For me, the most pressing of matters is the fate that awaits BAS. This may seems odd, but even after cutting its position sizing from almost 25% of my portfolio down to 10% in August, this singular company has had almost comic effect on my positions. The 5% or so in purchases I made throughout its decline can hardly be called the tipping point, as the source of my fate has been without a doubt the move BAS made from $29 to $6.

It is almost idiotic to speak of. Am I blind to something the rest of the market clearly spots? I am human, after all. Barely. But I am human.

So I decided to go take a walk down memory lane, to the dark days of 2010. It was a horrible time, following the worst recession the US had witnessed in almost 100 years. Oil prices had fallen from $140 to (for a few short months) the $30’s.

I believed that looking at these two companies, the BAS of 2010 and the BAS of today, I might learn something. Can BAS survive this oil price rout? Am I even now venturing down the path of my own demise?

I will let you decide.

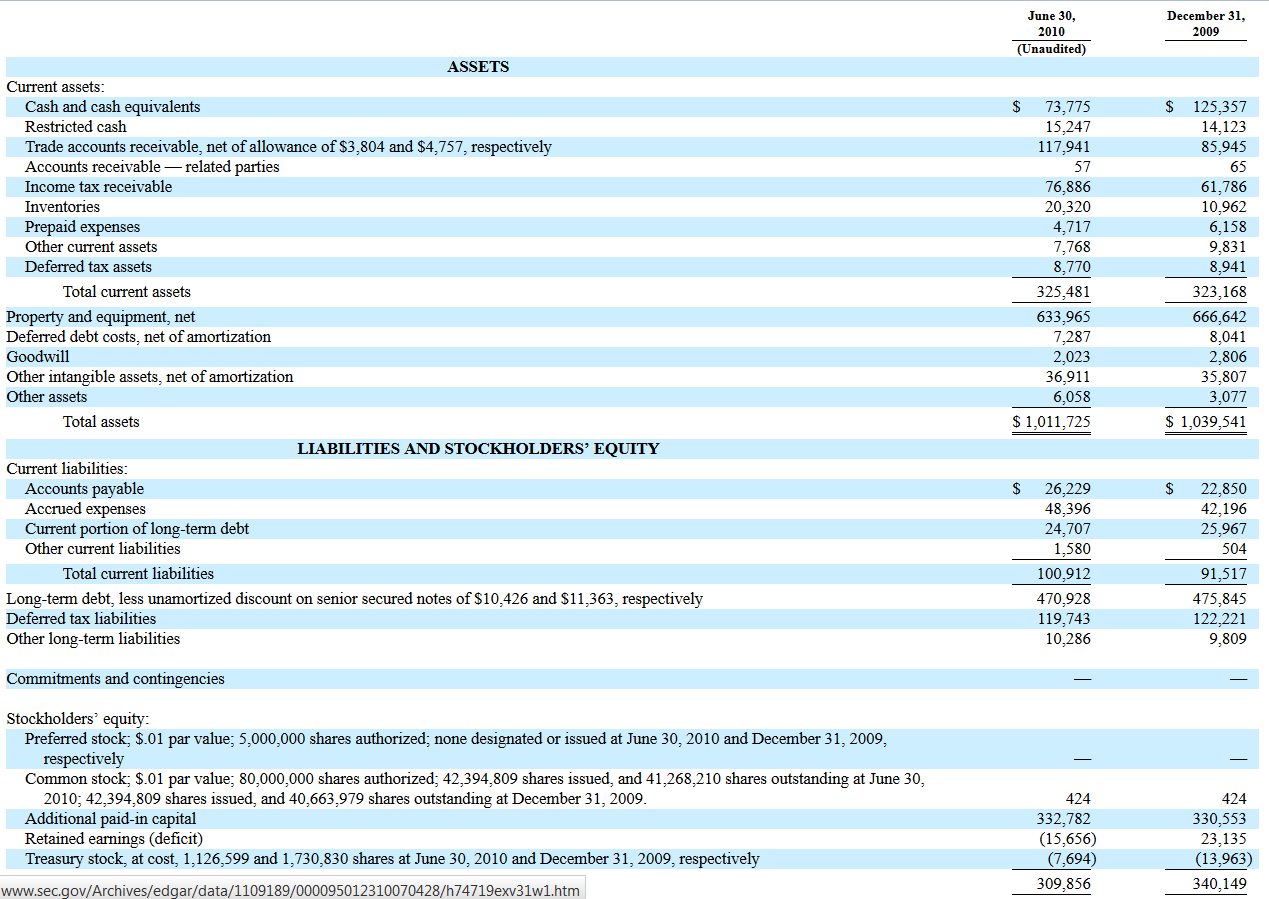

Here is BAS’ balance sheet in June of 2010 (when oil was trading comparably to where it is today).

