Well maybe not a vortex, but just pay close attention to S&P 1312-1315 over the next few days…..

Comments »Monthly Archives: June 2011

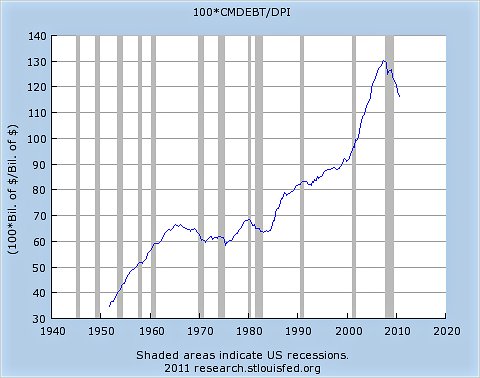

De leveraging Has Only Begun

“You can come up with all kinds of explanations for the fact that the recovery is fading: Japan, the Arab unrest, house prices, concerns over Europe, etc.

In reality there’s only one good answer: This isn’t a business cycle, it’s a balance sheet recession. And though there’s been some deleveraging (thank you Federal spending), the consumer is still way too leveraged to have any new breathing room.”

Comments »May Auto Sales Decline For GM and Toyota; Hyundai Hits 17.6% Increase

Funds Ditching The Banks

“(Reuters) – The recovery of Citigroup and Bank of America provided famed hedge fund managers like Lee Ainslie and Jeff Altman some of their biggest gains last year, but now the smart money is getting out while the getting is good.

With Ainslie’s Maverick Capital, Altman’s Owl Creek Asset Management and other major funds backing away from the banking sector in the first quarter, financials suffered the biggest decrease in sector holdings among the Smart Money 30, a group of some of the largest stock-picking hedge funds.

Ainslie, Altman and Stephen Cucchiaro’s Windhaven Investment Management dumped their entire holdings in Citigroup and Bank of America during the quarter, according to data compiled by Thomson Reuters.”

Comments »Today’s Worst Performing ETF’s

No. Ticker % Change

1 DRN -7.07

2 FAS -7.05

3 TNA -6.18

4 ERX -5.40

5 RUSL -5.32

6 UCO -5.07

7 UYG -4.90

8 EPU -4.79

9 SOXL -4.79

10 UPRO -4.70

11 BGU -4.68

12 LBJ -4.57

13 UYM -4.44

14 URE -4.32

15 AGQ -4.24

16 UWM -4.07

17 MWJ -3.91

18 TQQQ -3.78

19 TMV -3.78

20 DIG -3.64

21 EDC -3.63

22 TAN -3.47

23 CZM -3.45

24 MVV -3.38

25 DZK -3.37

Today’s Top Performing ETF’s

No. Ticker % Change

1 CVOL 7.24

2 FAZ 6.50

3 DRV 5.84

4 TZA 5.16

5 SRTY 5.14

6 CZI 4.65

7 SKF 4.46

8 SOXS 4.39

9 ERY 4.37

10 DTO 4.28

11 TVIX 4.24

12 SCO 4.22

13 SPXU 4.07

14 BGZ 4.06

15 BXDC 4.03

16 DPK 3.97

17 SRS 3.83

18 SMN 3.79

19 TMF 3.57

20 LHB 3.49

21 ZSL 3.48

22 TWM 3.44

23 FXP 3.44

24 SSG 3.26

25 EPV 3.12

Where in the World Are the Executives from HRBN?

Given Economic Data Over the Past Two Weeks; Expect QE3

“Investors should prepare themselves for a third round of quantitative easing, Simon Maughn, co-head of European equities at MF Global, told CNBC Wednesday.

“The bond market is going in one direction which is up-falling yields which is telling you quite clearly the direction of economic travel is downwards. Downgrades. QE3 (a third round of quantitative easing) is coming,” said Maughn. “The bond markets are all smarter than us, and that’s exactly what the bond markets are telling me.”

Comments »ISM Manufacturing Follows Suit With The Rest of the World: A Horrible Number Not Seen in Many Quarters

Macau revenue rises 42% in May

Comments »HONG KONG—Gambling revenue in Macau rose 42% in May from a year earlier, government statistics issued Wednesday show, as the opening of a massive new casino resort last month helped revenue rise to a record high for the fourth month in a row.

Yet Another Chinese Stock Fraud: SKU

“In this report, Absaroka will present compelling evidence that SkyPeople Fruit Juice, Inc. (NASDAQ: SPU) has materially misrepresented its production volume, revenue, and profitability. SkyPeople’s management has been focused on stock promotion and SPU appears overvalued by the market at this time.

