I’m busy, and have been for a week. So I thought I’d leave you with some light reading:

The rental vacancy rates for the nation declined from 8.4 percent in 2009 to 7.4 percent in 2011, according to one of two American Community Survey briefs covering the housing market released today by the U.S. Census Bureau. Approximately four times as many metro areas experienced declines in rental vacancy rates as those that experienced increases. The share of U.S. households that rent rather than own increased from 34.1 percent in 2009 to 35.4 percent in 2011. Nearly a quarter of the nation’s metro areas saw a rise in renting households, while less than 3.0 percent of the nation’s metro areas saw a decline.

Rental Housing Market Condition Measures: A Comparison of US Metropolitan Areas examines four characteristics of the rental housing stock using American Community Survey data collected in 2009 and 2011. The characteristics are gross rent, gross rent as a percentage of household income, rental vacancy rates, and renter share of total households and describe changes comparing 2009 with 2011.

The brief found that more renters are spending a high percentage of their household income on rent. Policymakers use gross rent as a percentage of income as a measure of housing affordability, and it is often used to determine eligibility for housing programs. In this report, renters spending 35 percent or more of household income on rent and utilities are considered to have high rental costs.

The share of renters with high housing costs in the United States rose from 42.5 percent in 2009 to 44.3 percent in 2011. However, average rental rates in the United States declined from 2009 to 2011.

“While we saw a decrease in rental vacancy rates and pricing in some areas, the burden of rental costs on households increased across many parts of the nation,” said Arthur Cresce, assistant division chief for housing characteristics at the Census Bureau. “Factors such as supply and demand for rental housing and local economic conditions play an important role in helping to explain these relationships.”

Nationwide, only 11 metro areas reduced their shares of renters with high housing costs, while 62 metro areas increased their shares.

Among the 50 most populous metro areas, some of the heaviest rental costs were borne by renters in metro areas in Florida, California and Louisiana in 2011, despite rent declines between 2009 and 2011. These include Miami with 55.7 percent of renters experiencing heavy rental costs. Orlando, Fla. (52.9 percent); Riverside, Calif. (52.2 percent); and New Orleans (51.3 percent), whose shares did not differ significantly from one another, followed closely.

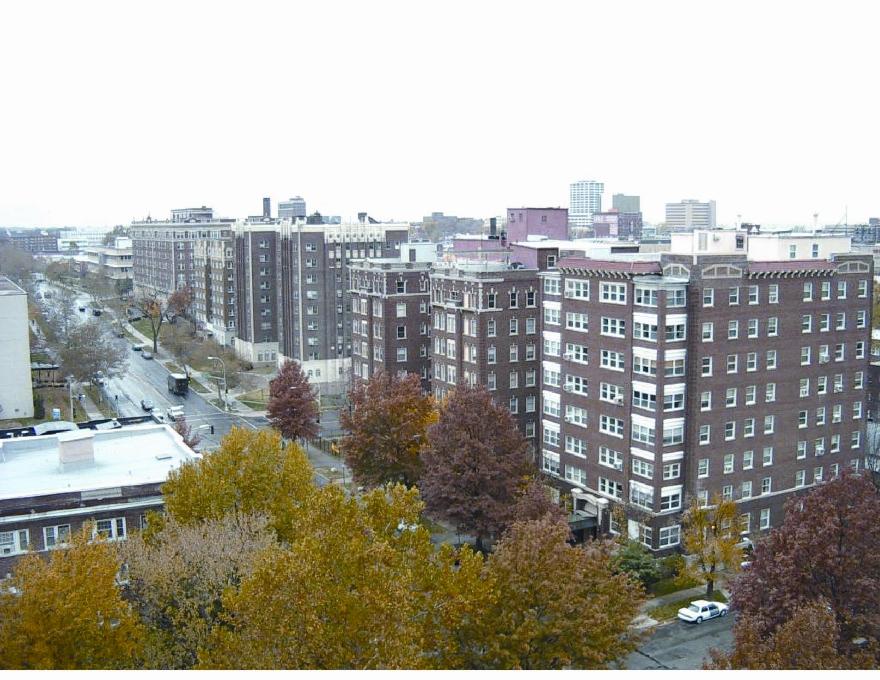

Among the 50 most populous metro areas, only two became affordable for more renters — Richmond, Va., with a decline of 3.2 percentage points in the share of renters with high rental costs from 42.7 percent to 39.5 percent between 2009 and 2011, and Buffalo, N.Y., with a decline of 3.0 percentage points from 45.6 percent to 42.6.

$AEC and $CLP and the renting class are still in effect.

Comments »