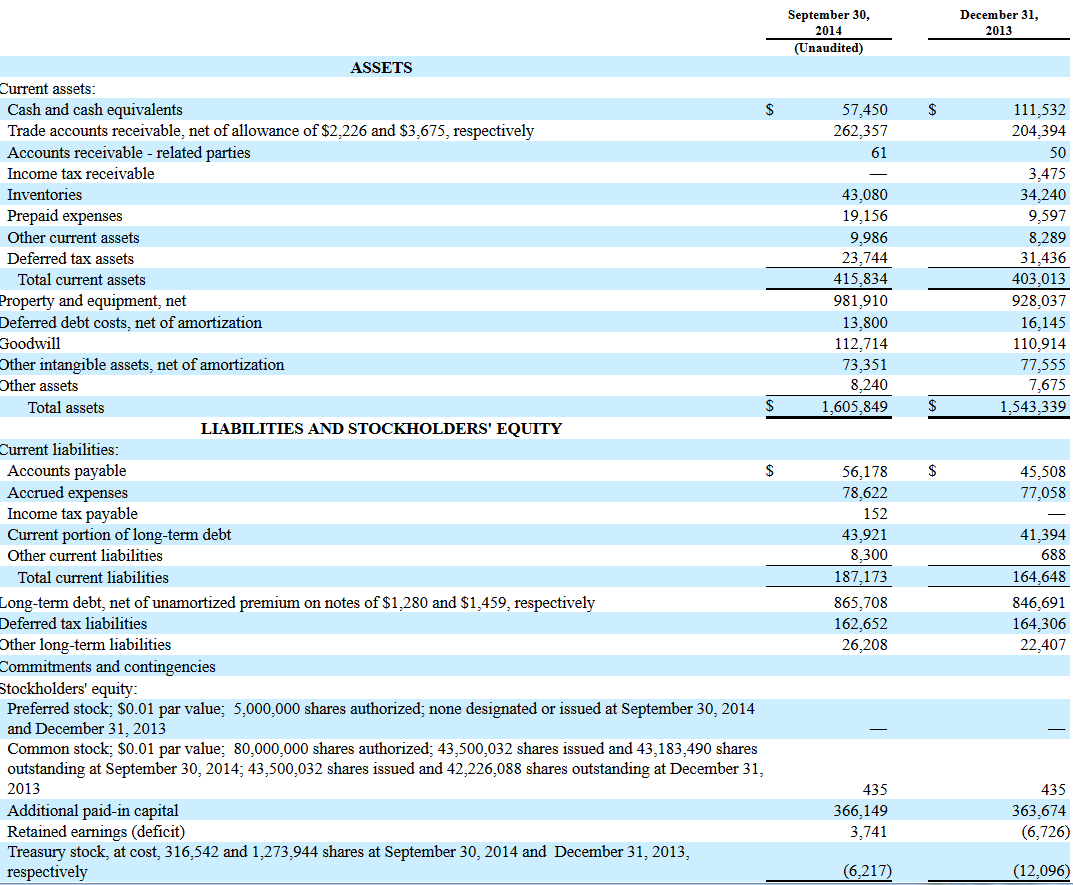

And this is BAS’ balance sheet as of their most recent filing.

Go then, Slavs. Pass your judgment, if you dare. Argue that these are somehow different companies.

If you enjoy the content at iBankCoin, please follow us on Twitter

Is someone making a bet they won’t

collect on their outsized receivables.

If they are, I believe they are making it on the wrong company. BAS has a smaller A/R as % of revenue compared to peers.

KEG FES NBR HAL are all 80%-90% compared to BAS at about ~65%

When the slowdown hits the industry, I expect Basic’s AR to decrease proportionately to revenue as it did in 08-09. If that doesn’t happen, then there might be cause for alarm. They may need that cashflow from AR to weather the storm.

I think the market might be panicking because of Basic’s debt/equity ratio

2.5 now compared to 1.65 in 2010.

However, didn’t BAS recently have a secondary offering for 100mil+? Shouldn’t additional paid in capital be higher than 366 Million…??

Nevermind – I now it was a offering on behalf of existing shareholders.

Anyone looking to ride this extended energy rout out should stick to pipelines and other midstream plays.

Those plays can cancel the capex and just pump money while drillers need capex just to offset the drop in reserves, anything with a decent dividend will get it cancelled.

That’s part of why I’m interested in a well servicer like BAS. I’m betting the upstream companies will need to keep drilling to generate cash flow… Even if isn’t all that profitable at current prices.

Considering the fact that they will earn marginally less going forward, cash flow leverage is higher. Perhaps some folks are worried about covenant violations, which may result in restructuring.

Why not just sell the bastard and move on to midstream and downstream players if you must be in oil names. There is still healthy interest in the market for these. It seems to me you are searching for reasons to stay with this stock.

You are correct, I am searching for reasons to stay with this stock, but only because I think it should rebound hard back to $20. If the facts on the ground had changed (outside of oil prices by themselves), I would sell.

But why pack up and leave if I’m a few weeks away from a sharp rebound? It’s going to be equally hard to find a position that can make that retrace. The only main reason to do so is tax related, and let’s face it…I don’t need this much tax write off.

I only ask this because I use to have this happen to me all the time – how can you watch a stock you own go down 80%? Thinking you’re married to it or something and you were right about it all along, and it’s coming back bigger than ever – that’s the worst mistake you can ever make. Anyway, it’s too late now, you pretty much have to hold and wait for the come back. Hope you still aren’t waiting six years later, like I am with some of the once high flying garbage I bought prior to the financial crisis.

Curious as to which high flying garbage you’re married to?

Thinking about signing a prenup here with OAS and closing my eyes for entry.

@cain

you are right.. hang in there. it might be three months or three years, but this will come back. I think the steeper the fall the quicker we come back. I am long oil dividends, but many are hedged and this price level will certainly curtail drilling in the next six months.. the highly levered will get hurt, but hose with serious balance sheets will do just fine in spite of being taken to the woodshed currently.

“it might be three months or three years, but this will come back.”

It had better be three months. I don’t think you appreciate what sitting around for three years feels like.

I know how hard it is to wait. We all got seriously bled out in 2008. And waited for commodities to recover. If there is anything positive t is the rest of the ” old” u.s. Market. With the slow and steady growth in the u.s. Market we have to have steady demand for energy.

My feeling is the saudi’s got tired f all the newcomers stealing their market share. Once these people are seriously curtailed with lower drilling .,prices will naturally recover and new drilling will be muted for a while. World demand will not subside.