- SkyPeople’s Chinese SAIC financials indicate the Company is less than 10% the size claimed in the United Sates SEC financials

- Visits to all four of SkyPeople’s production factories found idle facilities with limited and antiquated production equipment; the facilities only operate in production mode for less than two months per year due to limited demand and inefficient production

- SkyPeople does not own the largest kiwifruit plantation in Asia and is forced to source input fruits for its factories from local farmers at high costs due to its relatively small size

- Retail channel checks and discussions with SkyPeople’s distributors and customers make the company’s claims regarding product distribution and sales volume unbelievable. Many of the Company’s “customers” claim to have done little or no business with the Company and Absaroka’s researchers struggled to find the Company’s beverage products on store shelves

- EBITDA margins, inventory turnover, accounts receivables, and selling/marketing costs seem particularly dubious relative to peers and indicate potential accounting shenanigans

- A history of low-quality auditors raises significant concerns about validity of published financials and future business prospects….”

Experts Tell Corporate America to Raise Their Dividends

“While Standard & Poor’s 500 companies currently hold a record $960 billion of cash, their dividend payouts as a percentage of earnings are at a 75-year low.

That’s not right, writes Wall Street Journal columnist Jason Zweig. “In the past, companies paid out vastly more of their profits as dividends, and they should again,” he argues.

During the past four quarters S&P 500 companies paid out only 28.9 percent of their earnings as dividends.

Many experts agree that shareholders would be better off if companies returned their surplus cash as dividends rather than finding a way to spend it. Some cite Microsoft’s $8.5 billion purchase of Skype as an example of overspending.

“The likelihood of spending money poorly is increased by having a surplus of it,” Daniel Peris, co-manager of the Federated Strategic Value Dividend fund, told The Journal.

Investors would do well to get wise about this situation and complain.

“If there were a greater historical sensibility among investors and managers, (low dividends) would be called out as an abnormal situation that’s likely to lead to that money being less well-spent than it otherwise might be,” Peris says.

There is a lot to be said for healthy companies that pay high dividends.

“The dividend is a concrete instance of goodness amidst epic questions about the fate of Europe’s economy and slowing growth here in the United States,” writes Steven Sears of Barron’s.

“In short, dividends are beautiful”

Comments »Shakers and Movers: Hedge Fund Plays

“Hedge funds are moving into the dollar, maintaining their bullishness on oil, and losing faith in the China boom, according to the latest data from Societe Generale.

Their report details the recent buy and sell decisions of hedge funds, specifically their movements in and out of currencies, commodities, and equity futures contracts.

Soc Gen measures movements on e-mini accounts for equity futures, which are traded exclusively electronically. All other positions are measured in contracts as described on the charts. The latest data is as of May 24.

Comments »Upgrades and Downgrades This Morning

Upgrades

WAG – Walgreens initiated with Buy at UBS

BRCM – Broadcom upgraded to Buy from Neutral at Nomura

T – AT&T upgraded to Buy at Hudson Square Research

CNQR – Concur Tech upgraded to Buy at Needham

HANS – Hansen Natural initited with Buy at Jefferies

ESV – Ensco upgraded to Buy from Neutral at UBS

AL – Air Lease initiated with Outperform at Macquarie

SGNT – Sagent Pharma initiated with a Buy at Needham

Downgrades

SQNS – Sequans Communications downgraded to Hold at Needham based on valuation

TROW – T. Rowe Price downgraded to Neutral from Buy at Goldman

ASH – Ashland downgraded to Neutral from Overweight at JP Morgan

HNZ – HJ Heinz downgraded to Sell at Goldman

AMSC – Am Superconductor downgraded to Hold at Capstone

VZ – Verizon downgraded to Sell from Hold at Hudson Square because of valuation and concerns on smartphone

EXPE – Expedia downgraded to Hold from Buy at Standpoint Research

TIF – Tiffany & Co downgraded to Hold from Buy at Deutsche Bank

TAN – Price declines likely to be key message of Intersolar – Collins Stewart

NOK – Nokia downgraded to Underperform from Market Perform at Bernstein

Comments »Gapping Up and Down This Morning

Gapping Up

PVH +3.1%, UN +1%, HCP +5.0%, UN +1%, GAME +2.2%, M +1.3%, NBG +8.1%, GLNG +6.1%, LOGI +3.2%, ERIC +2.4%, TC +2.2%, GAME +2.2%, PVH +2%,

Gapping Down

NOK -9.5%, LNG -9.4%, NRGY -3.5%, ACI -1.9%, AMSC -5.5%, ARR -3.8%,

Comments »In Play and On the Wires

Oil Traded Higher Overnight on Greek Bailout Expectations and Dwindling Supply Stock

“Oil traded near the highest in three weeks on speculation shrinking U.S. crude supplies and Europe’s steps to stem its debt crisis will boost fuel demand.

