag global standard and companies remain more reliant on banking relationships rather than the international capital markets when compared to Mexico and the U.S., says a new special comment by Moody’s Investors Service.

“Market improvement over the past year allowed a number of companies to tap the capital markets and extend debt maturities,” said Filippe Goossens, a Moody’s Senior Vice President and an author of the report.

Moody’s concluded that 59% of the 39-rated companies—excluding homebuilders— have adequate or good liquidity, compared to the 81% observed in Mexico. Moody’s defines the degree of liquidity risk by considering each company’s cash needs to fund debt maturities from December 31, 2011 until December 31, 2013 against available cash sources.

Brazilian companies remain exposed to varied liquidity risks including potential credit market disruptions, the ongoing sovereign crisis in Europe, a potential hard landing in China, the fragile global economy and foreign exchange volatility, says Moody’s.

Companies in Brazil often rely heavily on bank financing and government-owned financial institutions, although few companies have committed bank lines of credit. Moody’s notes that this is a common practice in Latin America as companies prefer to maintain high cash balances to cover upcoming maturities and retain flexibility. Foreign exchange volatility also remains a key issue for companies with high levels of foreign currency denominated debt.

Read here:

Comments »Why Has Obama Been So Soft On Banks?

The presidential election is well under way but as President Barack Obama tries to position himself as the defender of the middle-class who will protect the 99% against corporate malfeasance and too big to fail banks, he may find himself in a precarious position. His record does not necessarily reflect his rhetoric and at the same time Wall Street donors have padded his campaign coffers.

Wall Street fell in love with the promise of change and Obama’s intellectual approach to governing the country during the 2008 presidential election. Obama raised nearly $16 million from Wall Street, nearly double the amount of his Republican rival John McCain, and eventually won the election on a promise to break the” business per usual” mindset in Washington.

Over the course of Obama’s three plus years in office, his tone toward Wall Street has shifted dramatically from the days of the campaign trail. He has routinely spoken out against the big banks and their role in what led to the worst financial crisis since 1929. He has chided the “fat cats” on Wall Street, much to their chagrin, for excessive compensation packages during a time when real wages have fallen to levels not seen since the 1970s.

But as it turns out, Obama’s bark has been much worse than his bite on the issue of the big banks.

Read here:

Comments »Mainstream Media Now Starting To Believe Lower Gas Prices Inevitable…

Mainstream media spent much of early 2012 selling consumers on the idea that $5 per gallon gas was inevitable. Not wanting to seem insensitive to genuinely cash-strapped consumers, pundits and politicos blamed Iran, energy policy and speculative “gambling” as the cause of the march towards all-time high prices at the pump.

Then, just when the outrage was truly building, crude oil and gasoline prices started moving lower. West Texas Intermediate (WTI) crude oil has fallen 10% since the start of May! According to AAA, the national average price for a gallon of gasoline has dropped to $3.76 from $3.92 in just the last one-month period. Still painfully high but well below what we were paying this time last year -$3.96 a gallon.

According to Phil Flynn, contributor to the Fox Business Network and senior energy analyst at PFG BEST, the recent decline in energy prices is only getting started. The admittedly “pro-giddy” Flynn says there’s a glut of oil available and lessening demand; an economics 101 recipe for falling prices.

Flynn runs through a list of reasons why crude oil is weak, including record OPEC output, the crumbling economy in Europe, and a run of horrible economic in the U.S., culminating in Friday’s atrocious jobs report.

“The question isn’t why oil is falling,” he says. “The question should be why it’s held up so good so long?”

An even better question for Americans is how crude oil can be down 10% but gasoline prices only half that much.

Flynn says one reason for the “stickiness” of gas prices is the seasonal “summertime blends” mandated by the Government in order to cut down smog. The cleaner burning gas makes it easier to breathe but costs more than the norm. This makes gas more expensive in the summer than it is in the winter.

Seasonal blends aside, Flynn thinks pump prices are going lower.

Read here:

Comments »Where Have All the Heroes Gone ?

“When we were children we all had heroes: the Three Musketeers, Robin Hood, King Arthur, Superman, the Green Lantern, the Flash, Wonder Woman, Iron Man and many other characters fought to defend the underprivileged and protect freedom.

They were fictitious characters, of course, but there was a lesson to be learned from them nonetheless.

As we grew up the characters changed to real life people: George Washington, Ben Franklin, John Adams, Thomas Jefferson, Reverend John Witherspoon, Abe Lincoln, John F. Kennedy and others were the people who shaped a nation.

Many of the signers of the Constitution died broke. They gave their all in order to help birth a Nation for a free people.

What about today? Where have all the heroes gone?

As we watch our representatives and senators battle over political points and fame, nothing is getting done….”

Comments »The True Spirit of Freedom

It is never to early to be an activist for change. While Cole did not succeed he will try again. He also stands as a symbol to what has died in most American adults.

Cheers to Cole!

[youtube://http://www.youtube.com/watch?v=PIQUcDt1dhE 450 300] Comments »