Ladies and Gentlemen:

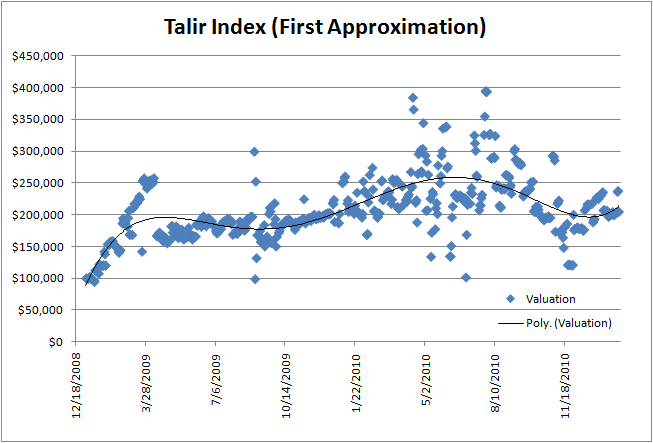

After tirelessly working since this afternoon, I present to you the culmination of my earliest efforts – the Talir Index (First Approximation).

I have decided that this metric should be built from a starting investment of $100K. This choice was made for one sole consideration; bonds.

I don’t know right now whether or not I will ever give out advice on bonds on these forums. I do, however, know that if I do give out advice on bonds, then it will be on specific bonds.

So, since bonds are generally sold with a $10,000 face value, if makes very little sense for me to say, “hey, you should buy bond issue #…” since for any amount less than $100K you’re either:

a) Inadequately funded to actually make the purchase OR

b) Buying the bond would eat up somewhere between 20-100% of your portfolio, which is fucking cashew-nut crazy, even by my standards.

So, $100K is the number of the initial counting. An investment of less than this amount would likely have to mirror all equity trades while making exemptions for any trades, like bonds, which require that significant minimum contribution. Likely, such an account would also compensate by making additional allocations, either into existing positions or else different ones.

As such, any account with less than $100K may find itself subject to wildly different performance, with enough time.

As to the specific questions of this print out I’ve provided:

1. This is not the final product; I found myself missing information on specific account balances for every day. Hence, I needed to approximate those specifics, which leads to wild volatility when I leverage/deleverage. As you can see, the last year particularly has quite a spread, which is thanks to my utilizing margin. The only way to get an exact series of numbers is for me to go through and with a set of predetermined rules, reconstruct my account balance based on transactions. It will be very, very time consuming, and I don’t expect it to be done any time soon…

2. This index is before including information on shorting. Again, that’s a product of account balances. I need to construct them before shorting makes sense. With shorting (specifically hedging) my account performance will most likely take a hit, as the biggest short positions I’ve taken have closed out with Realized Losses.

3. This performance is before including my precious metal position of the same time period. Therefore, I can guarantee that the Final Talir Index will show a considerably better performance. For the moment, in conjunction with the fact that I haven’t owned any bonds and haven’t included shorting, this index is effectively a Long-Only Equity Index of my performance.

4. I’ve slapped a 6th Order Polynomial on the scatter plot (because it looked good), which actually gives a fairly good idea of how one would do if they were to only follow my long equity ideas, without ever hedging or engaging in open shorting, during the last two years. My equity picks have seemed to generate an average 41.45% annual return over the last two years (which makes sense, given the broad market rebound during that time period).

That being said, I will admit my displeasure in this earliest attempt. When I realized how much information I was missing, I became rather disappointed. I will be working to make up for this disgrace of specifics, and replace the “approximation” bullshit with something more concrete.

This graph does not accurately depict what I’ve done over the last two years, during my time writing on this website. It completely ignores one of my greatest gainers, while also overstating my equity performance. I need to add the commodity and short side information in. But, that will require more time.

For now, rest assured that all future performance will be concrete thanks to better data, as will all future presentations thanks to the work I’m going to be undergoing in solidifying the past.

If you enjoy the content at iBankCoin, please follow us on Twitter

1) Why not just use an ETF for the long bond portion?

2) What does Talir mean? Is that some kind of CAIR sub-group?

3) Did you see that $9mm Detroit commercial last night?

_____

It could be done, but the results would still likely differ from my specific choices.

I did see that; it looked good but I don’t know where they came up with the $9mm

Here’s how they came up with the $9mm.

They whined for it!

Now, what about this name?

________

Never mind, I didn’t know you were talking about another spelling of the Thaler coins.

Hope you gots some!

______

Ha, sounds about right. If I were the rest of the country, I’d be pissed. You all need to stop tolerating this sort of behavior.

Personally, I hate most the people who live in Michigan. Especially our bums. You have never known a more pushy individual than a Michigan bum. You’d think they were entitled to your wallet, and will openly anex your pocket, in public, if they think you’re holding out on them.

They must be crafty bums to make it through the Detroit winter w.out becoming bumsicles.

In that sense, I give them their props.

______

$9mm (nine dollar eminem you mean)