As much fun as the occasional weekend pipe dream is, jam packed with physics and wacky ideas, from time to time, Monday brings with it a serious responibility to engage in actual thinking that produces real gains.

I see the weekday pipe dreamers are out and about now, writing mock up papers for major publications detailing how the hyperloop will create displacement by causing passengers to ride an acoustic wave, knocking my own crazy nonsense off the top. I suppose I’ll leave the making of unsubstantiated and ridiculous guessing to the professionals.

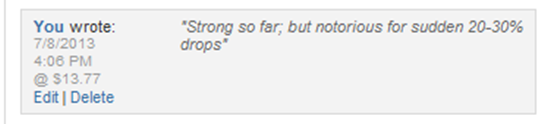

Back to things that actually matter; I’m watching RGR closely and have made the probably bad choice to hold through earnings. I am betting that gun ownership in this country will continue to expand at a higher pace that old normals, even after the initial fear buying craze has subsided. It’s difficult as RGR just announced some plant trouble, and background checks are down. Do not be surprised if RGR takes a spill lower. Whether or not I re-up my stake at that point will depend.

AEC is making to recover from the earnings miss. I am betting it will make new highs within the year.

BAS remains in a correction, and if my feeling for the stock is on, I’m betting that puts it around $11. Or rather, I’d buy around $11, if it can get there.

Comments »