Futures gained 2.1 percent yesterday and rose as much as 0.6 percent today as analysts surveyed by Bloomberg News predicted U.S. inventories dropped last week. EU leaders will decide on additional help for the Greek economy by the end of this month, according to Jean-Claude Juncker, head of the group of euro-area finance ministers. Prices may rise to $105 a barrel in “a few days”, MF Global Holdings Ltd. said today.

“From a pure fundamental point of view, the market is going to tighten and that means over the next few months rising prices are more likely,” said Andy Sommer, a senior analyst at EGL AG in Dietikon, Switzerland. He predicts Brent, now trading near $116 a barrel, will rise to $125 by the end of the year.

Crude for July delivery was at $102.56 a barrel, down 14 cents, in electronic trading on the New York Mercantile Exchange at 11:50 a.m. London time. Prices climbed $2.11 to $102.70 yesterday, the highest since May 10. Oil slipped 9.9 percent in May, the first decline in nine months.”

Comments »Higher Loan Costs Slowdown India’s Manufacturing

“India’s manufacturing grew at the slowest pace in four months as inflation above 8 percent and nine interest-rate increases since mid-March 2010 crimped output.

The Purchasing Managers’ Index fell to 57.5 in May from 58 in April, HSBC Holdings Plc and Markit Economics said in an e- mail statement today. A number above 50 indicates expansion.

Rising borrowing costs may have begun to hurt demand, reflected in slowing sales at Maruti Suzuki India Ltd. (MSIL), the nation’s biggest carmaker, and Ashok Leyland Ltd. The $1.4 trillion economy grew 7.8 percent in the three months through March, the slowest pace in five quarters, a government report showed yesterday.

“Even though the economy is showing signs of moderation, inflation running above 8 percent is a key problem that won’t allow the Reserve Bank of India to let its guard down,” said Sonal Varma, a Mumbai-based economist at Nomura Holdings Inc.”

Comments »European Markets Fall on China’s Manufacturing Data & Slow Growth Prospects

“European stocks declined for the second time in three days as China’s manufacturing expanded at the slowest pace in nine months. Asian shares advanced and U.S. index futures fluctuated between gains and losses.

Banca Monte dei Paschi SpA sank 6 percent as the Italian lender’s controlling shareholder sold 450 million shares. Nokia Oyj (NOK1V) tumbled for a second day, leading technology shares lower. Axa SA (CS), Europe’s second-biggest insurer, climbed 2.4 percent after agreeing to sell its Canadian business to Intact Financial Corp. for C$2.6 billion ($2.7 billion).

The Stoxx Europe 600 Index fell 0.2 percent to 280.53 at 1:02 p.m. in London, after swinging between gains and losses at least 10 times. The benchmark declined 1 percent last month amid speculation that Greece will restructure its debt. Since reaching this year’s high on Feb. 17, the gauge has retreated 3.7 percent.”

Comments »Dollar Falls Against Euro on Prospects of a Slowdown & Horrible ADP Data

“The dollar fell against the majority of its most-traded peers before reports likely to show U.S. companies hired fewer workers and manufacturing cooled.

The Dollar Index declined before the private ADP Employers Services report is released today, followed by the non-payroll figures on June 3. The euro advanced to a three-week high versus the greenback amid speculation Greece is close to an agreement on aid to ease its debt burden. The Swiss franc strengthened as data showed retail sales rose at the fastest rate for two years.

“The markets are shifting their focus, particularly from the intense concerns over debt restructuring, and we’ve had a series of weak economic data in the U.S.,” said Derek Halpenny, European head of currency research at Bank of Tokyo-Mitsubishi UFJ Ltd. in London. “If there’s any evidence of a considerable worsening in the employment situation, I think that would certainly hit confidence pretty significantly.”

The dollar was little changed at $1.4405 per euro as of 10:23 a.m. in London, after dropping 0.5 percent to $1.4448, the weakest since May 6. It declined 0.2 percent to 81.36 yen. The euro fetched 117.19 yen from 117.37 yesterday, when it reached 117.80, the highest since May 5.

IntercontinentalExchange Inc.’s Dollar Index, which measures the greenback against the currencies of six trading partners, was at 74.58 after declining as low as 74.39, also the lowest since May 6.”

Comments »