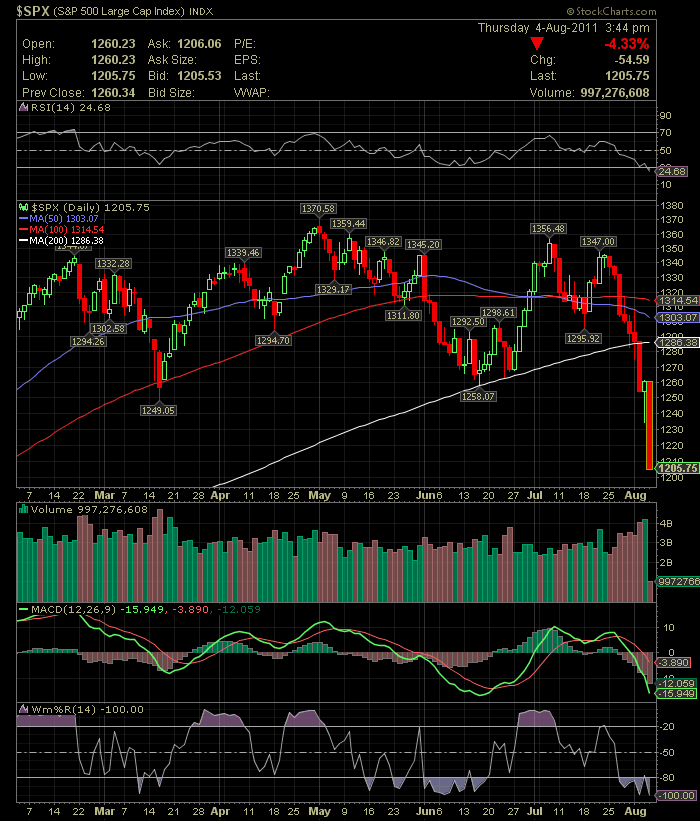

So today was a bad day to say the least. The other day i thought our sell off was not over.

Confidence has to be bolstered in order to get buyers to the table. The acceleration of selling into the bell is a clear indication that investors do not want to wake up to another debacle.

As stated a few days ago the support levels in the S&P are 1244, 1220, 1200. Given today’s action we must now consider 1182, 1170, 1140, and the Art Cashin mention of 1122ish.

The PPT has the SPY @ 1.65 hybrid score and we have seen as low as 1.44 as a low reversal number.

Given all the indicators tomorrow may be our reversal day, but being a Friday I’m not 100% on this especially if the ECB has nothing to say. So Probably best to wait for Monday or Tuesday.

Pay close attention to any emergency meetings in Europe and any mention of some sort of new bond purchasing approach. Also we have the Clam Beard Bernanke talking on Tuesday.

If tomorrow’s Unemployment is good to okay do not get caught up in a head fake rally.

[youtube:http://www.youtube.com/watch?v=kIjkW6iyXNo 450 300] If you enjoy the content at iBankCoin, please follow us on Twitter