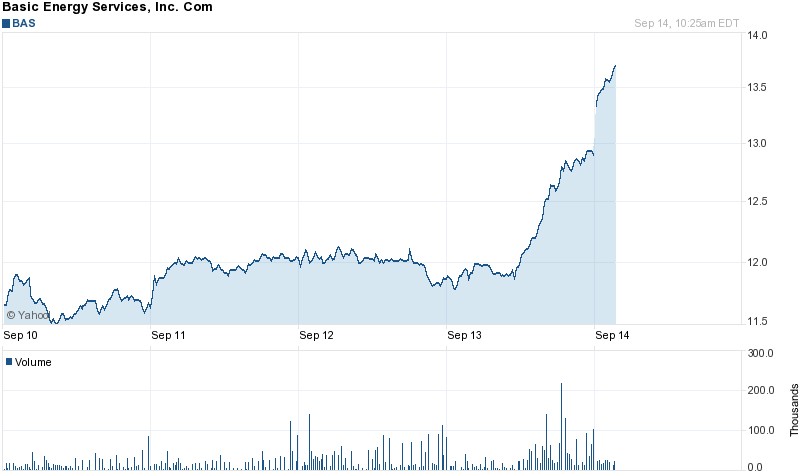

On or around August 28, a series of BLATANT hit pieces on BAS surfaced, portending that a sudden rise in demand for put options revealed a huge reversal imminent. These pieces, mostly disseminated by Yahoo Finance (the market manipulator’s preferred financial news source) and then hyper-linked on Twitter, led to massive losses in the name, cratering the stock by over 15%.

I am here to say, I outlasted you and your villainy. Another 2% and I will be back to even. All this redeeming occurred in a matter of just 3 short days.

What this tells me is that there was no real reason for BAS to have ever traded down in the first place. Demand for BAS shares is strong, and this was nothing shy of a coordinated attack orchestrated by unseen persons.

I can only hope that those of you behind this baleful comportment met your untimely demise, trapped in your own wickedness. However, I know better.

Market manipulators are wonted cowards, spineless from birth and devoid of any of the compulsions necessary for greatness.

Bereft of these qualities, they are forced to lurk in closets, casting aspersions on passerby’s. Rumors, gossip, lies, and all other physiognomies of wretched prevaricators are their haunts, and they lurk slyly out of sight, misleading the ignorant and gullible to their dooms.

The pests who caused this selloff were long gone before now, taking the easy profits, probably within the first 10% of downside, before scampering off back to their rat nests.

So instead I must hope that any who believed this racket learned their lesson – through fire.

This is what you deserve if you’re senseless enough to believe that a sudden demand for put options of all things is a guide to where stocks should be trading.

Funny enough, but in either case of a put or call option, the exact same relationship is being established; whereby one party receives cash with an obligation to transact stocks. The ONLY difference is on which party – long or short – gets to elect whether or not to exercise the terms of the contract.

A sudden demand for put options could be as much a desire to have temporary insurance as any direct evidence that prices of a security should go lower.

Someone played you for a sucker, BAS shorts, getting you to take a position against a company that ALREADY had 20% of their average float tied outstanding.

Now you get what you have coming to you.

Comments »